Question: Project A: Red Dirt Industries is looking at a project that will require an $80,000 investment in plant, property, & equipment. $20,000 in new inventory

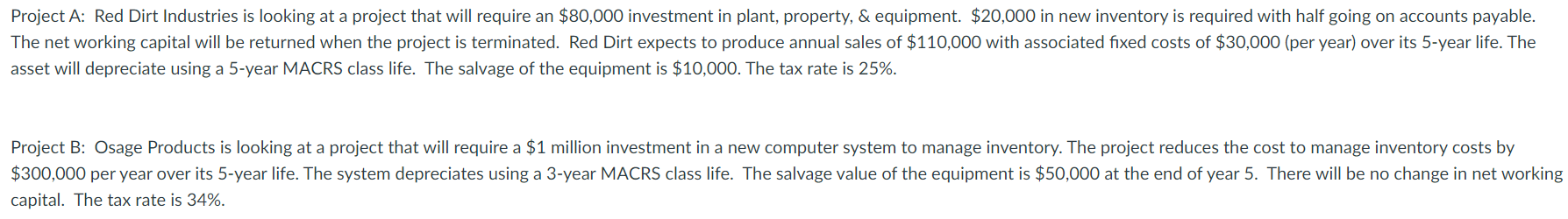

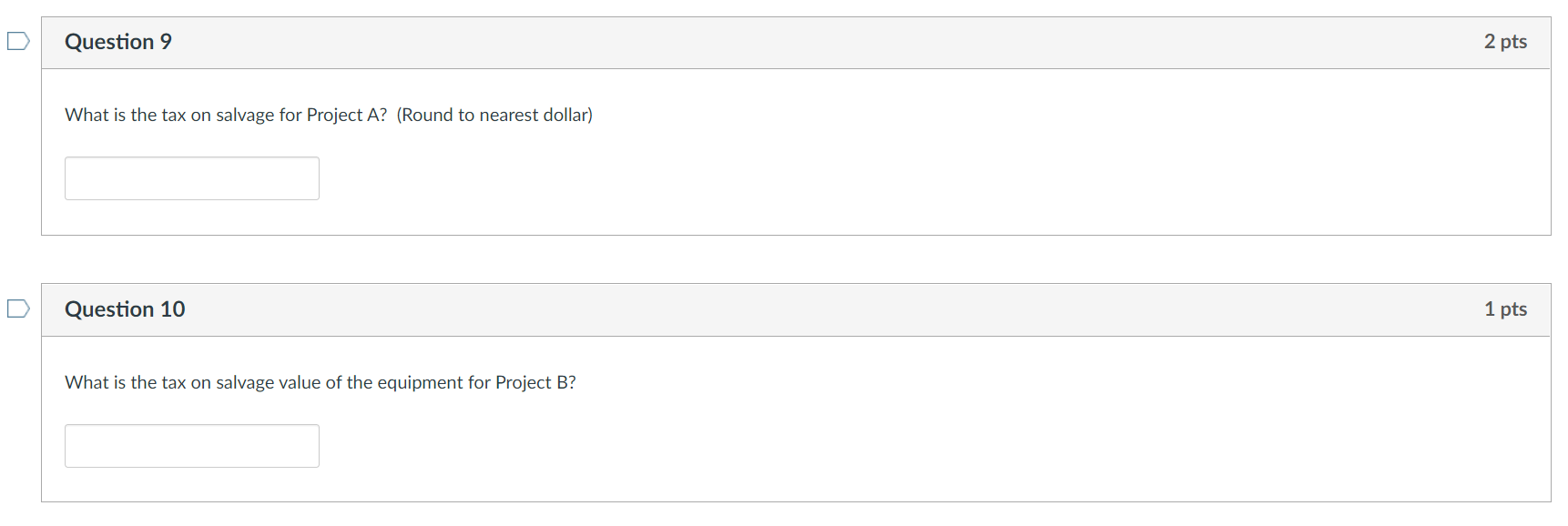

Project A: Red Dirt Industries is looking at a project that will require an $80,000 investment in plant, property, & equipment. $20,000 in new inventory is required with half going on accounts payable. The net working capital will be returned when the project is terminated. Red Dirt expects to produce annual sales of $110,000 with associated fixed costs of $30,000 (per year) over its 5-year life. The asset will depreciate using a 5-year MACRS class life. The salvage of the equipment is $10,000. The tax rate is 25%. Project B: Osage Products is looking at a project that will require a $1 million investment in a new computer system to manage inventory. The project reduces the cost to manage inventory costs by $300,000 per year over its 5-year life. The system depreciates using a 3-year MACRS class life. The salvage value of the equipment is $50,000 at the end of year 5. There will be no change in net working capital. The tax rate is 34%. Question 9 2 pts What is the tax on salvage for Project A? (Round to nearest dollar) Question 10 1 pts What is the tax on salvage value of the equipment for Project B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts