Question: Project 1 Assignment - Instruction Set Bill and Mary Clients are married and wish to file jointly. Bill has been promoted to Vice President for

Project Assignment Instruction Set

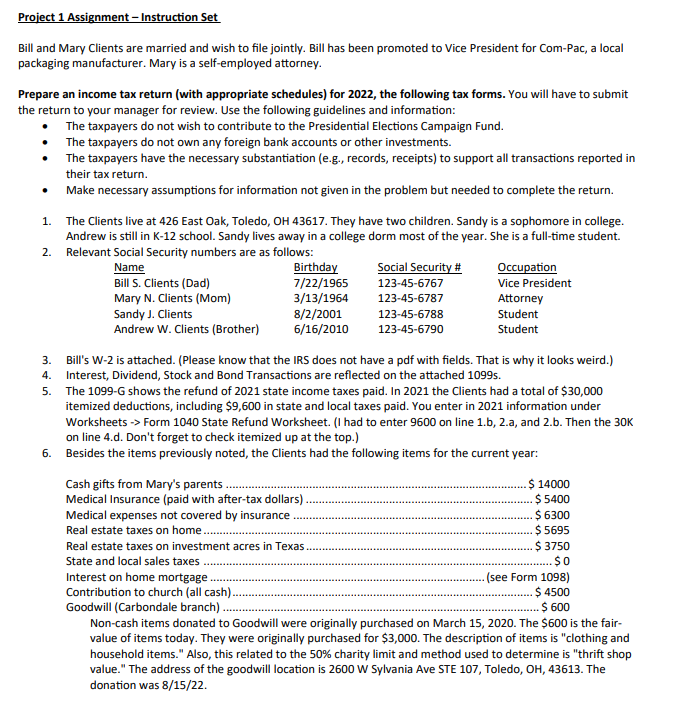

Bill and Mary Clients are married and wish to file jointly. Bill has been promoted to Vice President for ComPac, a local packaging manufacturer. Mary is a selfemployed attorney.

Prepare an income tax return with appropriate schedules for the following tax forms. You will have to submit the return to your manager for review. Use the following guidelines and information:

The taxpayers do not wish to contribute to the Presidential Elections Campaign Fund.

The taxpayers do not own any foreign bank accounts or other investments.

The taxpayers have the necessary substantiation eg records, receipts to support all transactions reported in their tax return.

Make necessary assumptions for information not given in the problem but needed to complete the return.

The Clients live at East Oak, Toledo, OH They have two children. Sandy is a sophomore in college. Andrew is still in K school. Sandy lives away in a college dorm most of the year. She is a fulltime student.

Relevant Social Security numbers are as follows:

Bill's W is attached. Please know that the IRS does not have a pdf with fields. That is why it looks weird.

Interest, Dividend, Stock and Bond Transactions are reflected on the attached s

The G shows the refund of state income taxes paid. In the Clients had a total of $ itemized deductions, including $ in state and local taxes paid. You enter in information under Worksheets Form State Refund Worksheet. I had to enter on line ba and b Then the K on line d Don't forget to check itemized up at the top.

Besides the items previously noted, the Clients had the following items for the current year:

Cash gifts from Mary's parents $

Medical Insurance paid with aftertax dollars

Medical expenses not covered by insurance $

Real estate taxes on home. $

Real estate taxes on investment acres in Texas. $

State and local sales taxes $

Interest on home mortgage see Form

Contribution to church all cash$

Goodwill Carbondale branch$

Noncash items donated to Goodwill were originally purchased on March The $ is the fairvalue of items today. They were originally purchased for $ The description of items is "clothing and household items." Also, this related to the charity limit and method used to determine is "thrift shop value." The address of the goodwill location is W Sylvania Ave STE Toledo, OH The donation was

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock