Question: Process Costing Using Excel to prepare a production cost report Salish Craft Beers provides the following information for the Malting Department for the month of

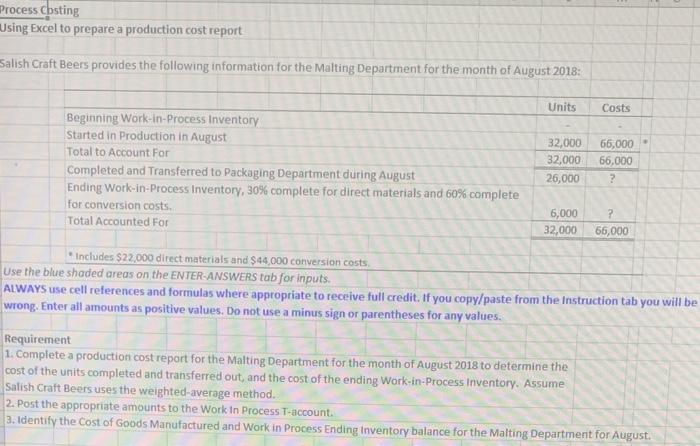

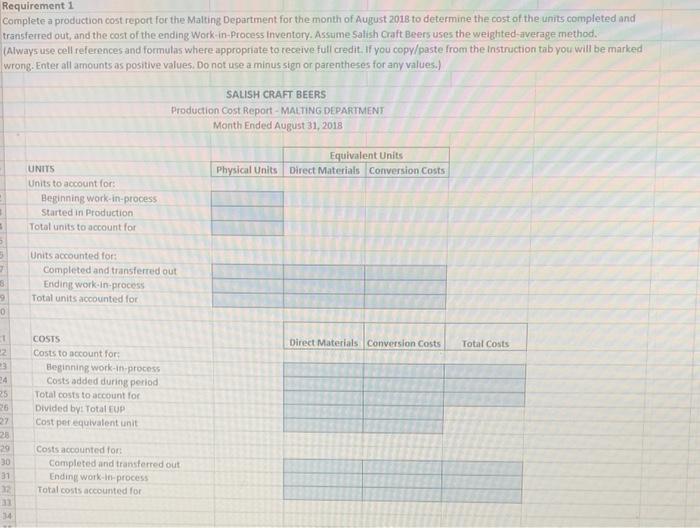

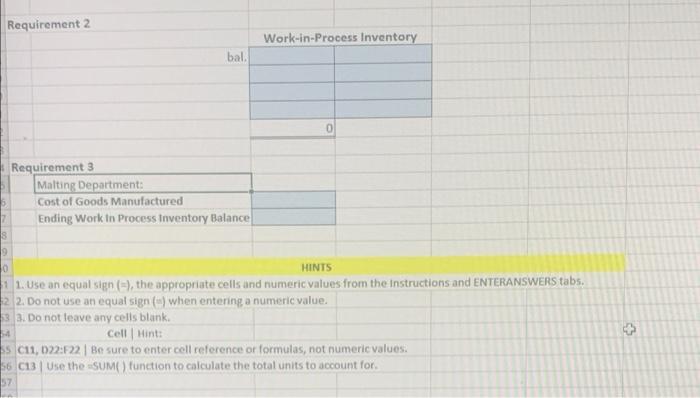

Process Costing Using Excel to prepare a production cost report Salish Craft Beers provides the following information for the Malting Department for the month of August 2018: Units Costs Beginning Work-in-Process Inventory Started in Production in August Total to Account For Completed and Transferred to Packaging Department during August Ending Work-in-Process Inventory, 30% complete for direct materials and 60% complete for conversion costs Total Accounted For 32,000 32,000 26,000 66,000 66,000 ? 6,000 32,000 ? 66,000 * Includes $22,000 direct materials and $44,000 conversion costs Use the blue shaded areas on the ENTER ANSWERS tab for inputs. ALWAYS use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruction tab you will be wrong. Enter all amounts as positive values. Do not use a minus sign or parentheses for any values. Requirement 1. Complete a production cost report for the Malting Department for the month of August 2018 to determine the cost of the units completed and transferred out, and the cost of the ending Work-in-Process Inventory. Assume Salish Craft Beers uses the weighted average method. 2. Post the appropriate amounts to the Work In Process T-account. 3. Identify the Cost of Goods Manufactured and Work in Process Ending Inventory balance for the Malting Department for August. Requirement i Complete a production cost report for the Malting Department for the month of August 2018 to determine the cost of the units completed and transferred out, and the cost of the ending Work in Process inventory. Assume Satish Craft Beers uses the weighted average method. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the instruction tab you will be marked wrong. Enter all amounts as positive values. Do not use a minus sign or parentheses for any values.) SALISH CRAFT BEERS Production Cost Report -MALTING DEPARTMENT Month Ended August 31, 2018 Equivalent Units Physical Units Direct Materials Conversion Costs UNITS Units to account for: Beginning work in process Started in Production Total units to account for Units accounted for Completed and transferred out Ending work in process Total units accounted for 9 0 Direct Materials Conversion Costs Total Costs 1 2 3 COSTS Costs to account for Beginning work-in-process Costs added during period Total costs to account for Divided by: Total EUP Cost per equivalent unit 25 26 28 29 30 31 Costs accounted for Completed and transferred out Ending work-in-process Total costs accounted for 14 Requirement 2 Work-in-Process Inventory bal. 0 Requirement 3 Malting Department: Cost of Goods Manufactured Ending Work in Process Inventory Balance 8 10 HINTS 1. Use an equal sign (=), the appropriate cells and numeric values from the instructions and ENTERANSWERS tabs. 2 2. Do not use an equal sign (-) when entering a numeric value. 33. Do not leave any cells blank. Cell Hint: SC11, 022:122 Be sure to enter cell reference or formulas, not numeric values. 56 C13 Use the SUM() function to calculate the total units to account for 67 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts