Question: progress-dise nment eBook Calculator E Print Item Example 4-1 Carl Jamison, an employee for the Scharman School, belongs to a tax-deferred retirement plan to which

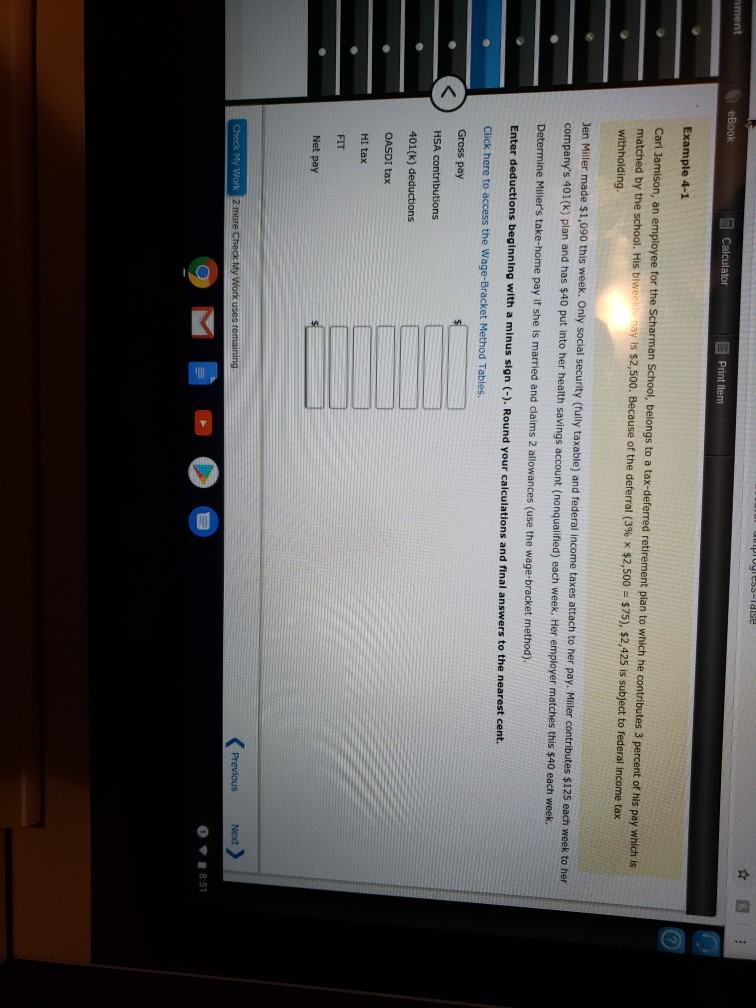

progress-dise nment eBook Calculator E Print Item Example 4-1 Carl Jamison, an employee for the Scharman School, belongs to a tax-deferred retirement plan to which he contributes 3 percent of his pay which is matched by the school. His biwe say is $2,500. Because of the deferral (3% x $2,500 = $75), $2,425 is subject to federal income tax withholding Jen Miller made $1,090 this week. Only social security (fully taxable) and federal income taxes attach to her pay. Miller contributes $125 each week to her company's 401(k) plan and has $40 put into her health savings account (nonqualified) each week. Her employer matches this $40 each week. Determine Miller's take-home pay if she is married and claims 2 allowances (use the wage-bracket method). Enter deductions beginning with a minus sign (-). Round your calculations and final answers to the nearest cent. Click here to access the Wage-Bracket Method Tables. Gross pay HSA contributions 401(k) deductions OASDI tax HI tax FIT Net pay Check My Work 2 more Check My Work uses remaining Previous Next > 18:51 progress-dise nment eBook Calculator E Print Item Example 4-1 Carl Jamison, an employee for the Scharman School, belongs to a tax-deferred retirement plan to which he contributes 3 percent of his pay which is matched by the school. His biwe say is $2,500. Because of the deferral (3% x $2,500 = $75), $2,425 is subject to federal income tax withholding Jen Miller made $1,090 this week. Only social security (fully taxable) and federal income taxes attach to her pay. Miller contributes $125 each week to her company's 401(k) plan and has $40 put into her health savings account (nonqualified) each week. Her employer matches this $40 each week. Determine Miller's take-home pay if she is married and claims 2 allowances (use the wage-bracket method). Enter deductions beginning with a minus sign (-). Round your calculations and final answers to the nearest cent. Click here to access the Wage-Bracket Method Tables. Gross pay HSA contributions 401(k) deductions OASDI tax HI tax FIT Net pay Check My Work 2 more Check My Work uses remaining Previous Next > 18:51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts