Question: Product S is eventually sold for $80,000. It's separable costs after the splitoff point are $45,000. Product T is eventually sold for $130,000. It's separable

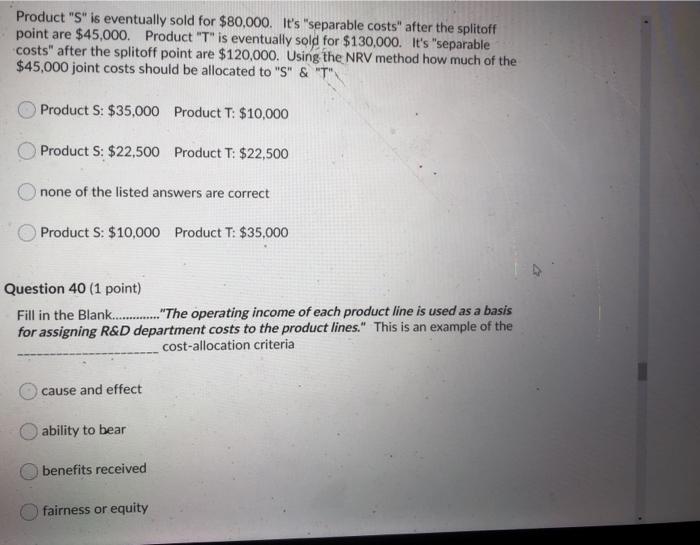

Product "S" is eventually sold for $80,000. It's "separable costs" after the splitoff point are $45,000. Product "T" is eventually sold for $130,000. It's "separable costs" after the splitoff point are $120,000. Using the NRV method how much of the $45,000 joint costs should be allocated to "S" & "T" Product S: $35,000 Product T: $10,000 Product S: $22,500 Product T: $22,500 none of the listed answers are correct Product S: $10,000 Product T: $35.000 Question 40 (1 point) Fill in the Blank. ...... "The operating income of each product line is used as a basis for assigning R&D department costs to the product lines." This is an example of the cost-allocation criteria cause and effect ability to bear benefits received fairness or equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts