Question: Project A, whose expected net cash flows are shown in Table below, is to be evaluated using the certainty equivalent method. Assume that the

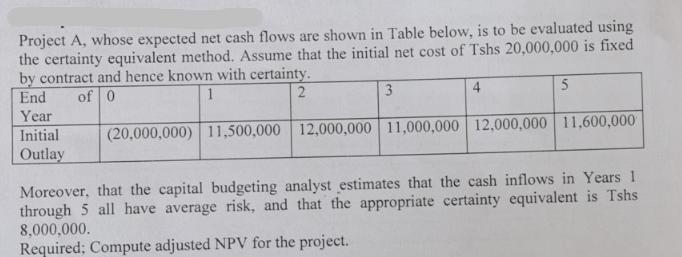

Project A, whose expected net cash flows are shown in Table below, is to be evaluated using the certainty equivalent method. Assume that the initial net cost of Tshs 20,000,000 is fixed by contract and hence known with certainty. End of 0 1 2 Year Initial Outlay 3 4 5 (20,000,000) 11,500,000 12,000,000 11,000,000 12,000,000 11,600,000 Moreover, that the capital budgeting analyst estimates that the cash inflows in Years 1 through 5 all have average risk, and that the appropriate certainty equivalent is Tshs 8,000,000. Required; Compute adjusted NPV for the project.

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

The adjusted NPV can be calculated as follows Year 0 Initial Outlay Tshs 20000000 known with certain... View full answer

Get step-by-step solutions from verified subject matter experts