Question: Profitability analysis section Case Study: In 2 0 1 5 , Spotify stepped into the podcasting business, adding them to its mix of offerings alongside

Profitability analysis section

Case Study:

In Spotify stepped into the podcasting business, adding them to its mix of offerings alongside music and video. However, only in did Spotify begin to pursue the business seriously by building its podcasting capabilities through the purchase of studios, such as Soundtrap, and established podcast studies like Gimlet Media purchase Then in Spotify began to sign exclusive deals with creators such as Jemele Hill, Rob Riggle, and the Obamas Steele

In the third quarter of Anne Steele of the Wall Street Journal reported that,

Thirdquarter advertising revenue increased from a year earlier, and user growth picked up after a lull earlier this year. Spotify is now the top podcast platform in the US by listeners, according to Edison Research, passing incumbent Apple Podcasts in the largest market.

Average revenue per user for the subscription business in the quarter climbed to equivalent to $ That is a turnaround for the metric, which has been declining for years as the company attracted new subscribers through discounted plans and lower prices in newer markets. Last fall, Spotify began raising the price of its family plan in dozens of markets, including the US It said those increases have finally helped lift peruser revenue.

Spotify swung to a profit of million from a loss of million a year earlier. Per share, the company posted a loss of European cents, compared with a loss of European cents a year earlier. While the company has periodically reported a quarterly profit, executives have said it will continue to give priority to growthattracting new subscribers and investing in podcasting.

Profitability Analysis questions:

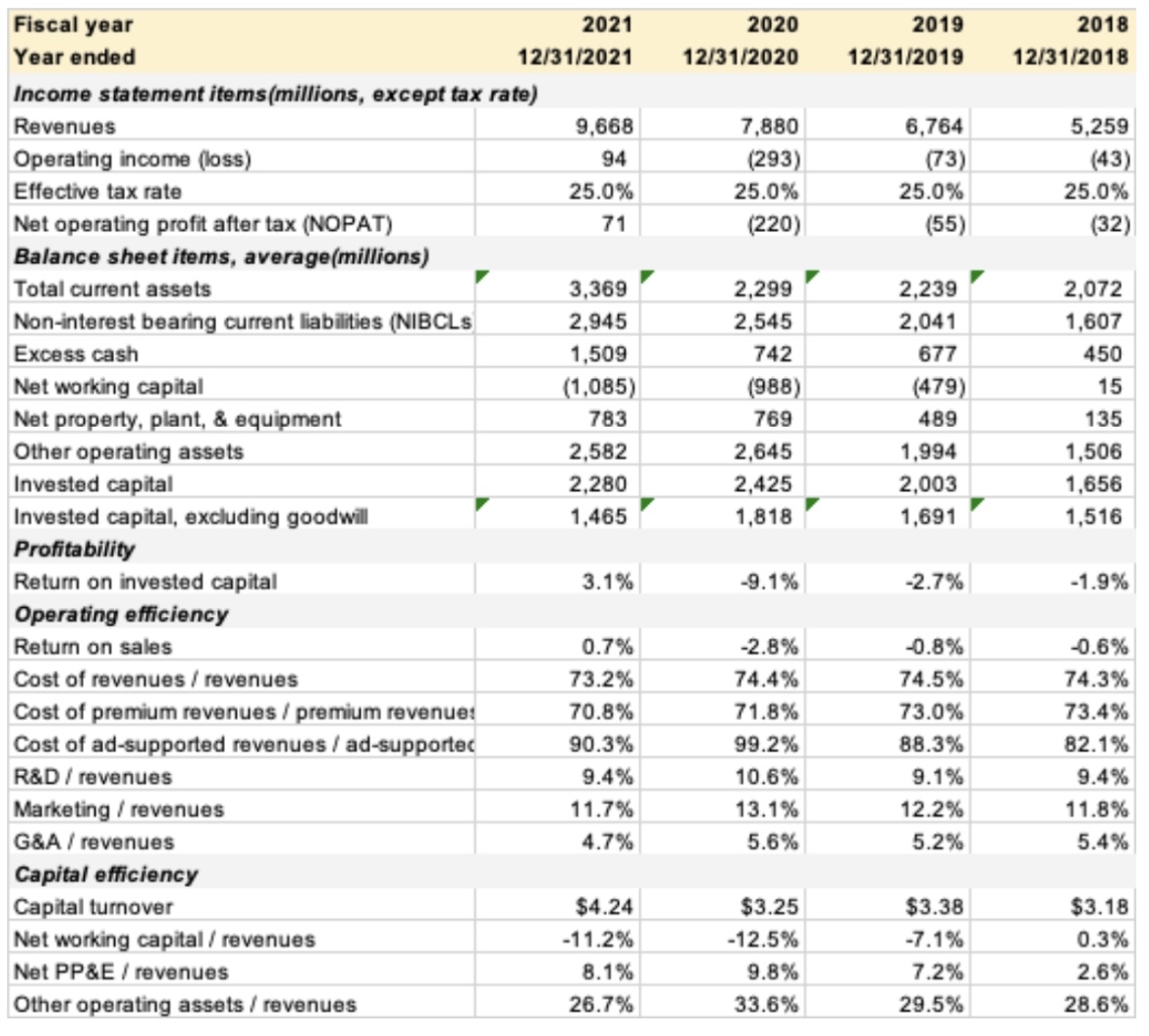

Based on the profitability metrics, has Spotify experienced steady growth in profitability since beginning its podcast investment?

Where can Spotify's profitability be most improved: operating efficiency or capital efficiency?

Which expense ratio can be most improved for Spotify, on average? What would you suggest for improvement?

Which asset ratio can be most improved for Spotify, on average? What would you suggest for improvement?

tableFiscal year,Year ended,Income statement itemsmillions except tax rateRevenuesOperating income lossEffective tax rate,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock