Question: Project #7: Developing Insurance Rates Danforth Insurance Co. has an auto insurance portfolio consisting of 100,000 insured vehicles (exposure units) in a territory annually. Danforth

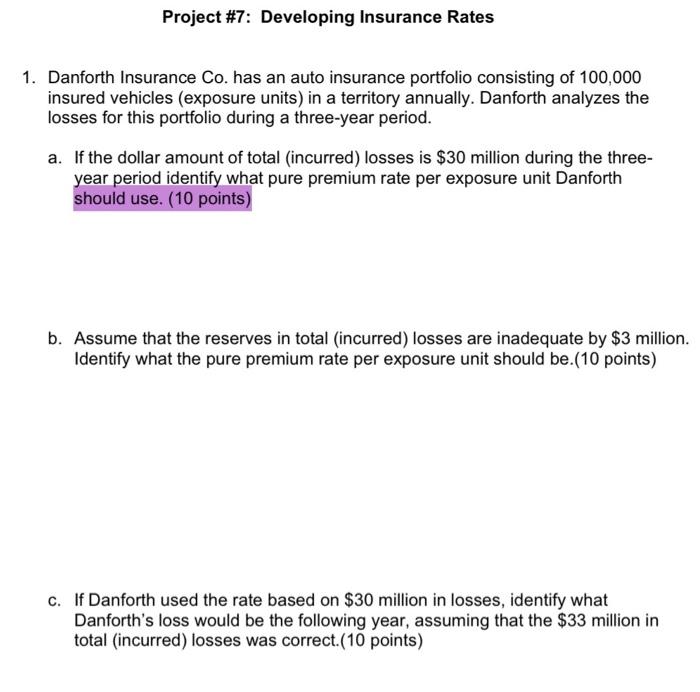

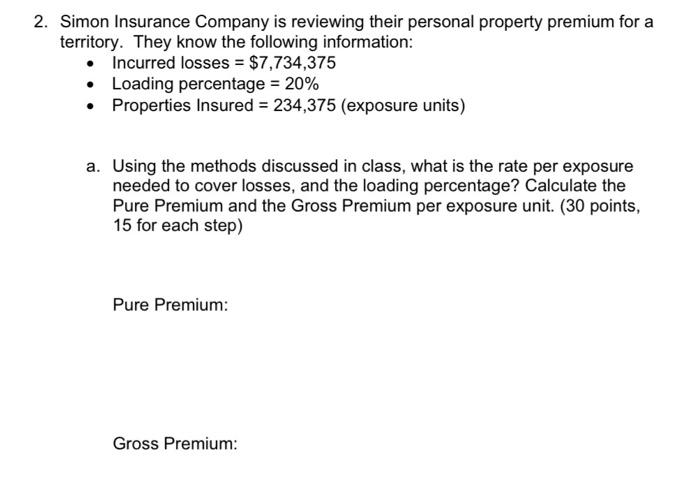

Project #7: Developing Insurance Rates Danforth Insurance Co. has an auto insurance portfolio consisting of 100,000 insured vehicles (exposure units) in a territory annually. Danforth analyzes the osses for this portfolio during a three-year period. a. If the dollar amount of total (incurred) losses is $30 million during the threeyear period identify what pure premium rate per exposure unit Danforth should use. (10 points) b. Assume that the reserves in total (incurred) losses are inadequate by $3 million Identify what the pure premium rate per exposure unit should be.(10 points) c. If Danforth used the rate based on $30 million in losses, identify what Danforth's loss would be the following year, assuming that the $33 million in total (incurred) losses was correct.(10 points) 2. Simon Insurance Company is reviewing their personal property premium for a territory. They know the following information: - Incurred losses =$7,734,375 - Loading percentage =20% - Properties Insured = 234,375 (exposure units) a. Using the methods discussed in class, what is the rate per exposure needed to cover losses, and the loading percentage? Calculate the Pure Premium and the Gross Premium per exposure unit. (30 points, 15 for each step) Pure Premium: Gross Premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts