Question: PROJECT 4 INFORMATION: FOR FORMULAS & EXAMPLE: Refer to Handouts/Audio Lecture for Chapter 10-12 and WACC with BreakPoint Example posted in Content/Unit 4 Newington Chemicals

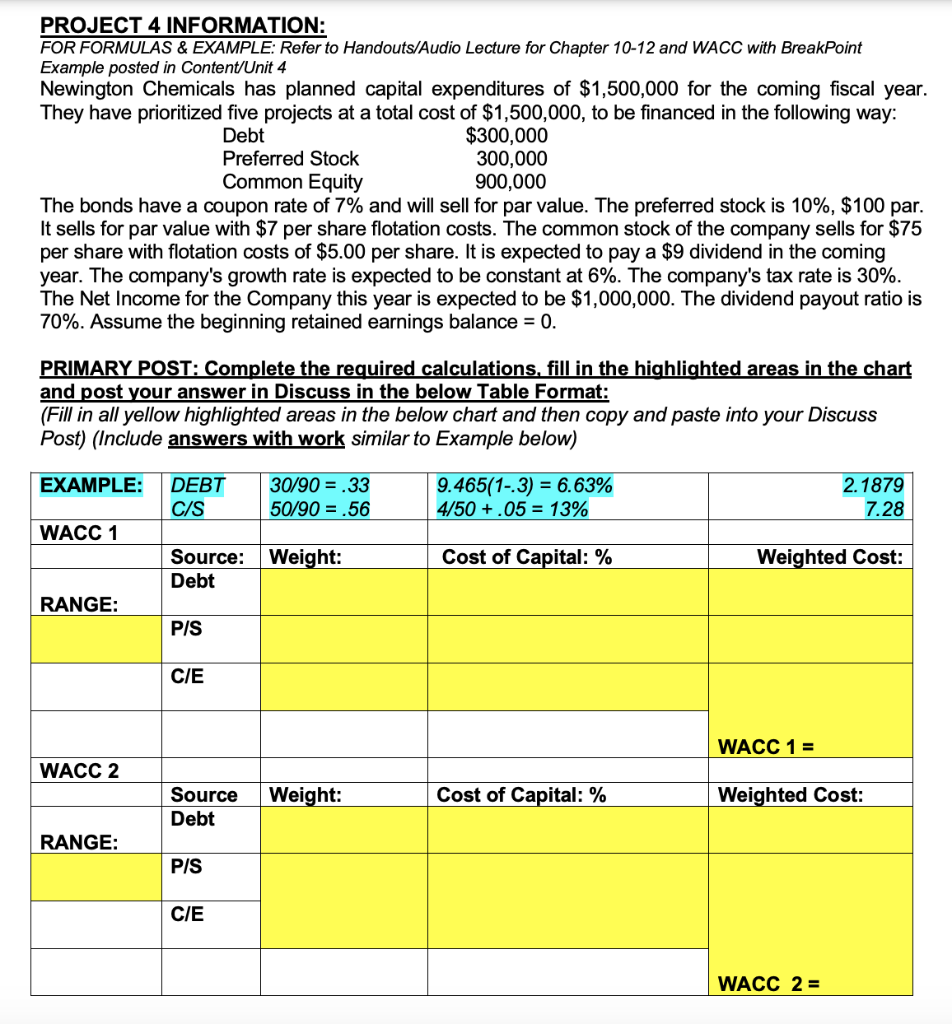

PROJECT 4 INFORMATION: FOR FORMULAS \& EXAMPLE: Refer to Handouts/Audio Lecture for Chapter 10-12 and WACC with BreakPoint Example posted in Content/Unit 4 Newington Chemicals has planned capital expenditures of $1,500,000 for the coming fiscal year. They have prioritized five projects at a total cost of $1,500,000, to be financed in the following way: The bonds have a coupon rate of 7% and will sell for par value. The preferred stock is 10%,$100 par. It sells for par value with $7 per share flotation costs. The common stock of the company sells for $75 per share with flotation costs of $5.00 per share. It is expected to pay a $9 dividend in the coming year. The company's growth rate is expected to be constant at 6%. The company's tax rate is 30%. The Net Income for the Company this year is expected to be $1,000,000. The dividend payout ratio is 70%. Assume the beginning retained earnings balance =0. PRIMARY POST: Complete the required calculations, fill in the highlighted areas in the chart and post your answer in Discuss in the below Table Format: (Fill in all yellow highlighted areas in the below chart and then copy and paste into your Discuss Post) (Include answers with work similar to Example below)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts