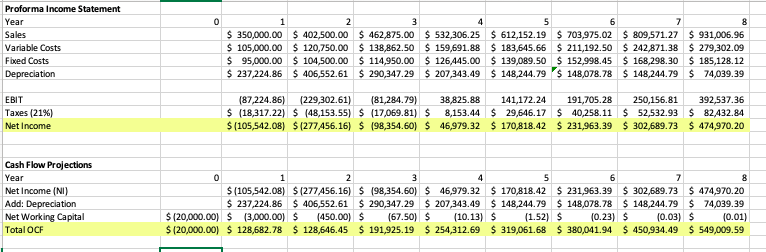

Question: Proforma Income Statement Year 0 1 2 3 4 6 7 Sales $ 350,000.00 $ 402,500.00 $ 462,875.00 $ 532,306.25 $ 612,152.19 $ 703,975.02 $

Proforma Income Statement Year 0 1 2 3 4 6 7 Sales $ 350,000.00 $ 402,500.00 $ 462,875.00 $ 532,306.25 $ 612,152.19 $ 703,975.02 $ 809,571.27 $ 931,006.96 Variable Costs $ 105,000.00 $ 120,750.00 $ 138,862.50 $ 159,691.88 $ 183,645.66 $ 211,192.50 $ 242,871.38 $ 279,302.09 Fixed Costs $ 95,000.00 $ 104,500.00 $ 114,950.00 $ 126,445.00 $ 139,089.50 $ 152,998.45 $ 168,298.30 $ 185,128.12 Depreciation $ 237,224.86 $ 406,552.61 $ 290,347.29 $ 207,343.49 $ 148,244.79 $ 148,078.78 $ 148,244.79 $ 74,039.39 EBIT (87,224.86] (229,302.61) [81,284.79) 38,825.88 141,172.24 191,705.28 250,156.81 392,537.36 Taxes (21%) $ (18,317.22) $ (48,153.55) $ (17,069.81) $ 8,153.44 $ 29,646.17 $ 40,258.11 $ 52,532.93 5 82,432.84 Net Income $ [105,542.08) $ [277,456.16) $ (98,354.60) $ 46,979.32 5 170,818.42 $ 231,963.39 $ 302,689.73 $ 474,970.20 Cash Flow Projections Year 0 2 3 5 6 7 Net Income (NI) $ (105,542.08) $ (277,456.16) $ (98,354.60) $ 46,979.32 5 170,818.42 $ 231,963.39 $ 302,689.73 5 474,970.20 Add: Depreciation $ 237,224.86 $ 406,552.61 $ 290,347.29 $ 207,343.49 $ 148,244.79 $ 148,078.78 $ 148,244.79 5 74,039.39 Net Working Capital $ (20,000.00) $ (3,000.00) $ (450.00) $ (67.50) $ (10.13] $ (1.52) $ (0.23) $ $ (FO O) (0.01) Total OCF $ (20,000.00) $ 128,682.78 $ 128,646.45 $ 191,925.19 $ 254,312.69 $ 319,061.68 $ 380,041.94 $ 450,934.49 $ 549,009.59