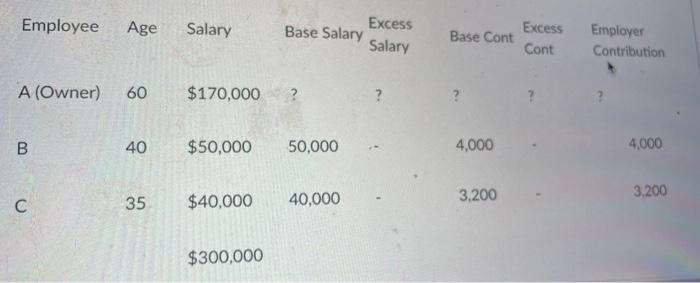

Question: Profit Sharing Question Part A ( 5 points). The following is list of ABC Corp's eligible employees. Complete the blank cells in the permitted disparity

Profit Sharing Question Part A ( 5 points). The following is list of ABC Corp's eligible employees. Complete the blank cells in the permitted disparity table for Employee A (owner). You can create a new table if easiest (with just the row of answers needed for Employee A) or type out your answers separately. Provide your work in the spaces below for partial credit. Permitted Disparity - 8% Base Rate Contribution (assume 13.7% total rate on excess salary) Employee Age Salary Base Salary Excess Salary Base Cont Excess Employer A(Owner) 60$170,000 ? ? ? ? ? ? BC4035$50,000$40,00050,00040,0004,0003,2004,0003,200 $300,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock