Question: Project 12: please answer all questions and show work. Thank you! Project #12: Statement of Cash Flows 76 Note: Use the Financial Statements prepared for

Project 12: please answer all questions and show work. Thank you!

Project 12: please answer all questions and show work. Thank you!

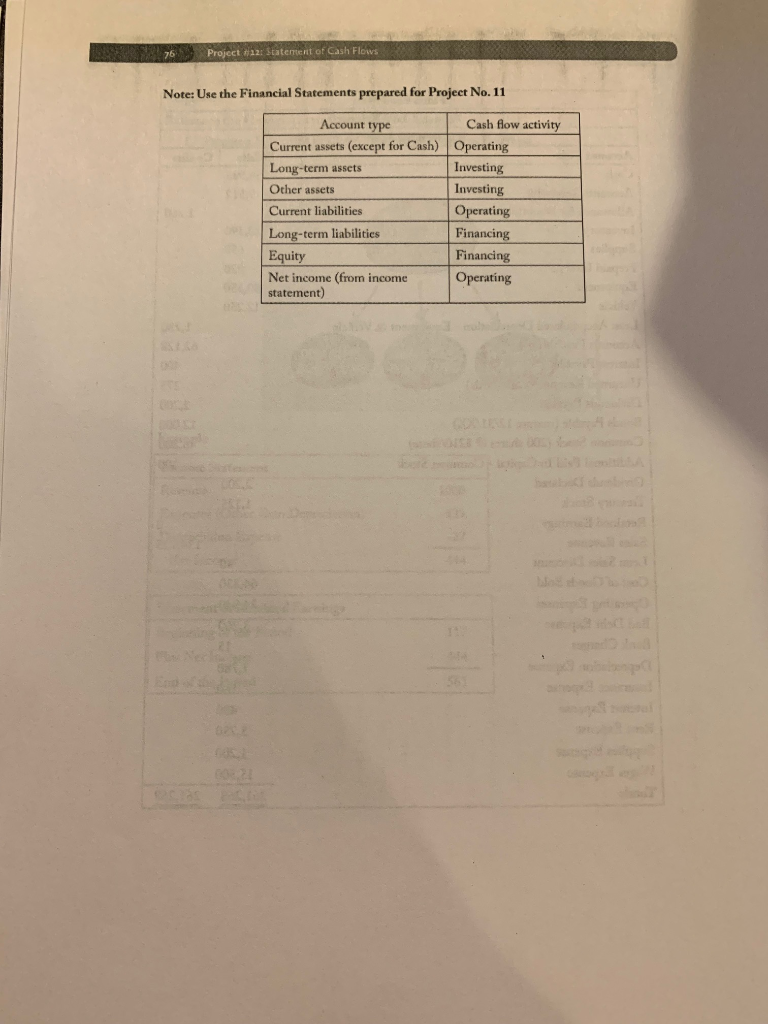

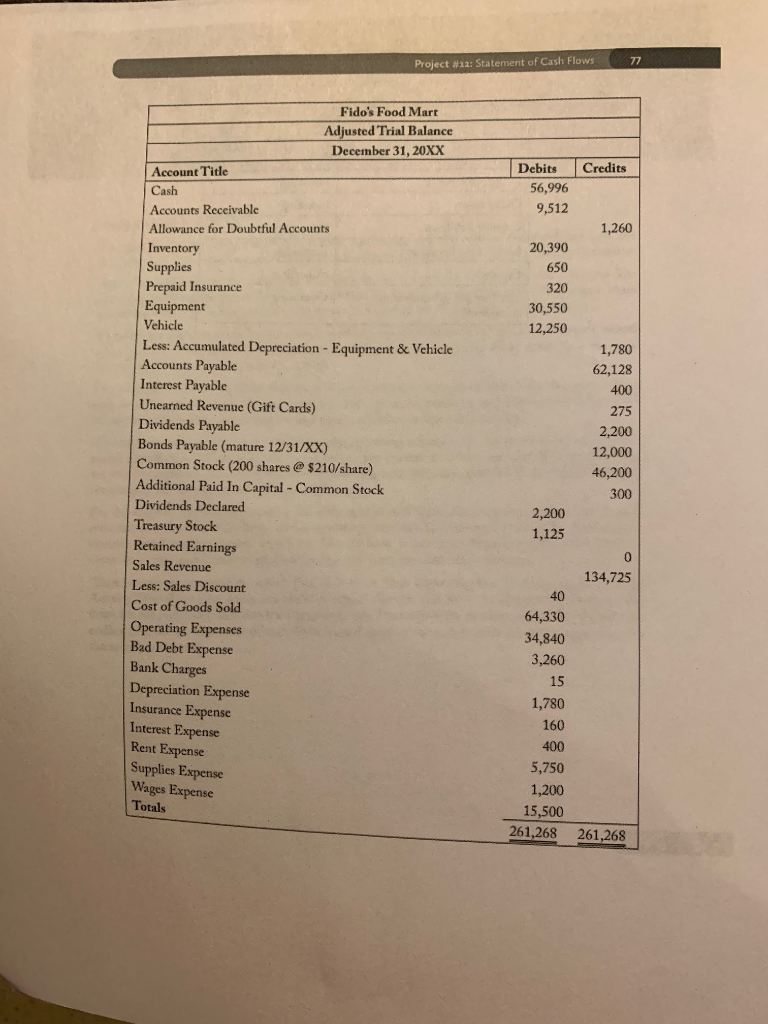

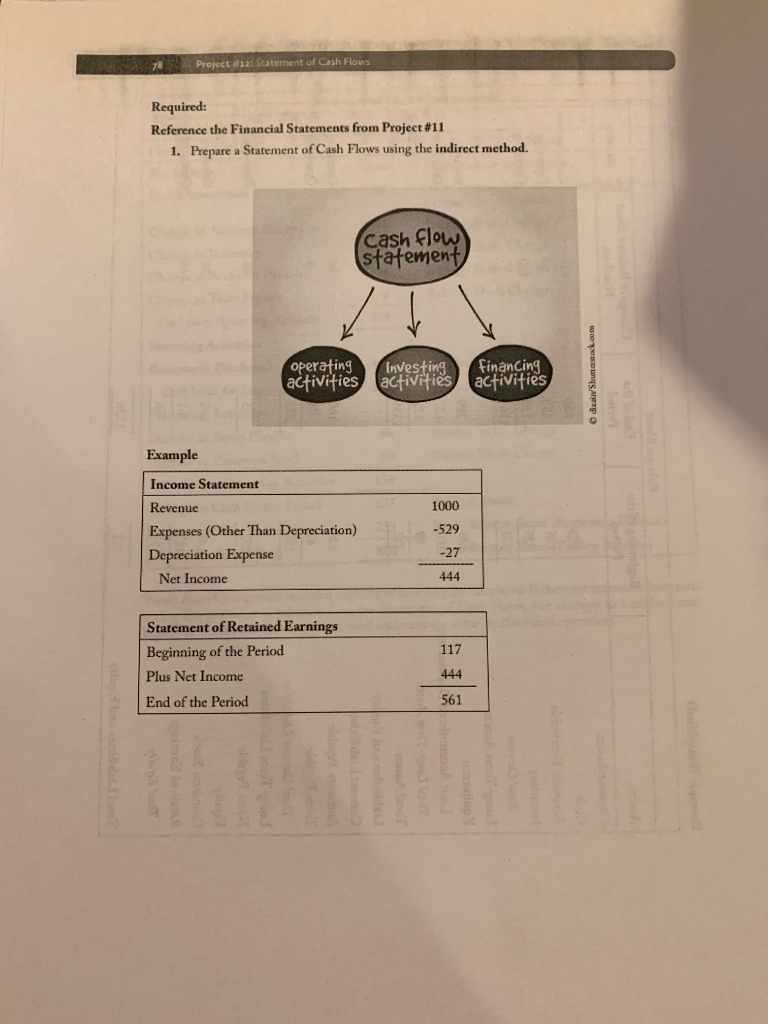

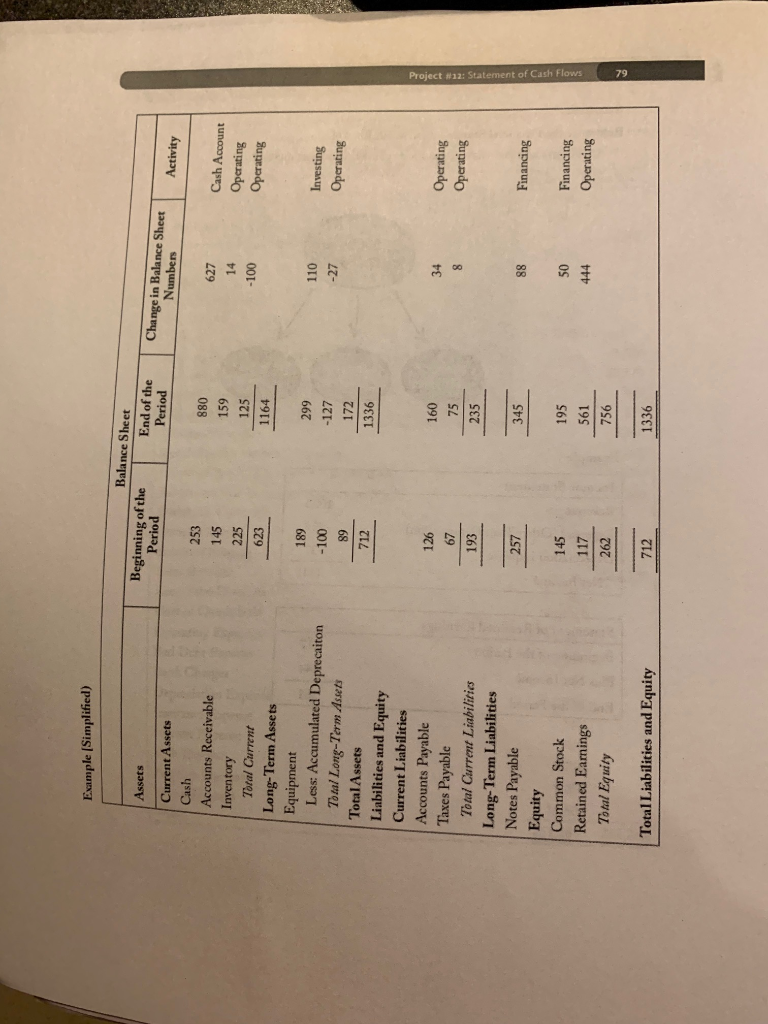

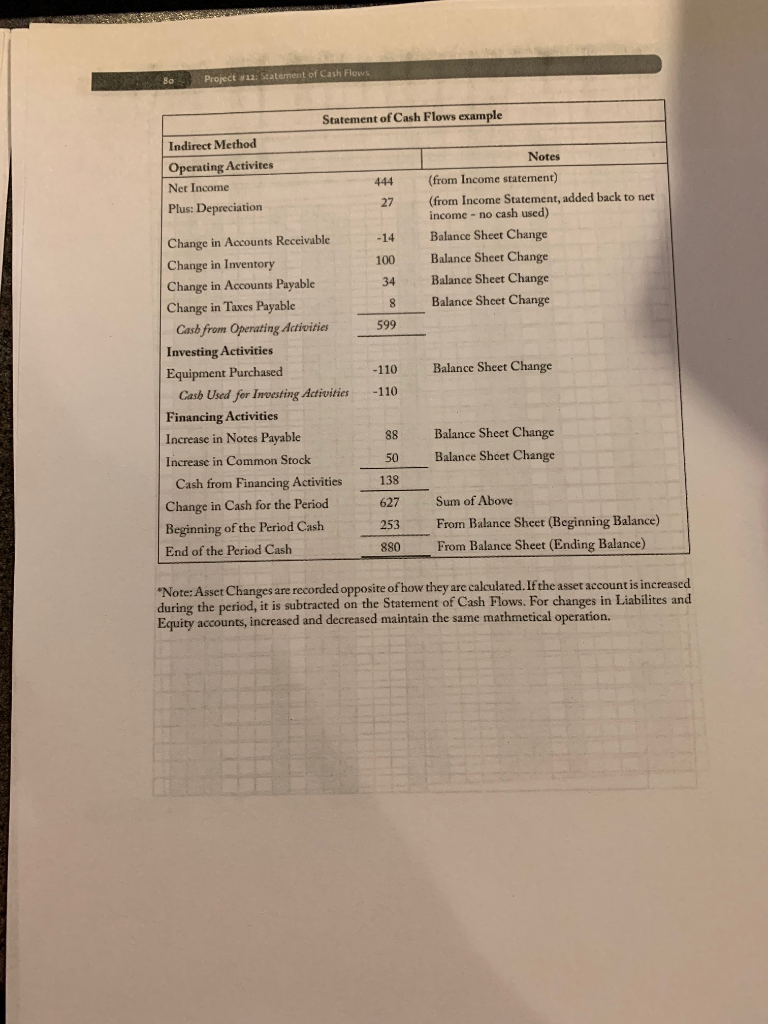

Project #12: Statement of Cash Flows 76 Note: Use the Financial Statements prepared for Projeet No. 11 Account type Cash flow activity Current assets (except for Cash) Operating Investing Investing Operating Financing Financing Operating Long-term assets Other assets Current liabilities Long-term liabilities Equity Net income (from income statement) Project #12: Statement of Cash Flows Fido's Food Mart Adjusted Trial Balance Debits Credits Account Title Cash Accounts Receivable Allowance for Doubtful Accounts Inventory 56,996 9,512 20,390 650 320 30,550 12,250 Prepaid Insurance Equipment Vehicle Less: Accumulated Depreciation - Equipment & Vehicle Accounts Payable 1,780 62,128 Interest Payable Unearned Revenue (Gift Cards) 275 2,200 12,000 46,200 Dividends Payable Bonds Payable (mature 12/31/XX) Common Stock (200 shares@ $210/share) Additional Paid In Capital - Common Stock Dividends Declared Treasury Stock Retained Earnings Sales Revenue Less: Sales Discount Cost of Goods Sold Operating Expenses Bad Debt Expense Bank Charges Depreciation Expense Insurance Expense Interest Expense 2,200 1 134,725 64,330 34,840 3,260 1,780 160 Supplies Expense 5,750 1,200 15,500 3 ages Totals 261,268 261,268 8Project pa: Statement of Cash Flows Required Reference the Financial Statements from Project #11 1. Prepare a Statement of Cash Flows using the indirect method. cash Slouw stafement ratingInvestingFinanCing tivties activifies activifies Example Income Statement Revenue Expenses (Other Than Depreciation) Depreciation Expense 1000 529 -27 Net Income Statement of Retained Earnings Beginning of the Period Plus Net Income End of the Period 561 Example (Simplified) Balance Sheet Beginning of the Period End of the Period Change in Balance Sheet Numbers Current Assets Cash Accounts Receivable Inventory 253 Cash Account Operating Operating 145 159 125 1164 14 100 Total Current Long-Term Assets Equipment 189 -100 299 -127 172 1336 110 -27 Less: Accumulated Deprecaiton Total Long-Term Assets Total Assets Liabilities and Equity Current Liabilities Accounts Payable Taxes Payable 712 Operating Operating 160 75 235 34 67 193 Total Current Liabilities Long-Term Liabilities Notes Payable Financing 345 Financing Operating 195 561 756 Common Stock Retained Earnings 262 Total Equity 1336 Total Liabilities and Equity Project #12: Statement of Cash Flows 80 , Statement of Cash Flows example Indirect Method Operating Activites Net Income Plus: Depreciation Notes (from Income statement) (from Income Statement, added back to net 444 27 income - no cash used) 14 Balance Sheet Change 100 Balance Sheet Change 34 Balance Sheet Change 8 Balance Sheet Change Change in Accounts Receivable Change in Inventory Change in Accounts Payable Change in Taxes Payable Cash from Operating Activities Investing Activities Equipment Purchased 599 Balance Sheet Change -110 Cash Used for Investing Adtivities-110 Financing Activities Increase in Notes Payable Increase in Common Stock 88 50 138 627 253 880 Balance Sheet Change Balance Sheet Change Cash from Financing Activities Change in Cash for the Period Beginning of the Period Cash End of the Period Cash Sum of Above From Balance Sheet (Beginning Balance) From Balance Sheet (Ending Balance) Note: Asset Changes are recorded opposite of how they are calculated. If the asset account is increased during the period, it is subtracted on the Statement of Cash Flows. For changes in Liabilites and Equity accounts, increased and decreased maintain the same mathmetical operation. Project #12: Statement of Cash Flows 76 Note: Use the Financial Statements prepared for Projeet No. 11 Account type Cash flow activity Current assets (except for Cash) Operating Investing Investing Operating Financing Financing Operating Long-term assets Other assets Current liabilities Long-term liabilities Equity Net income (from income statement) Project #12: Statement of Cash Flows Fido's Food Mart Adjusted Trial Balance Debits Credits Account Title Cash Accounts Receivable Allowance for Doubtful Accounts Inventory 56,996 9,512 20,390 650 320 30,550 12,250 Prepaid Insurance Equipment Vehicle Less: Accumulated Depreciation - Equipment & Vehicle Accounts Payable 1,780 62,128 Interest Payable Unearned Revenue (Gift Cards) 275 2,200 12,000 46,200 Dividends Payable Bonds Payable (mature 12/31/XX) Common Stock (200 shares@ $210/share) Additional Paid In Capital - Common Stock Dividends Declared Treasury Stock Retained Earnings Sales Revenue Less: Sales Discount Cost of Goods Sold Operating Expenses Bad Debt Expense Bank Charges Depreciation Expense Insurance Expense Interest Expense 2,200 1 134,725 64,330 34,840 3,260 1,780 160 Supplies Expense 5,750 1,200 15,500 3 ages Totals 261,268 261,268 8Project pa: Statement of Cash Flows Required Reference the Financial Statements from Project #11 1. Prepare a Statement of Cash Flows using the indirect method. cash Slouw stafement ratingInvestingFinanCing tivties activifies activifies Example Income Statement Revenue Expenses (Other Than Depreciation) Depreciation Expense 1000 529 -27 Net Income Statement of Retained Earnings Beginning of the Period Plus Net Income End of the Period 561 Example (Simplified) Balance Sheet Beginning of the Period End of the Period Change in Balance Sheet Numbers Current Assets Cash Accounts Receivable Inventory 253 Cash Account Operating Operating 145 159 125 1164 14 100 Total Current Long-Term Assets Equipment 189 -100 299 -127 172 1336 110 -27 Less: Accumulated Deprecaiton Total Long-Term Assets Total Assets Liabilities and Equity Current Liabilities Accounts Payable Taxes Payable 712 Operating Operating 160 75 235 34 67 193 Total Current Liabilities Long-Term Liabilities Notes Payable Financing 345 Financing Operating 195 561 756 Common Stock Retained Earnings 262 Total Equity 1336 Total Liabilities and Equity Project #12: Statement of Cash Flows 80 , Statement of Cash Flows example Indirect Method Operating Activites Net Income Plus: Depreciation Notes (from Income statement) (from Income Statement, added back to net 444 27 income - no cash used) 14 Balance Sheet Change 100 Balance Sheet Change 34 Balance Sheet Change 8 Balance Sheet Change Change in Accounts Receivable Change in Inventory Change in Accounts Payable Change in Taxes Payable Cash from Operating Activities Investing Activities Equipment Purchased 599 Balance Sheet Change -110 Cash Used for Investing Adtivities-110 Financing Activities Increase in Notes Payable Increase in Common Stock 88 50 138 627 253 880 Balance Sheet Change Balance Sheet Change Cash from Financing Activities Change in Cash for the Period Beginning of the Period Cash End of the Period Cash Sum of Above From Balance Sheet (Beginning Balance) From Balance Sheet (Ending Balance) Note: Asset Changes are recorded opposite of how they are calculated. If the asset account is increased during the period, it is subtracted on the Statement of Cash Flows. For changes in Liabilites and Equity accounts, increased and decreased maintain the same mathmetical operation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts