Question: Project #4 Crane Rental Analysis-Risk Analysis This project is an extension of project 2, for which the solution key was posted previously. Use this solution

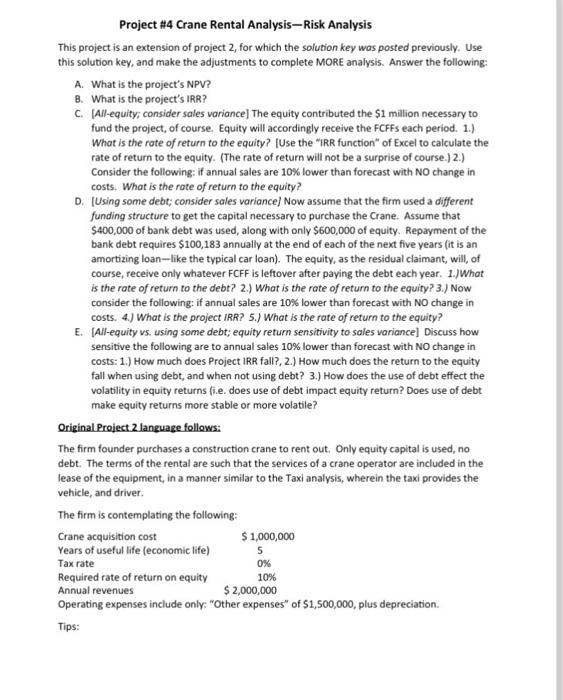

Project #4 Crane Rental Analysis-Risk Analysis This project is an extension of project 2, for which the solution key was posted previously. Use this solution key, and make the adjustments to complete MORE analysis. Answer the following: A. What is the project's NPV? 8. What is the project's IRR? C. [All-equity; consider sales variance] The equity contributed the $1 milion necessary to fund the project, of course. Equity will accordingly receive the FCFFs each period. 1.) What is the rate of return to the equity? [Use the "IRR function" of Excel to calculate the rate of return to the equity. (The rate of return will not be a surprise of course.) 2.) Consider the following: if annual sales are 10% lower than forecast with NO change in costs. What is the rate of return to the equity? D. [Using some debt; consider sales variance] Now assume that the firm used a different funding structure to get the capital necessary to purchase the Crane. Assume that $400,000 of bank debt was used, along with only $600,000 of equity. Repayment of the bank debt requires $100,183 annually at the end of each of the next five years (it is an amortizing loan-like the typical car loan). The equity, as the residual claimant, will, of course, receive only whatever FCFF is leftover after paying the debt each year. 1.) What is the rate of return to the debt? 2.) What is the rate of return to the equity? 3.) Now consider the following: if annual sales are 10% lower than forecast with NO change in costs. 4.) What is the project IRR? 5.) What is the rate of return to the equity? E. [All-equity v5. using some debt; equity return sensitivity to sales variance] Discuss how sensitive the following are to annual sales 10% lower than forecast with NO change in costs: 1.) How much does Project IRR fall?, 2.) How much does the return to the equity fall when using debt, and when not using debt? 3.) How does the use of debt effect the volatility in equity returns (i.e. does use of debt impact equity return? Does use of debt make equity returns more stable or more volatile? Original Project 2 language follows: The firm founder purchases a construction crane to rent out. Only equity capital is used, no debt. The terms of the rental are such that the services of a crane operator are included in the lease of the equipment, in a manner similar to the Taxi analysis, wherein the taxi provides the vehicle, and driver. The firm is contemplating the following: Operating expenses include only: "Other expenses" of $1,500,000, plus depreciation. Tips

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts