Question: Programming Fundamentals. Making a payroll program in c++ Assignment Develop a top-down design and write a program utilizing at least three functions to calculate payroll

Programming Fundamentals. Making a payroll program in c++

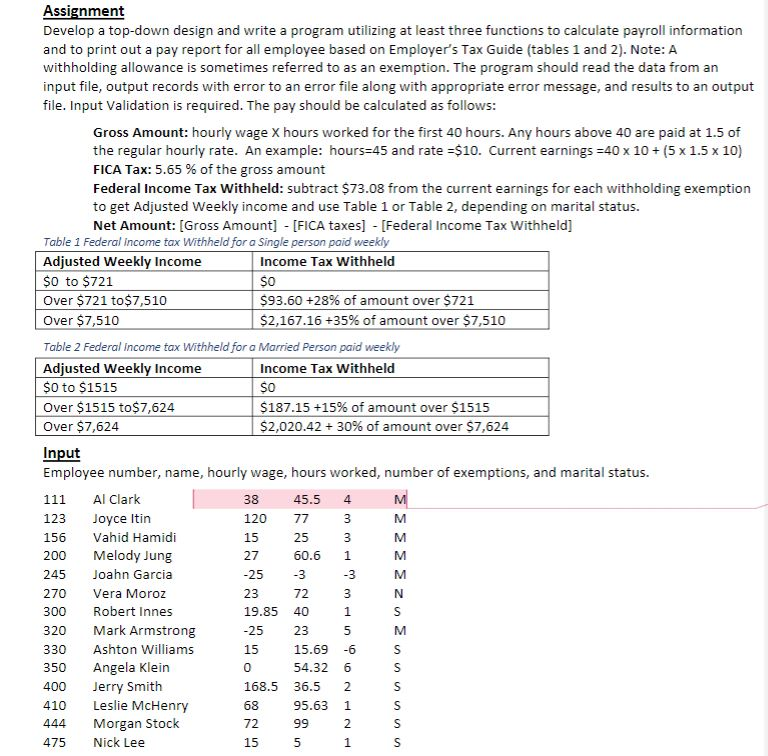

Assignment Develop a top-down design and write a program utilizing at least three functions to calculate payroll information and to print out a pay report for all employee based on Employer's Tax Guide (tables 1 and 2). Note: A withholding allowance is sometimes referred to as an exemption. The program should read the data from an input file, output records with error to an error file along with appropriate error message, and results to an output file. Input Validation is required. The pay should be calculated as follows: Gross Amount: hourly wage X hours worked for the first 40 hours. Any hours above 40 are paid at 1.5 of the regular hourly rate. An example: hours 45 and rate $10. Current earnings 40 x 10(5 x 1.5 x 10) FICA Tax: 5.65 % of the gross amount Federal Income Tax Withheld: subtract $73.08 from the current earnings for each withholding exemption to get Adjusted Weekly income and use Table 1 or Table 2, depending on marital status. Net Amount: [Gross Amount] [FICA taxes] [Federal Income Tax Withheld] Table 1 Federal income tax Withheld for a Single person paid weekly Adjusted Weekly Income $0 to $721 Over $721 to$7,510 Over $7,510 Table 2 Federal income tax Withheld for a Married Person paid weekly Adjusted Weekly Income $0 to $1515 Over $1515 to$7,624 Over $7,624 Input Employee number, name, hourly wage, hours worked, number of exemptions, and marital status. 111 Al Clark 123 Joyce Itin 156 Vahid Hamidi 200 Melody Jung 245 Joahn Garcia 270 Vera Moroz 300 Robert Innes 320 Mark Armstrong 330 Ashton Williams 350 Angela Klein 400 Jerry Smith 410 Leslie McHenry 444 Morgan Stock 475 Nick Lee Income Tax Withheld $0 93.60 +28% of amount over $721 $2,167.16 +35% of amount over $7,510 Income Tax Withheld 0 $187.15 +15% of amount over $1515 $2,020.42 + 30% of amount over $7,624 45.5 4 120 25 1 15 60.0 3 27 -25 -3 23 19.85 40 -25 23 15 SA5 72 15.69 -6 54.32 168.5 36.5 2 63 99 72 15 95.63 1 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts