Question: Profitability: Overview - You will use ratio analysis to evaluate the current and past performance of the business and assess its sustainability from a

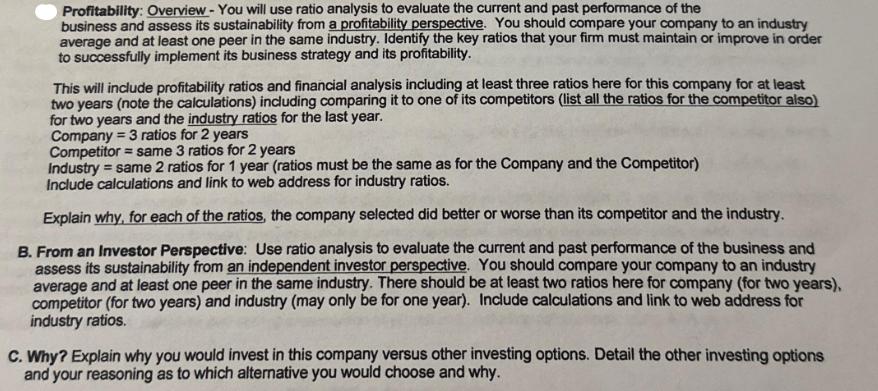

Profitability: Overview - You will use ratio analysis to evaluate the current and past performance of the business and assess its sustainability from a profitability perspective. You should compare your company to an industry average and at least one peer in the same industry. Identify the key ratios that your firm must maintain or improve in order to successfully implement its business strategy and its profitability. This will include profitability ratios and financial analysis including at least three ratios here for this company for at least two years (note the calculations) including comparing it to one of its competitors (list all the ratios for the competitor also) for two years and the industry ratios for the last year. Company = 3 ratios for 2 years Competitor - same 3 ratios for 2 years Industry = same 2 ratios for 1 year (ratios must be the same as for the Company and the Competitor) Include calculations and link to web address for industry ratios. Explain why, for each of the ratios, the company selected did better or worse than its competitor and the industry. B. From an Investor Perspective: Use ratio analysis to evaluate the current and past performance of the business and assess its sustainability from an independent investor perspective. You should compare your company to an industry average and at least one peer in the same industry. There should be at least two ratios here for company (for two years), competitor (for two years) and industry (may only be for one year). Include calculations and link to web address for industry ratios. C. Why? Explain why you would invest in this company versus other investing options. Detail the other investing options and your reasoning as to which alternative you would choose and why.

Step by Step Solution

There are 3 Steps involved in it

A Profitability Ratios Company A for 2 years 1 Net Profit Margin This ratio measures the companys net profit as a percentage of its revenue Its calculated as Net Profit Revenue 100 2 Return on Assets ... View full answer

Get step-by-step solutions from verified subject matter experts