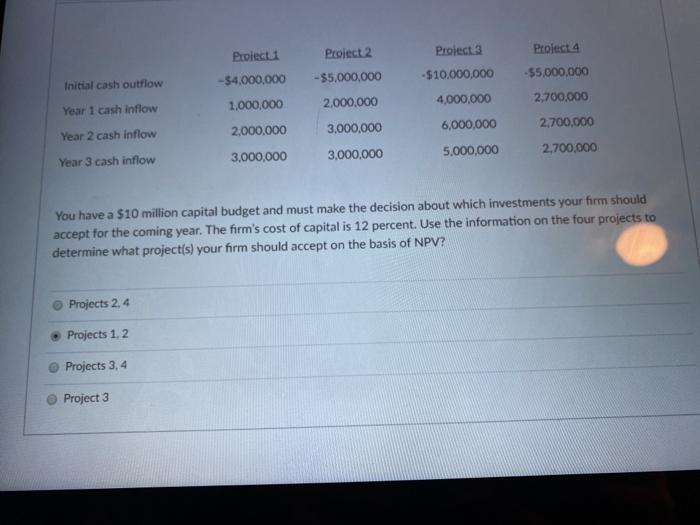

Question: Project 3 Initial cash outflow Project 2 -$5,000,000 2,000,000 3,000,000 3,000,000 Proiect 4 -55,000,000 2.700.000 Proiect -$4,000,000 1,000,000 2.000.000 3,000,000 -$10,000,000 4,000,000 6,000,000 Year 1

Project 3 Initial cash outflow Project 2 -$5,000,000 2,000,000 3,000,000 3,000,000 Proiect 4 -55,000,000 2.700.000 Proiect -$4,000,000 1,000,000 2.000.000 3,000,000 -$10,000,000 4,000,000 6,000,000 Year 1 cash Inflow 2,700,000 Year 2 cash inflow 5.000.000 2,700,000 Year 3 cash inflow You have a $10 million capital budget and must make the decision about which investments your firm should accept for the coming year. The firm's cost of capital is 12 percent. Use the information on the four projects to determine what project(s) your firm should accept on the basis of NPV? Projects 2.4 Projects 1.2 Projects 3,4 Project 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts