Question: Professors A, B, and C are having a conversation about investments. They all participate in a retirement plan where they can invest in any combination

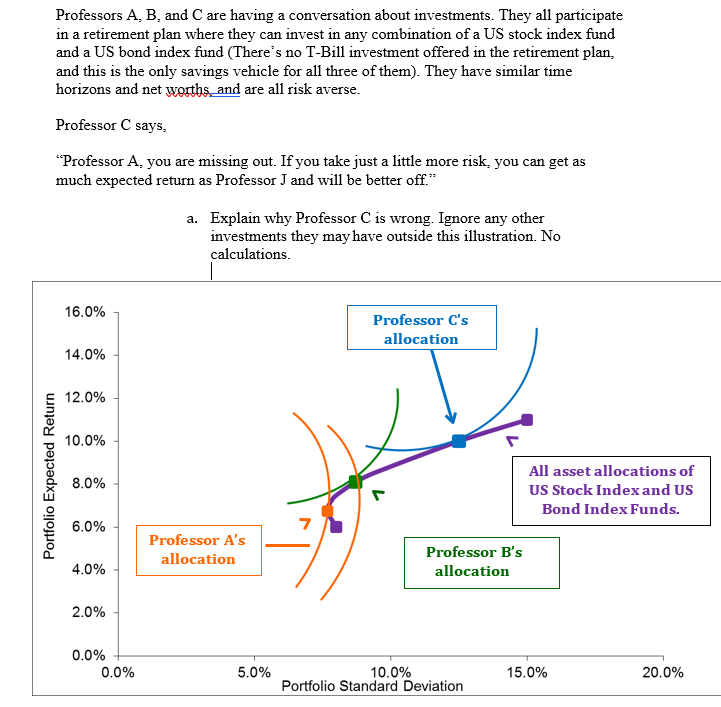

Professors A, B, and C are having a conversation about investments. They all participate in a retirement plan where they can invest in any combination of a US stock index fund and a US bond index fund (There's no T-Bill investment offered in the retirement plan. and this is the only savings vehicle for all three of them). They have similar time horizons and net worths and are all risk averse. Professor C says, "Professor A, you are missing out. If you take just a little more risk, you can get as much expected return as Professor J and will be better off." a. Explain why Professor C is wrong. Ignore any other investments they may have outside this illustration. No calculations. 16.0% Professor C's allocation 14.0% 12.0% 10.0% Portfolio Expected Return 8.0% All asset allocations of US Stock Index and US Bond Index Funds. 6.0% 7 Professor A's allocation Professor B's allocation 4.0% 2.0% 0.0% 0.0% 5.0% 15.0% 10.0% Portfolio Standard Deviation 20.0% Professors A, B, and C are having a conversation about investments. They all participate in a retirement plan where they can invest in any combination of a US stock index fund and a US bond index fund (There's no T-Bill investment offered in the retirement plan. and this is the only savings vehicle for all three of them). They have similar time horizons and net worths and are all risk averse. Professor C says, "Professor A, you are missing out. If you take just a little more risk, you can get as much expected return as Professor J and will be better off." a. Explain why Professor C is wrong. Ignore any other investments they may have outside this illustration. No calculations. 16.0% Professor C's allocation 14.0% 12.0% 10.0% Portfolio Expected Return 8.0% All asset allocations of US Stock Index and US Bond Index Funds. 6.0% 7 Professor A's allocation Professor B's allocation 4.0% 2.0% 0.0% 0.0% 5.0% 15.0% 10.0% Portfolio Standard Deviation 20.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts