Question: Program: Write a complete C++ program that calculates the local annual tax for residents in the Lakeland. Input: 1. Annual income of a resident in

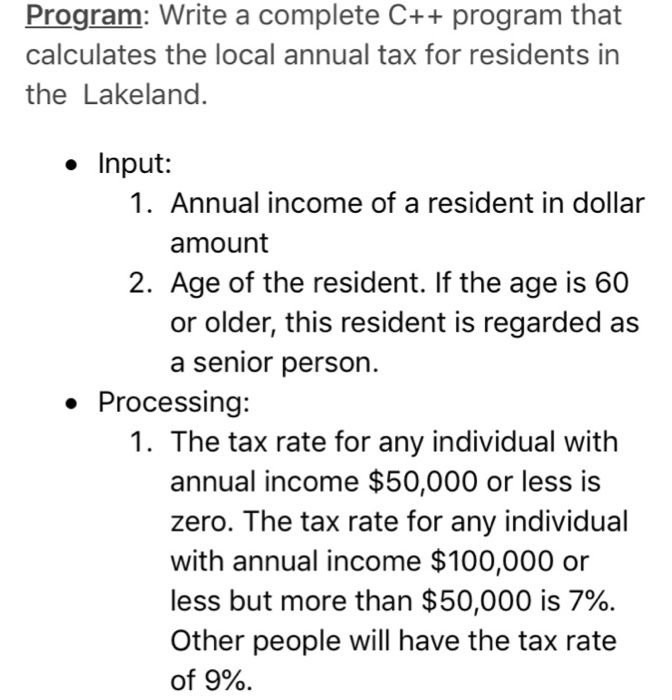

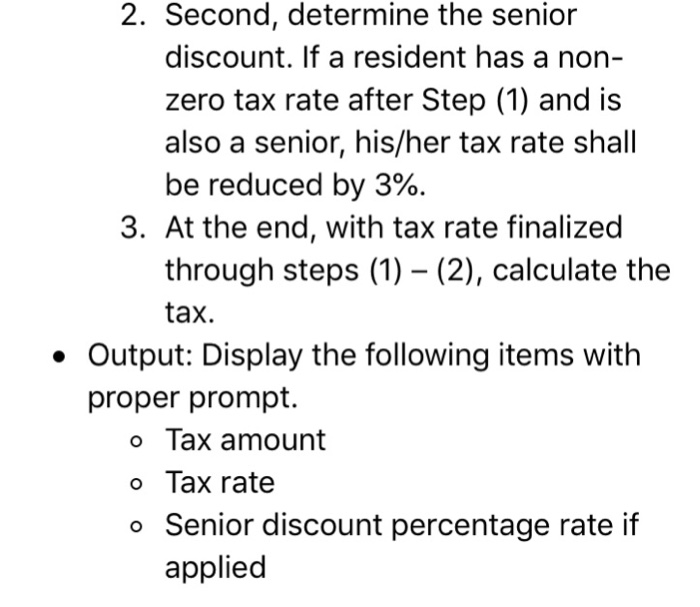

Program: Write a complete C++ program that calculates the local annual tax for residents in the Lakeland. Input: 1. Annual income of a resident in dollar amount 2. Age of the resident. If the age is 60 or older, this resident is regarded as a senior perso . Processing: 1. The tax rate for any individual with annual income $50,000 or less is zero. The tax rate for any individual with annual income $100,000 or less but more than $50,000 is 7%. Other people will have the tax rate of 9%. 2. Second, determine the senior discount. If a resident has a non- zero tax rate after Step (1) and is also a senior, his/her tax rate shall be reduced by 3%. 3. At the end, with tax rate finalized through steps (1) (2), calculate the tax Output: Display the following items with proper prompt. o Tax amount o Tax rate o Senior discount percentage rate if applied

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts