Question: Processing beyond split-off and cost allocations All-A-Buzz makes three products from a joint production process using honey. Joint cost for the process for the year

Processing beyond split-off and cost allocations All-A-Buzz makes three products from a joint production process using honey. Joint cost for the process for the year is $197,120.

| Per Unit | Incremental | |||

|---|---|---|---|---|

| Units of | Selling Price | Processing | Final Sales | |

| Product | Output | at Split-Off | Cost | Price |

| Honey butter | 16,000 | 4.00 | $3.00 | $6.00 |

| Honey jam | 32,000 | 6.40 | 4.00 | 14.00 |

| Honey syrup | 1,600 | 3.00 | 0.40 | 3.60 |

Each container of honey butter, jam, and syrup, respectively, contains 16 ounces, 8 ounces, and 3 ounces of product. a. Determine which products should be processed beyond the split-off point.

| Process Further? | |

|---|---|

| Honey butter | AnswerYesNo |

| Honey jam | AnswerYesNo |

| Honey syrup | AnswerYesNo |

b. Assume honey syrup should be treated as a by-product. Allocate the joint cost based on (1) units produced, (2) weight, and (3) sales value at split-off. Use the net realizable value approach, assuming by-product revenues reduce joint production costs. (1) joint cost allocated based on units produced

| Honey butter | Answer |

| Honey jam | Answer |

| Total | Answer |

(2) joint cost allocated based on weight

| Honey butter | Answer |

| Honey jam | Answer |

| Total | Answer |

(3) joint cost allocated based on sales value at split-off Note: Round proportions to the nearest whole percentage and dollar amounts to the nearest whole dollar.

| Honey butter | Answer |

| Honey jam | Answer |

| Total | Answer |

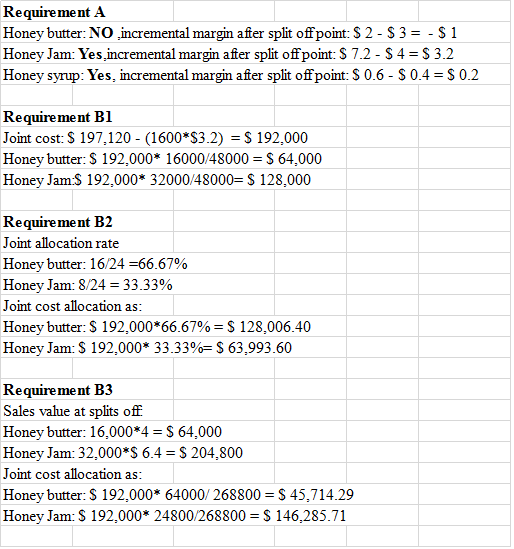

Requirement A Honey butter: NO incremental margin after split off point: $ 2 - $ 3 = - $ 1 Honey Jam: Yes,incremental margin after split offpoint: $ 7.2 - $ 4 = $ 3.2 Honey syrup: Yes, incremental margin after split off point: $ 0.6 - $ 0.4 = $ 0.2 Requirement Bl Joint cost: $ 197,120 - (1600*$3.2) = $ 192,000 Honey butter: $ 192,000* 16000/48000 = $ 64,000 Honey Jam:$ 192,000* 32000/48000= $ 128,000 Requirement B2 Joint allocation rate Honey butter: 16/24=66.67% Honey Jam: 8/24 = 33.33% Joint cost allocation as: Honey butter: $ 192,000*66.67% = $ 128,006.40 Honey Jam: $ 192,000* 33.33%= $ 63,993.60 Requirement B3 Sales value at splits off. Honey butter: 16,000*4 = $ 64,000 Honey Jam: 32,000*$ 6.4 = $ 204,800 Joint cost allocation as: Honey butter: $ 192,000* 64000/ 268800 = $ 45,714.29 Honey Jam: $ 192,000* 24800/268800 = $ 146.285.71

Requirement A Honey butter: NO incremental margin after split off point: $ 2 - $ 3 = - $ 1 Honey Jam: Yes,incremental margin after split offpoint: $ 7.2 - $ 4 = $ 3.2 Honey syrup: Yes, incremental margin after split off point: $ 0.6 - $ 0.4 = $ 0.2 Requirement Bl Joint cost: $ 197,120 - (1600*$3.2) = $ 192,000 Honey butter: $ 192,000* 16000/48000 = $ 64,000 Honey Jam:$ 192,000* 32000/48000= $ 128,000 Requirement B2 Joint allocation rate Honey butter: 16/24=66.67% Honey Jam: 8/24 = 33.33% Joint cost allocation as: Honey butter: $ 192,000*66.67% = $ 128,006.40 Honey Jam: $ 192,000* 33.33%= $ 63,993.60 Requirement B3 Sales value at splits off. Honey butter: 16,000*4 = $ 64,000 Honey Jam: 32,000*$ 6.4 = $ 204,800 Joint cost allocation as: Honey butter: $ 192,000* 64000/ 268800 = $ 45,714.29 Honey Jam: $ 192,000* 24800/268800 = $ 146.285.71 Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts