Question: Project 1 Probability Return Standard Deviation Beta 50% Chance 22% 12% 1.2 50% Chance -4% Project 2 Probability Return Standard Deviation Beta 30 % Chance

Project 1

Probability Return Standard Deviation Beta

50% Chance 22% 12% 1.2

50% Chance -4%

Project 2

Probability Return Standard Deviation Beta

30 % Chance 28% 19.5% .08

40% Chance 10.5%

30% Chance -20%

Project 3

Probability Return Standard Deviation Beta

10% Chance 28% 12% 2.0

70% Chance 18%

20% Chance -8%

Assume the risk free rate of return is 2% and the market risk premium is 8$. If you are a risk averse investor, which project should you choose?

Please be specific and explain why -

A. Either Project 2 or Project 3 because the higher expected return on Project 3 offsets its higher risk

B. Project 2

C. Project 1

D. Project

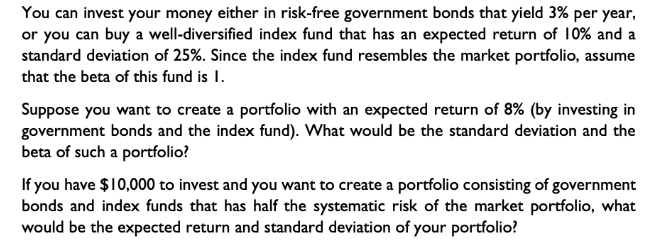

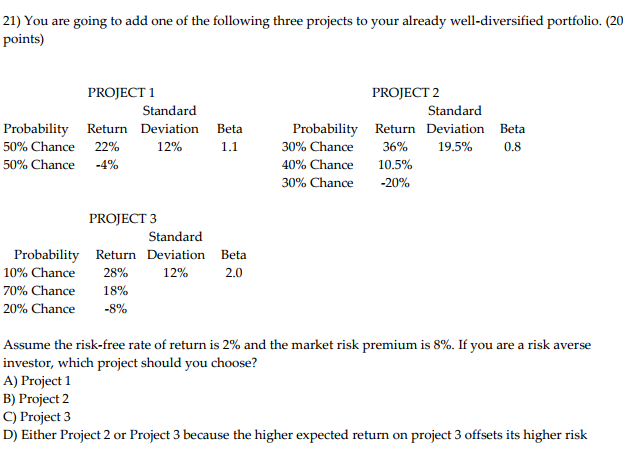

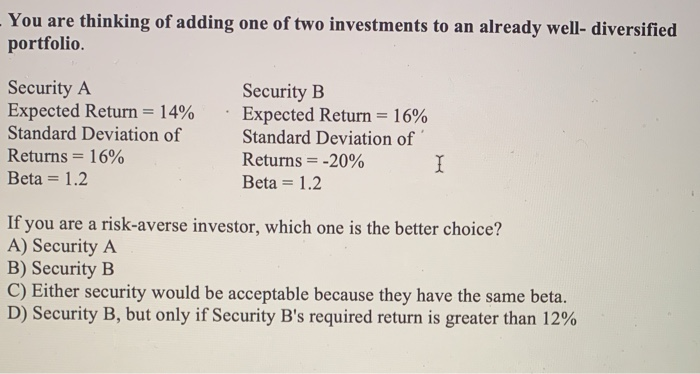

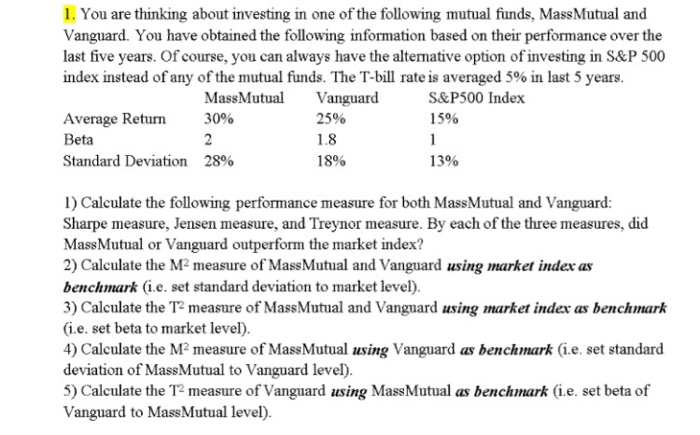

You can invest your money either in risk-free government bonds that yield 3% per year. or you can buy a well-diversied index fund that has an expected return of \"3% and a standard deviation of 25%. Since the index fund resembles the market portfolio, assume that the beta ofthis fund is I. Suppose you want to create a portfolio with an expected return of 3% {by investing in government bonds and the index fund}. 1'vl'il'haa would be the standard deviation and the beta of such a portfolio? If you have $ i 0.000 to invest and you want to create a portfolio consisting of government bonds and index funds that has half the systematic risk of the market portfolio. what would be the expected return and standard deviation of your portfolio? 21) You are going to add one of the following three projects to your already well-diversified portfolio. (20 points) PROJECT 1 PROJECT 2 Standard Standard Probability Return Deviation Beta Probability Return Deviation Beta 50% Chance 22% 12% 1.1 30% Chance 36% 19.5% 0.8 50% Chance -4% 40% Chance 10.5% 30% Chance -20% PROJECT 3 Standard Probability Return Deviation Beta 10% Chance 28% 12% 2.0 70% Chance 18% 20% Chance -8% Assume the risk-free rate of return is 2% and the market risk premium is 8%. If you are a risk averse investor, which project should you choose? A) Project 1 B) Project 2 C) Project 3 D) Either Project 2 or Project 3 because the higher expected return on project 3 offsets its higher riskYou are thinking of adding one of two investments to an already well- diversified portfolio. Security A Security B Expected Return = 14% . Expected Return = 16% Standard Deviation of Standard Deviation of Returns = 16% Returns = -20% Beta = 1.2 Beta = 1.2 If you are a risk-averse investor, which one is the better choice? A) Security A B) Security B C) Either security would be acceptable because they have the same beta. D) Security B, but only if Security B's required return is greater than 12%1. You are thinking about investing in one of the following mutual funds, MassMutual and Vanguard. You have obtained the following information based on their performance over the last five years. Of course, you can always have the alternative option of investing in S&P 500 index instead of any of the mutual funds. The T-bill rate is averaged 5% in last 5 years. MassMutual Vanguard S&P500 Index Average Return 30% 25% 15% Beta 2 1.8 Standard Deviation 28% 18% 13% 1) Calculate the following performance measure for both MassMutual and Vanguard: Sharpe measure, Jensen measure, and Treynor measure. By each of the three measures, did MassMutual or Vanguard outperform the market index? 2) Calculate the M2 measure of MassMutual and Vanguard using market index as benchmark (i.e. set standard deviation to market level). 3) Calculate the T2 measure of MassMutual and Vanguard using market index as benchmark (i.e. set beta to market level). 4) Calculate the M2 measure of MassMutual using Vanguard as benchmark (i.e. set standard deviation of MassMutual to Vanguard level). 5) Calculate the T2 measure of Vanguard using MassMutual as benchmark (i.e. set beta of Vanguard to MassMutual level)