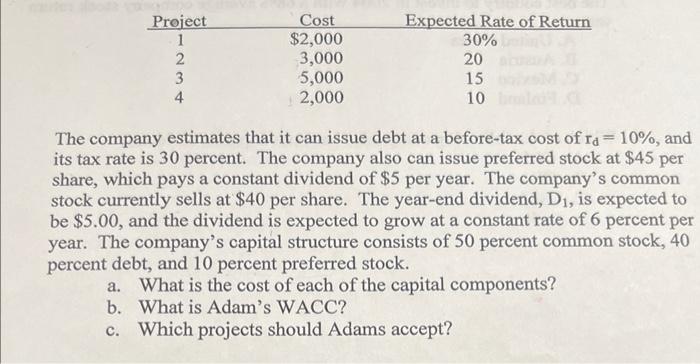

Question: Project 1 Cost $2,000 Expected Rate of Return 30% 2 3,000 5,000 2,000 20 15 10 bil 3 4 The company estimates that it

Project 1 Cost $2,000 Expected Rate of Return 30% 2 3,000 5,000 2,000 20 15 10 bil 3 4 The company estimates that it can issue debt at a before-tax cost of ra = 10%, and its tax rate is 30 percent. The company also can issue preferred stock at $45 per share, which pays a constant dividend of $5 per year. The company's common stock currently sells at $40 per share. The year-end dividend, D, is expected to be $5.00, and the dividend is expected to grow at a constant rate of 6 percent per year. The company's capital structure consists of 50 percent common stock, 40 percent debt, and 10 percent preferred stock. What is the cost of each of the capital components? b. What is Adam's WACC? c. Which projects should Adams accept?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts