Question: Project 2: Replacement Project: Old Asset ( 5 years old): - Cost of equipment =$1,125,000. - 10-year project life, 10-year class life. - Simplified straight

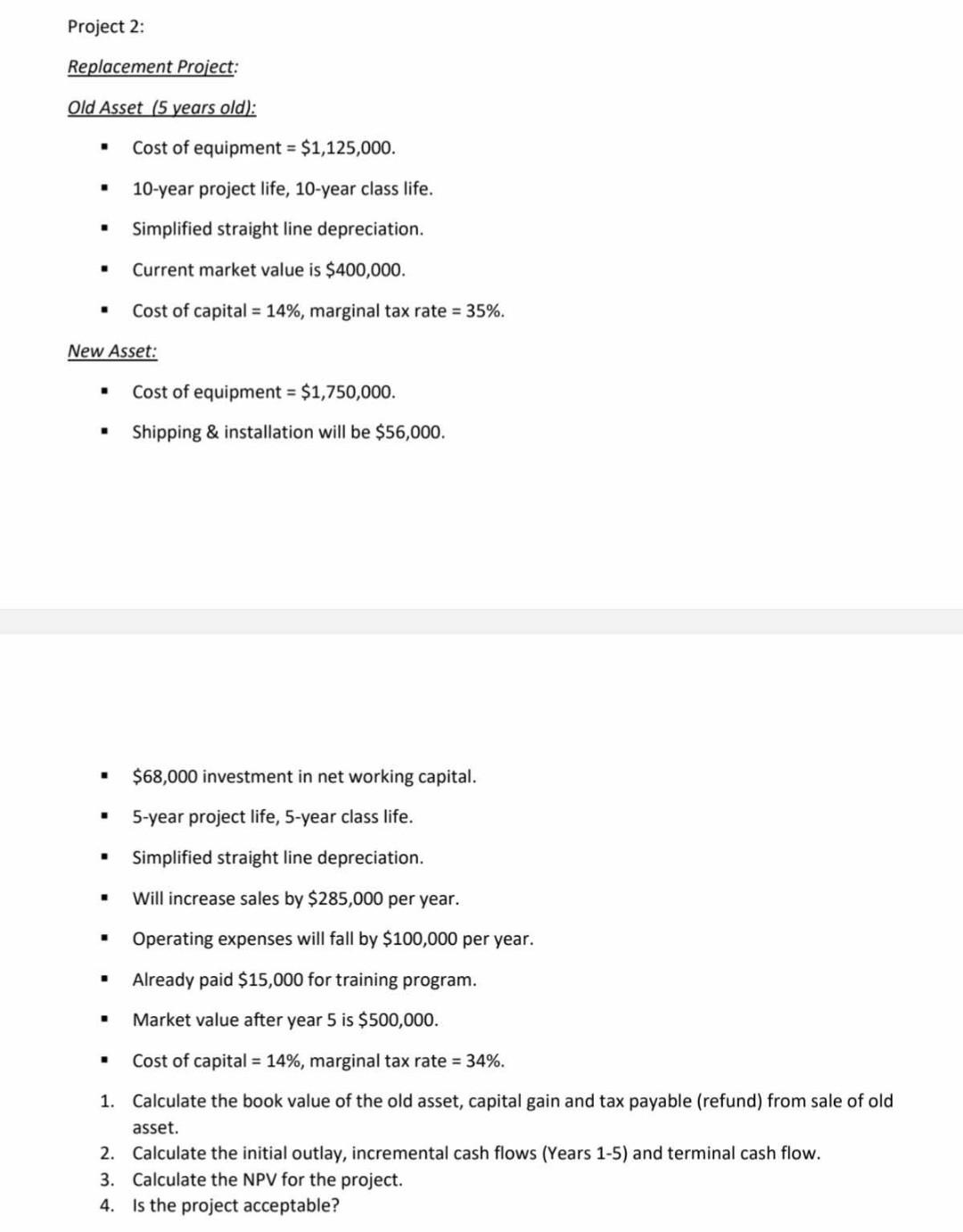

Project 2: Replacement Project: Old Asset ( 5 years old): - Cost of equipment =$1,125,000. - 10-year project life, 10-year class life. - Simplified straight line depreciation. - Current market value is $400,000. - Cost of capital =14%, marginal tax rate =35%. New Asset: - Cost of equipment =$1,750,000. - Shipping \& installation will be $56,000. - $68,000 investment in net working capital. - 5-year project life, 5-year class life. - Simplified straight line depreciation. - Will increase sales by $285,000 per year. - Operating expenses will fall by $100,000 per year. - Already paid $15,000 for training program. - Market value after year 5 is $500,000. - Cost of capital =14%, marginal tax rate =34%. 1. Calculate the book value of the old asset, capital gain and tax payable (refund) from sale of old asset. 2. Calculate the initial outlay, incremental cash flows (Years 1-5) and terminal cash flow. 3. Calculate the NPV for the project. 4. Is the project acceptable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts