Question: Project 7-Risk Management Instructions: Please complete this assignment and submit though Blackboard. You may consult with the classmates/instructor at any time. Please be very thoughtful

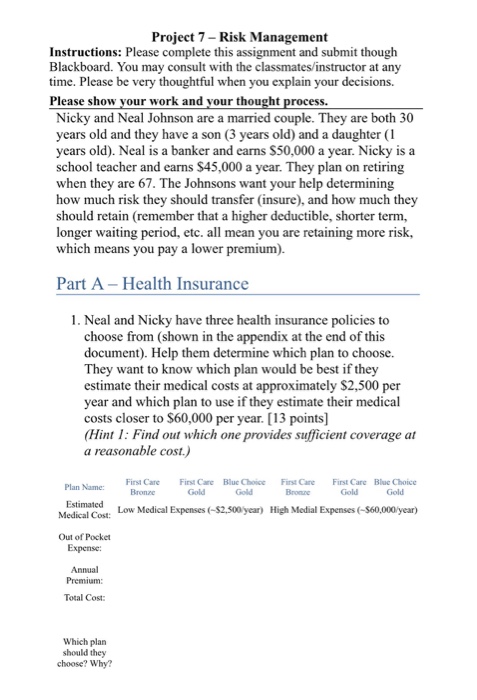

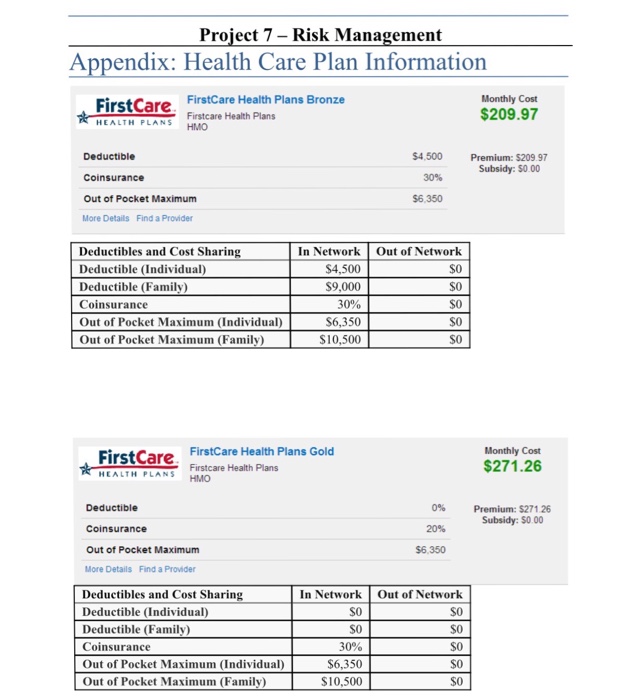

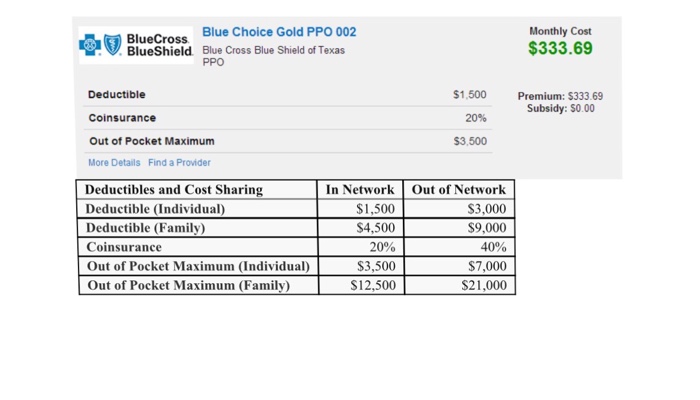

Project 7-Risk Management Instructions: Please complete this assignment and submit though Blackboard. You may consult with the classmates/instructor at any time. Please be very thoughtful when you explain your decisions. Please show your work and your thought process. Nicky and Neal Johnson are a married couple. They are both 30 years old and they have a son (3 years old) and a daughter (1 years old). Neal is a banker and earns S50,000 a year. Nicky is a school teacher and earns $45,000 a year. They plan on retiring when they are 67. The Johnsons want your help determining how much risk they should transfer (insure and how much they should retain (remember that a higher deductible, shorter term, longer waiting period, etc. all mean you are retaining more risk, which means you pay a lower premium) Part A Health Insurance 1. Neal and Nicky have three health insurance policies to choose from (shown in the appendix at the end of this document). Help them determine which plan to choose. They want to know which plan would be best if they estimate their medical costs at approximately $2,500 per year and which plan to use if they estimate their medical costs closer to $60,000 per year. [13 points] (Hint 1: Find out which one provides sufficient coverage at a reasonable cost) First Care First Care Blue Choice First Care Blue Choice First Care Estimated Low Medical Expenses -S2,500year) High Medial Expenses -S60,000year) Medical Cost Out of Pocket Total Cost Which plan should they choose? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts