Question: Project ABC and Project XYZ are dependent (contingent) projects. The projects have the following characteristics: ABC requires an initial investment of $ 105,000 and generates

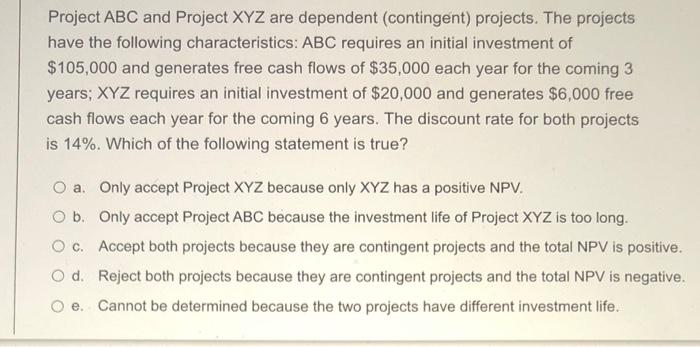

Project ABC and Project XYZ are dependent (contingent) projects. The projects have the following characteristics: ABC requires an initial investment of $ 105,000 and generates free cash flows of $35,000 each year for the coming 3 years; XYZ requires an initial investment of $20,000 and generates $6,000 free cash flows each year for the coming 6 years. The discount rate for both projects is 14%. Which of the following statement is true? O a. Only accept Project XYZ because only XYZ has a positive NPV. Ob. Only accept Project ABC because the investment life of Project XYZ is too long. Oc. Accept both projects because they are contingent projects and the total NPV is positive. O d. Reject both projects because they are contingent projects and the total NPV is negative. e. Cannot be determined because the two projects have different investment life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts