Question: Professor Brown's Beer Distributor - Case Study: After winning big at the Casino Professor Brown had some additional cash to invest in a business. The

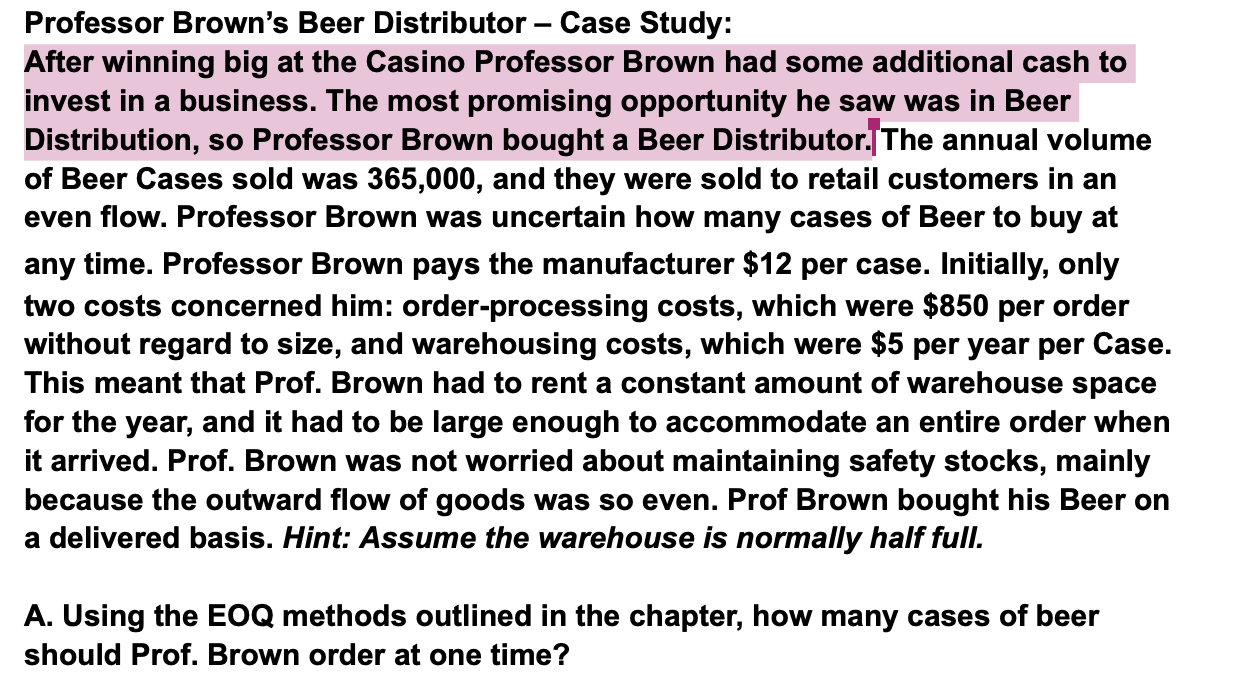

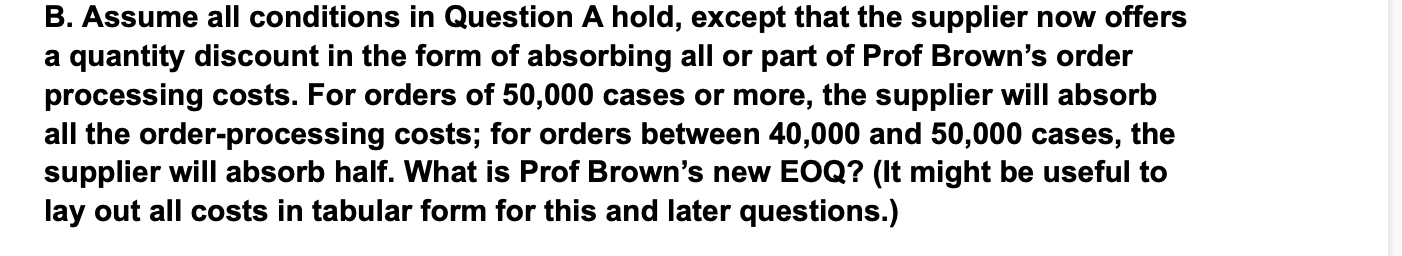

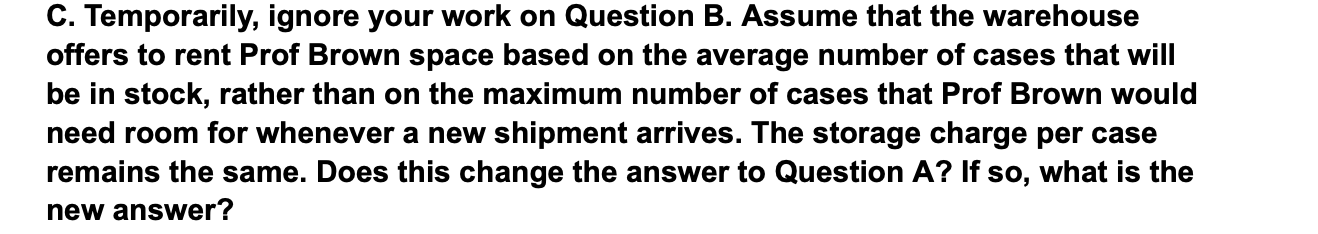

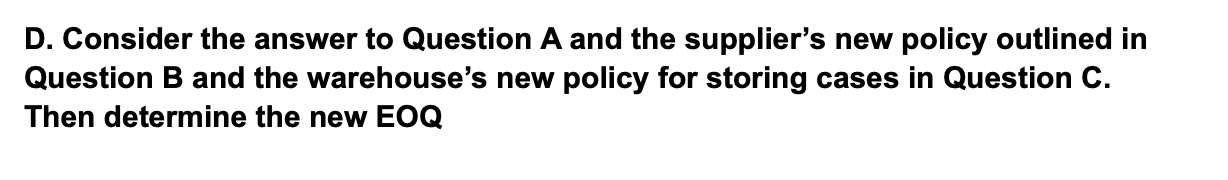

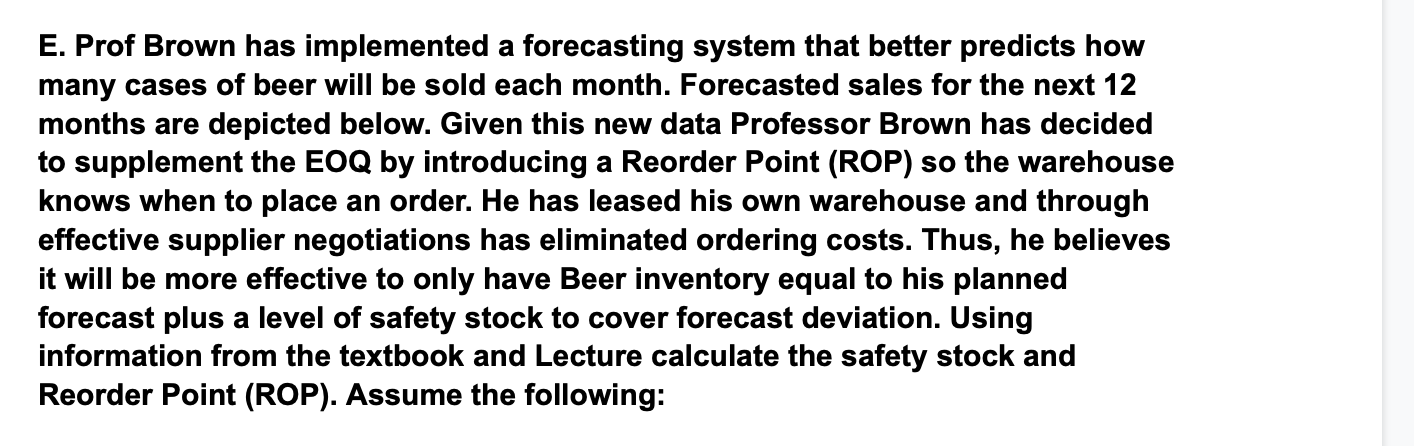

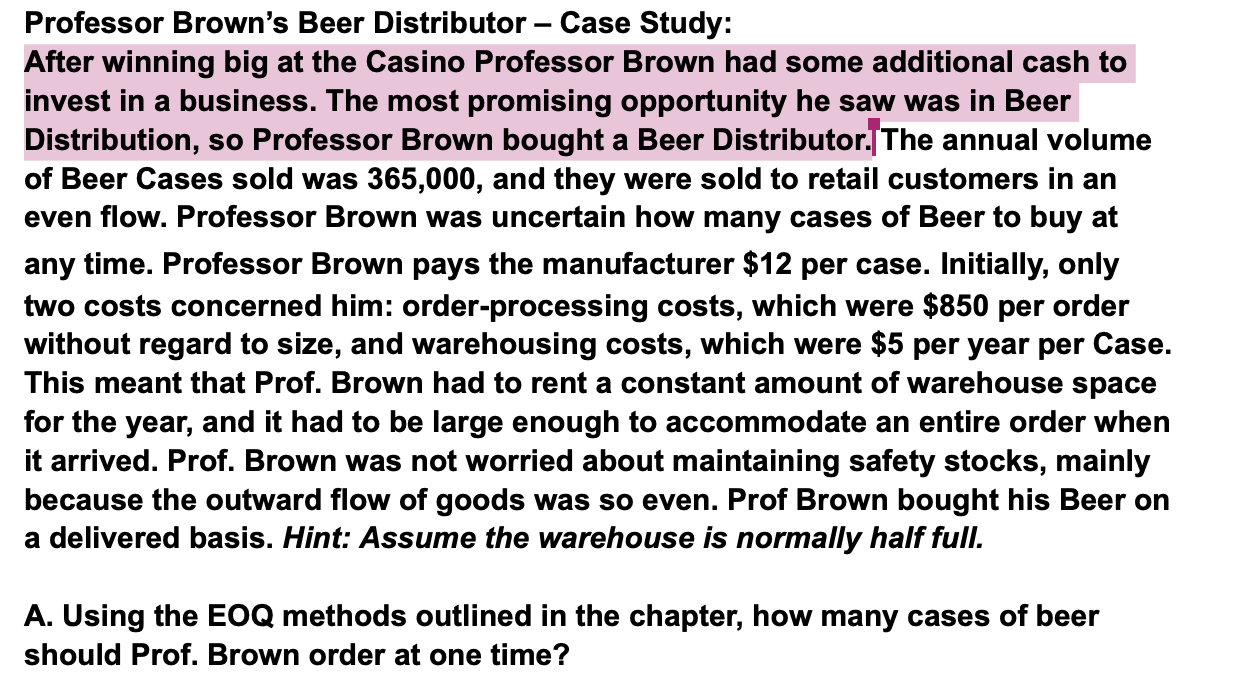

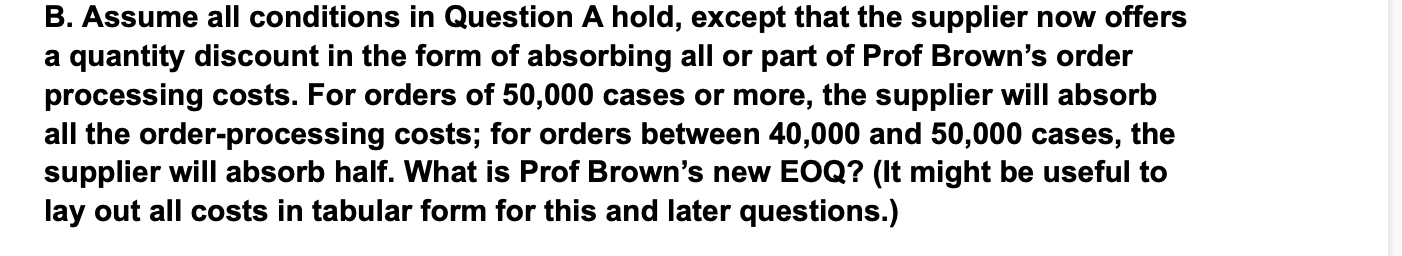

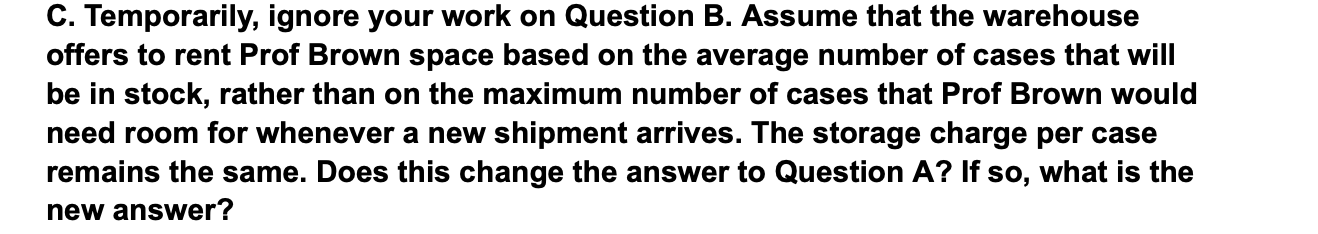

Professor Brown's Beer Distributor - Case Study: After winning big at the Casino Professor Brown had some additional cash to invest in a business. The most promising opportunity he saw was in Beer Distribution, so Professor Brown bought a Beer Distributor.|The annual volume of Beer Cases sold was 365,000 , and they were sold to retail customers in an even flow. Professor Brown was uncertain how many cases of Beer to buy at any time. Professor Brown pays the manufacturer $12 per case. Initially, only two costs concerned him: order-processing costs, which were $850 per order without regard to size, and warehousing costs, which were $5 per year per Case. This meant that Prof. Brown had to rent a constant amount of warehouse space for the year, and it had to be large enough to accommodate an entire order when it arrived. Prof. Brown was not worried about maintaining safety stocks, mainly because the outward flow of goods was so even. Prof Brown bought his Beer on a delivered basis. Hint: Assume the warehouse is normally half full. A. Using the EOQ methods outlined in the chapter, how many cases of beer should Prof. Brown order at one time? B. Assume all conditions in Question A hold, except that the supplier now offers a quantity discount in the form of absorbing all or part of Prof Brown's order processing costs. For orders of 50,000 cases or more, the supplier will absorb all the order-processing costs; for orders between 40,000 and 50,000 cases, the supplier will absorb half. What is Prof Brown's new EOQ? (It might be useful to lay out all costs in tabular form for this and later questions.) C. Temporarily, ignore your work on Question B. Assume that the warehouse offers to rent Prof Brown space based on the average number of cases that will be in stock, rather than on the maximum number of cases that Prof Brown would need room for whenever a new shipment arrives. The storage charge per case remains the same. Does this change the answer to Question A ? If so, what is the new answer? D. Consider the answer to Question A and the supplier's new policy outlined in Question B and the warehouse's new policy for storing cases in Question C. Then determine the new EOQ E. Prof Brown has implemented a forecasting system that better predicts how many cases of beer will be sold each month. Forecasted sales for the next 12 months are depicted below. Given this new data Professor Brown has decided to supplement the EOQ by introducing a Reorder Point (ROP) so the warehouse knows when to place an order. He has leased his own warehouse and through effective supplier negotiations has eliminated ordering costs. Thus, he believes it will be more effective to only have Beer inventory equal to his planned forecast plus a level of safety stock to cover forecast deviation. Using information from the textbook and Lecture calculate the safety stock and Reorder Point (ROP). Assume the following: Professor Brown's Beer Distributor - Case Study: After winning big at the Casino Professor Brown had some additional cash to invest in a business. The most promising opportunity he saw was in Beer Distribution, so Professor Brown bought a Beer Distributor.|The annual volume of Beer Cases sold was 365,000 , and they were sold to retail customers in an even flow. Professor Brown was uncertain how many cases of Beer to buy at any time. Professor Brown pays the manufacturer $12 per case. Initially, only two costs concerned him: order-processing costs, which were $850 per order without regard to size, and warehousing costs, which were $5 per year per Case. This meant that Prof. Brown had to rent a constant amount of warehouse space for the year, and it had to be large enough to accommodate an entire order when it arrived. Prof. Brown was not worried about maintaining safety stocks, mainly because the outward flow of goods was so even. Prof Brown bought his Beer on a delivered basis. Hint: Assume the warehouse is normally half full. A. Using the EOQ methods outlined in the chapter, how many cases of beer should Prof. Brown order at one time? B. Assume all conditions in Question A hold, except that the supplier now offers a quantity discount in the form of absorbing all or part of Prof Brown's order processing costs. For orders of 50,000 cases or more, the supplier will absorb all the order-processing costs; for orders between 40,000 and 50,000 cases, the supplier will absorb half. What is Prof Brown's new EOQ? (It might be useful to lay out all costs in tabular form for this and later questions.) C. Temporarily, ignore your work on Question B. Assume that the warehouse offers to rent Prof Brown space based on the average number of cases that will be in stock, rather than on the maximum number of cases that Prof Brown would need room for whenever a new shipment arrives. The storage charge per case remains the same. Does this change the answer to Question A ? If so, what is the new answer? D. Consider the answer to Question A and the supplier's new policy outlined in Question B and the warehouse's new policy for storing cases in Question C. Then determine the new EOQ E. Prof Brown has implemented a forecasting system that better predicts how many cases of beer will be sold each month. Forecasted sales for the next 12 months are depicted below. Given this new data Professor Brown has decided to supplement the EOQ by introducing a Reorder Point (ROP) so the warehouse knows when to place an order. He has leased his own warehouse and through effective supplier negotiations has eliminated ordering costs. Thus, he believes it will be more effective to only have Beer inventory equal to his planned forecast plus a level of safety stock to cover forecast deviation. Using information from the textbook and Lecture calculate the safety stock and Reorder Point (ROP). Assume the following