Question: Process Costing. Answer the questions below Part A Calculation Question Using the following worksheet format, assign costs to the inventory transferred out and the ending

Process Costing. Answer the questions below

Part A Calculation Question

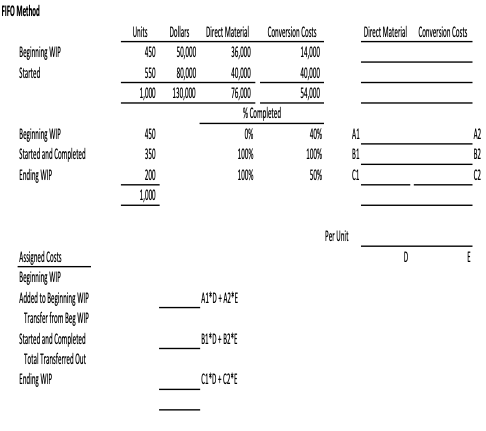

Using the following worksheet format, assign costs to the inventory transferred out and the ending inventory using the FIFO method. The percentages indicate the amount of work completed on the inventory. Show your calculations for full marks.

Part B Calculation Question

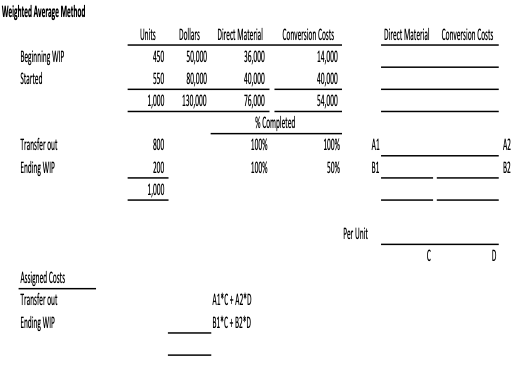

Using the following worksheet format, assign costs to the inventory transferred out and the ending inventory using the weighted average method. The percentages indicate the amount of work completed on the inventory. Show your calculations for full marks.

Questions:

- Calculate the inventory cost transferred out and ending inventory (WIP) value for the FIFO method.

- Calculate the inventory cost transferred out and ending inventory (WIP) value for the weighted average method.

- What is a benefit of the weighted average method?

- Why might a company use the FIFO method?

- When is process costing used by a company?

FIFO Method Direct Material Conversion Costs Beginning WIP Started Units Dollars Direct Material Conversion Costs 450 50,000 36,000 14,000 550 80,000 40,000 40,000 1,000 130,000 76,000 54,000 % Completed 450 0% 40% 350 100% 100% 200 100% 50% 1,000 Beginning WIP Started and Completed Ending WIP A1 B1 C1 A2 B2 C2 Per Unit D E A1*D +AZ*E Assigned Costs Beginning WIP Added to Beginning WIP Transfer from Beg WIP Started and completed Total Transferred Out B1+0+82" Ending MP C1+0+02 Weighted Average Method Direct Material Conversion Costs Beginning WIP Started Units Dollars Direct Material Conversion Costs 450 50,000 36,000 14,000 550 80,000 40,000 40,000 1,000 130,000 76,000 54,000 % Completed 800 100% 100% 200 100% 50% 1,000 A1 Transfer out Ending WP AZ B2 B1 Per Unit C D Assigned Costs Transfer out Ending WP A1C+A25D B1C + B2*D FIFO Method Direct Material Conversion Costs Beginning WIP Started Units Dollars Direct Material Conversion Costs 450 50,000 36,000 14,000 550 80,000 40,000 40,000 1,000 130,000 76,000 54,000 % Completed 450 0% 40% 350 100% 100% 200 100% 50% 1,000 Beginning WIP Started and Completed Ending WIP A1 B1 C1 A2 B2 C2 Per Unit D E A1*D +AZ*E Assigned Costs Beginning WIP Added to Beginning WIP Transfer from Beg WIP Started and completed Total Transferred Out B1+0+82" Ending MP C1+0+02 Weighted Average Method Direct Material Conversion Costs Beginning WIP Started Units Dollars Direct Material Conversion Costs 450 50,000 36,000 14,000 550 80,000 40,000 40,000 1,000 130,000 76,000 54,000 % Completed 800 100% 100% 200 100% 50% 1,000 A1 Transfer out Ending WP AZ B2 B1 Per Unit C D Assigned Costs Transfer out Ending WP A1C+A25D B1C + B2*D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts