Question: Project 2: Historical Simulation Complete your work using the excel file Hist_Simulation_Project2 and submit it via Project2 Dropbox. Find the attached file named Hist_Simulation_Project2. You

Project 2: Historical Simulation

Complete your work using the excel file "Hist_Simulation_Project2"

and submit it via Project2 Dropbox.

Find the attached file named "Hist_Simulation_Project2." You will use this file

to calculate VaR under the historical simulation approach. The first worksheet

"Historical data" shows historical data for 501 trading days for three indices,

S&P 500 index, DJIA index, and BofA Merrill Lynch US Corporate Index Total

Return Value. The value of the investment in each index on December 28,

2020 is as follows:

INDEX PORTOFOLIO VALUE('000S)

S&P 7,000

DJIA 5,000

BofA Merril Lynch 3,000

Total 15,000

1. Go to the second worksheet "500 Scenarios" and calculate the values

of the three indices on 12/29/2020 for 500 scenarios. For example,

Scenario 1 in the first row shows the values of the indices on

12/29/2020, assuming that their percentage changes between

12/28/2020 and 12/29/2020 are the same as they were between

01/02/2019 and 01/03/2019. You will repeat this for Days 1 through

500.

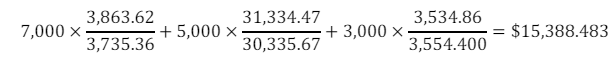

2. Once you calculate the values of the indices for 500 scenarios, you can

calculate the value of your portfolio. For example, the value of the

portfolio under Scenario 1 is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts