Question: product line using activity - basec cusinis. ( b ) What amount of overhead would be allocated to the wool and cotton procuuct innco using

product line using activitybasec cusinis.

b What amount of overhead would be allocated to the wool and cotton procuuct innco using the traditional approach, assuming direct labor hours were incurred evenly between the wool and cotton? How does this compare with the amount allocated using ABC in part a

E Altex Inc. manufactures two products: car wheels and truck wheels. To determine ABC. the amount of overhead to assign to each product line, the controller, Robert Hermann, has developed the following information.

tableleos Car,Trucked wheels produced,

Total estimated overhead costs for the two product lines are $

Instructions

a Compute the overhead cost assigned to the car wheels and truck wheels, assuming that direct labor hours is used to allocate overhead costs.

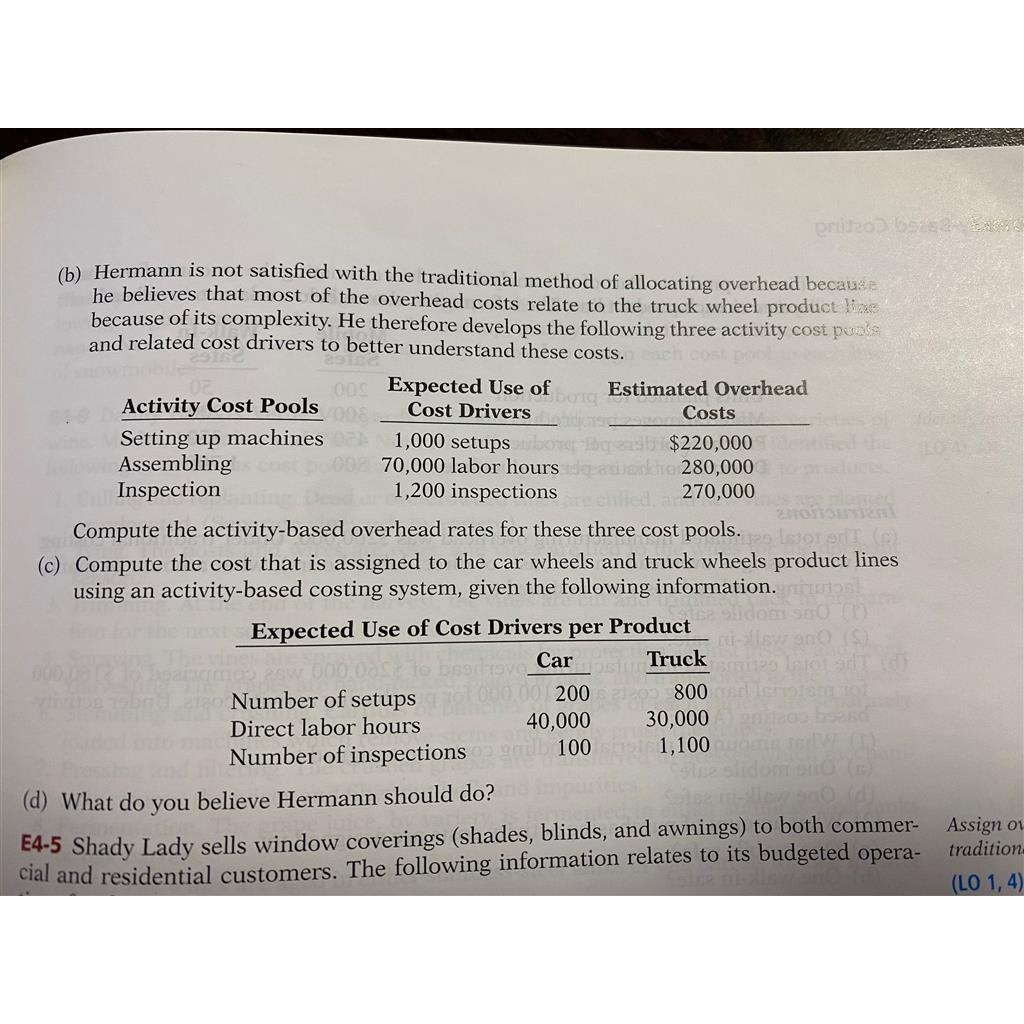

b Hermann is not satisfied with the traditional method of allocating overhead becaus he believes that most of the overhead costs relate to the truck wheel product because of its complexity. He therefore develops the following three activity cost purs and related cost drivers to better understand these costs.

tableActivity Cost Pools,tableExpected Use ofCost DriverstableEstimated OverheadCostsSetti setur,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock