Question: Project 1 for Mathematical Modeling Question 1 : 2 0 points With the rising price of gas, you wish to buy a new ( hybrid

Project for Mathematical Modeling

Question : points

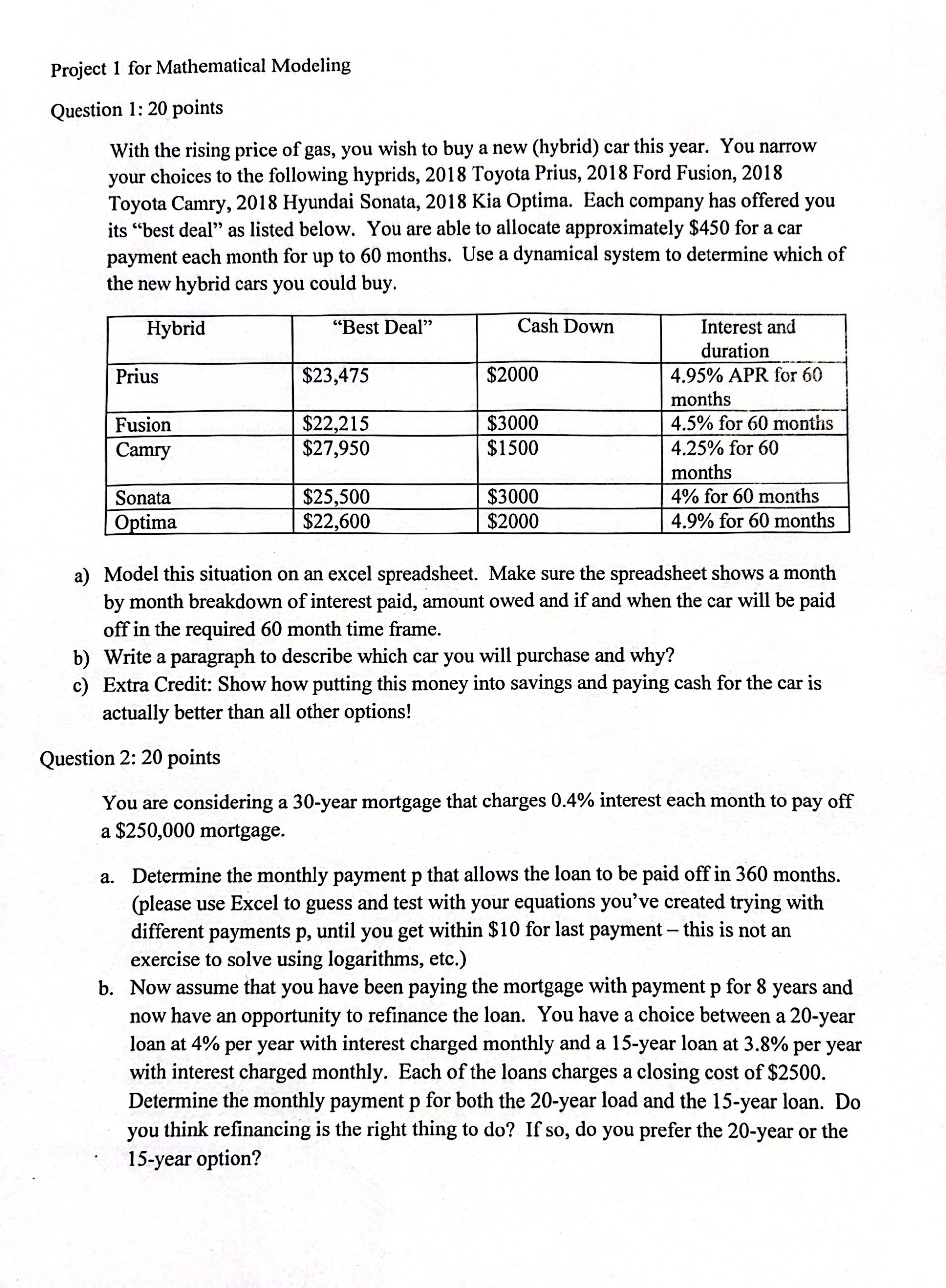

With the rising price of gas, you wish to buy a new hybrid car this year. You narrow your choices to the following hyprids, Toyota Prius, Ford Fusion, Toyota Camry, Hyundai Sonata, Kia Optima. Each company has offered you its "best deal" as listed below. You are able allocate approximately $ for a car payment each month for up to months. Use a dynamical system to determine which of

the new hybrid cars you could buy.

a Model this situation on an excel spreadsheet. Make sure the spreadsheet shows a month

by month breakdown of interest paid, amount owed and if and when the car will be paid

off in the required month time frame.

b Write a paragraph to describe which car you will purchase and why?

c Extra Credit: Show how putting this money into savings and paying cash for the car is

actually better than all other options!

Question : points

You are considering a year mortgage that charges interest each month to pay off

a $ mortgage.

a Determine the monthly payment p that allows the loan to be paid off in months.

please use Excel to guess and test with your equations you've created trying with

different payments p until you get within $ for last payment this is not an

exercise to solve using logarithms, etc.

b Now assume that you have been paying the mortgage with payment p for years and

now have an opportunity to refinance the loan. You have a choice between a year

loan at per year with interest charged monthly and a year loan at per year

with interest charged monthly. Each of the loans charges a closing cost of $

Determine the monthly payment p for both the year load and the year loan. Do

you think refinancing is the right thing to do If so do you prefer the year or the

year option?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock