Question: PROJECT 2 Deadline: Friday, April 17, 2020 Develop an Excel spreadsheet model to calculate the values of European call and put option using the Black-Sholes

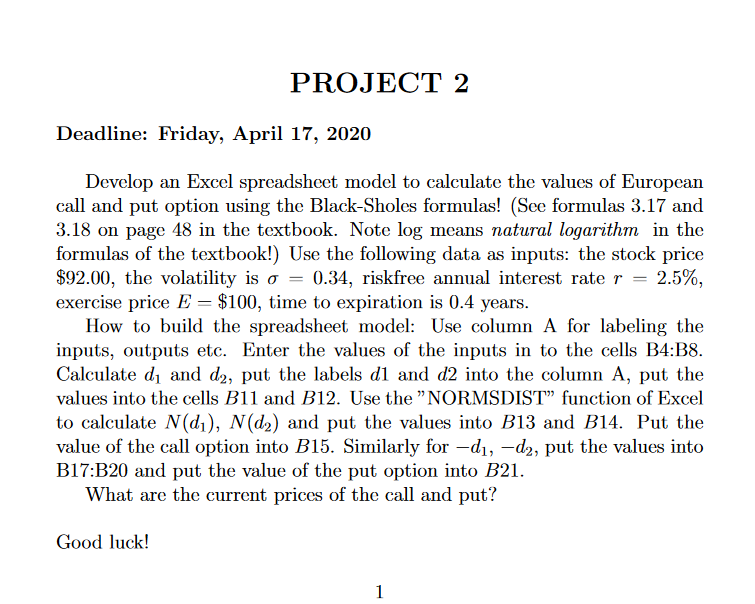

PROJECT 2 Deadline: Friday, April 17, 2020 Develop an Excel spreadsheet model to calculate the values of European call and put option using the Black-Sholes formulas! (See formulas 3.17 and 3.18 on page 48 in the textbook. Note log means natural logarithm in the formulas of the textbook!) Use the following data as inputs: the stock price $92.00, the volatility is o = 0.34, riskfree annual interest rate r = 2.5%, exercise price E = $100, time to expiration is 0.4 years. How to build the spreadsheet model: Use column A for labeling the inputs, outputs etc. Enter the values of the inputs in to the cells B4:38. Calculate di and d2, put the labels dl and d2 into the column A, put the values into the cells B11 and B12. Use the "NORMSDIST function of Excel to calculate N(di), N(d2) and put the values into B13 and B14. Put the value of the call option into B15. Similarly for -d, -d2, put the values into B17:B20 and put the value of the put option into B21. What are the current prices of the call and put? Good luck! PROJECT 2 Deadline: Friday, April 17, 2020 Develop an Excel spreadsheet model to calculate the values of European call and put option using the Black-Sholes formulas! (See formulas 3.17 and 3.18 on page 48 in the textbook. Note log means natural logarithm in the formulas of the textbook!) Use the following data as inputs: the stock price $92.00, the volatility is o = 0.34, riskfree annual interest rate r = 2.5%, exercise price E = $100, time to expiration is 0.4 years. How to build the spreadsheet model: Use column A for labeling the inputs, outputs etc. Enter the values of the inputs in to the cells B4:38. Calculate di and d2, put the labels dl and d2 into the column A, put the values into the cells B11 and B12. Use the "NORMSDIST function of Excel to calculate N(di), N(d2) and put the values into B13 and B14. Put the value of the call option into B15. Similarly for -d, -d2, put the values into B17:B20 and put the value of the put option into B21. What are the current prices of the call and put? Good luck

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts