Question: Project: American Put Option Valuation Using 4 - Period Binomial Tree Problem Statement You are tasked with valuing an American put option on a non

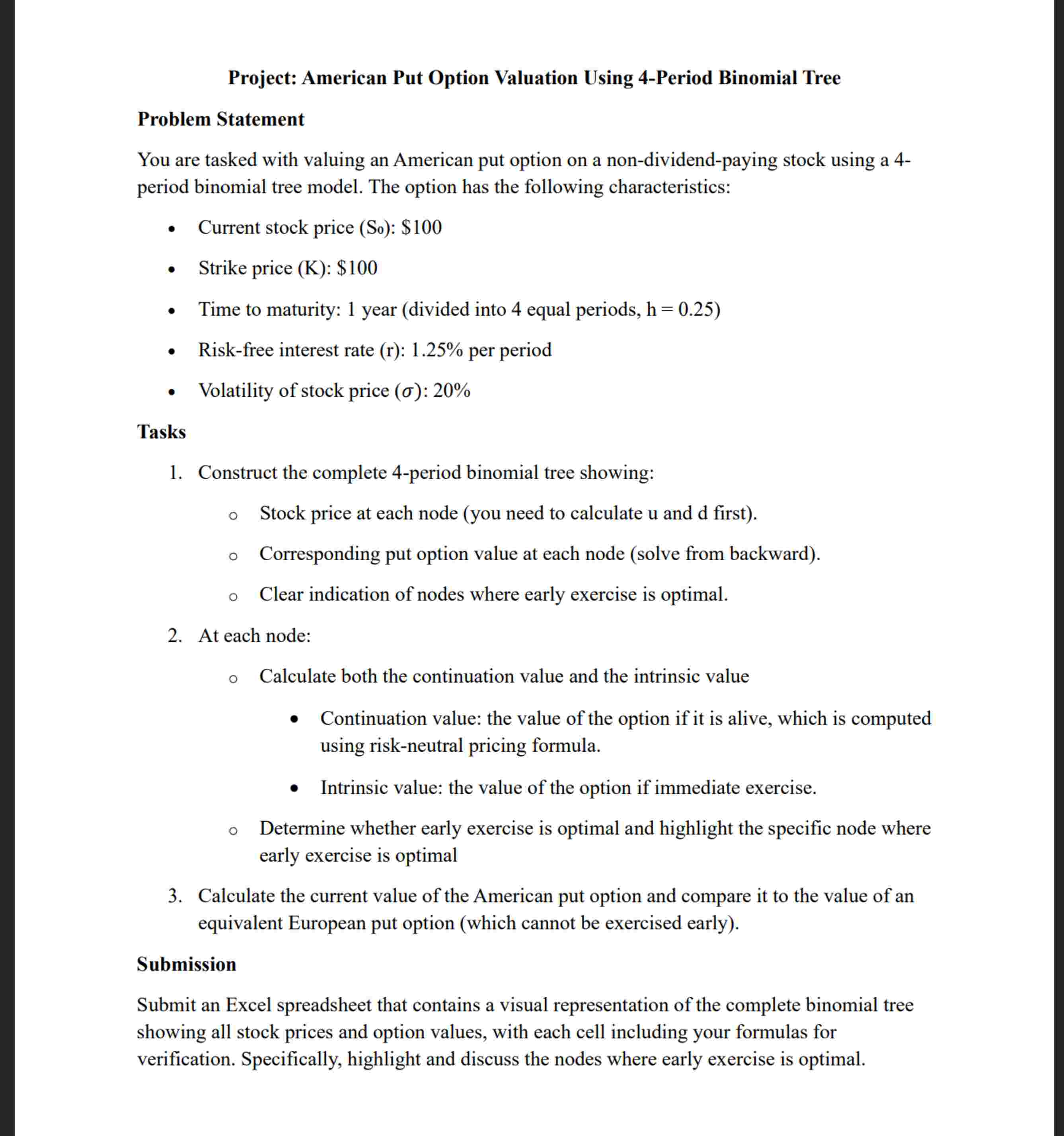

Project: American Put Option Valuation Using Period Binomial Tree Problem Statement You are tasked with valuing an American put option on a nondividendpaying stock using a period binomial tree model. The option has the following characteristics: Current stock price leftmathrmSmathrmoright: $ Strike price K: $ Time to maturity: year divided into equal periods, mathrmh Riskfree interest rate r: per period Volatility of stock price sigma: Tasks Construct the complete period binomial tree showing: Stock price at each node you need to calculate u and d first Corresponding put option value at each node solve from backward Clear indication of nodes where early exercise is optimal. At each node: Calculate both the continuation value and the intrinsic value Continuation value: the value of the option if it is alive, which is computed using riskneutral pricing formula. Intrinsic value: the value of the option if immediate exercise. Determine whether early exercise is optimal and highlight the specific node where early exercise is optimal Calculate the current value of the American put option and compare it to the value of an equivalent European put option which cannot be exercised early Submission Submit an Excel spreadsheet that contains a visual representation of the complete binomial tree showing all stock prices and option values, with each cell including your formulas for verification. Specifically, highlight and discuss the nodes where early exercise is optimal.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock