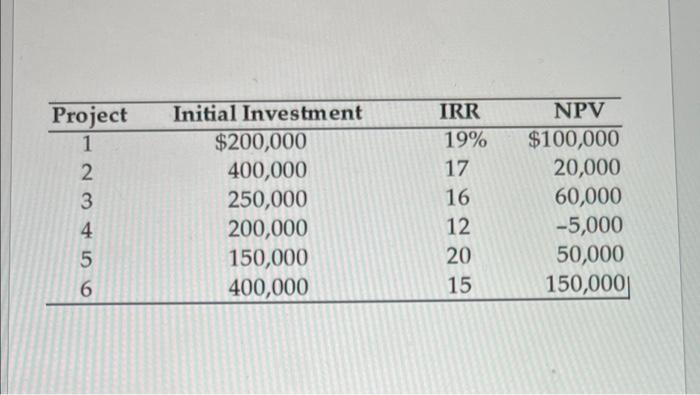

Question: Project 1 2 3 4 5 6 Initial Investment $200,000 400,000 250,000 200,000 150,000 400,000 IRR 19% 17 16 12 20 15 NPV $100,000 20,000

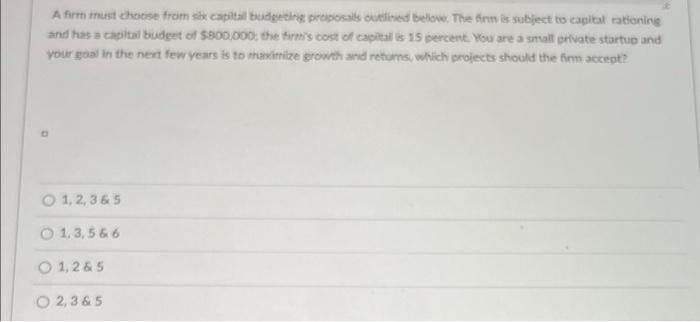

Project 1 2 3 4 5 6 Initial Investment $200,000 400,000 250,000 200,000 150,000 400,000 IRR 19% 17 16 12 20 15 NPV $100,000 20,000 60,000 -5,000 50,000 150,000 A form must choose from she capital budgeting proposals outlined below. The firm is subject to capital rationing and has a capital budget of $800.000: the firm's cost of capital is 15 percent. You are a small private startup and your goal in the next few years is to maximize growth and returns, which projects should the firm accept? 1, 2, 365 O 1,3,5 & 6 O 1,265 O 2,3&5

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock