Question: Programming I: PYTHON 1. Type in (in the editor, not at the prompt) the program (including comments) on photos 1 and 2. Correct any errors

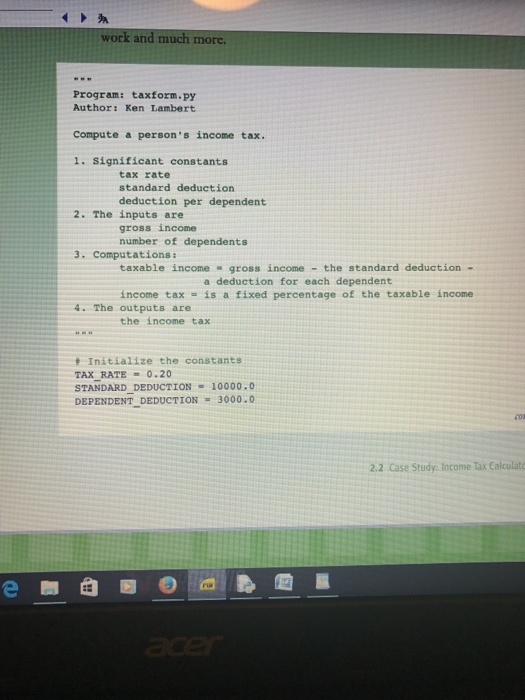

work and much more Program: taxform.py Author: Ken Lambert Compute a person's income tax 1. Significant constants tax rate standard deduction deduction per dependent 2. The inputs are gross income number of dependents 3. Computations: taxable income gross income - the standard deduction - income tax = is a fixed percentage of the taxable income the income tax a deduction for each dependent 4. The outputs are Initialize the constants TAX RATE = 0.20 STANDARD DEDUCTION 10000.0 DEPENDENT DEDUCTION = 3000.0 2.2 Case Study: Income Tax Calculato

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts