Question: process design, optimization and economics question. please help me solve with full handwritten solution. thank you QUESTION 2: (25 marks) a) A firm has identified

process design, optimization and economics question. please help me solve with full handwritten solution. thank you

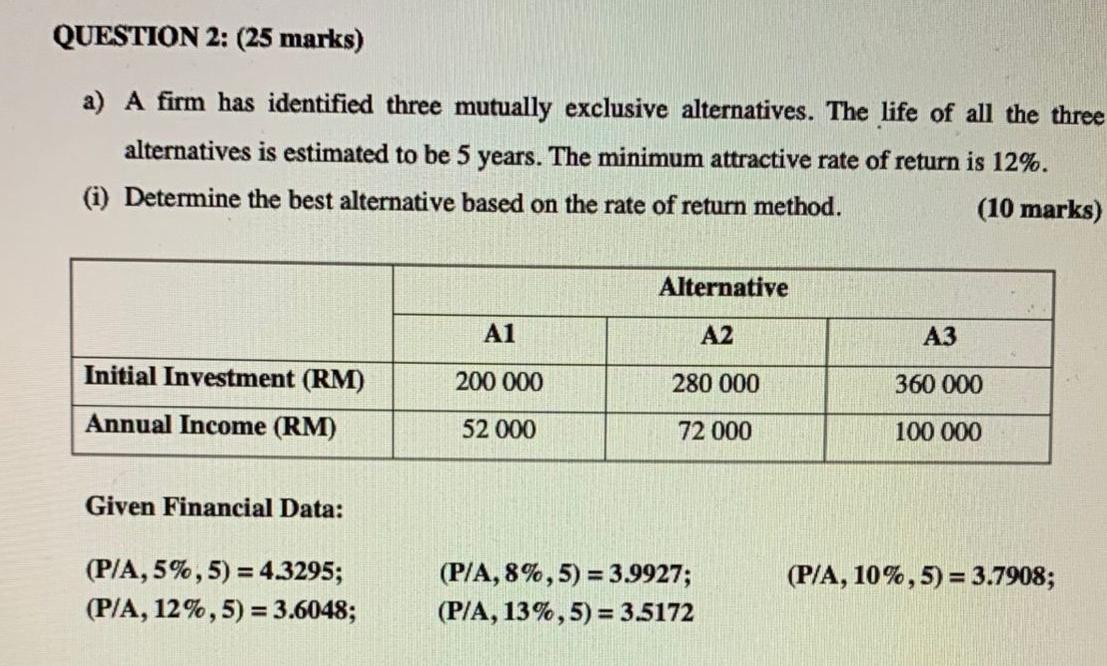

QUESTION 2: (25 marks) a) A firm has identified three mutually exclusive alternatives. The life of all the three alternatives is estimated to be 5 years. The minimum attractive rate of return is 12%. (i) Determine the best alternative based on the rate of return method. (10 marks) Alternative A1 A2 A3 Initial Investment (RM) 200 000 280 000 360 000 Annual Income (RM) 52 000 72 000 100 000 Given Financial Data: (P/A, 5%,5) = 4.3295; (P/A, 12%,5) = 3.6048; (P/A, 10%,5) = 3.7908; (P/A, 8%,5) = 3.9927; (P/A, 13%,5) = 3.5172 ONFIDENTIAL Draw the discrete cash flow diagrams for all the three alternatives. 3/5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts