Question: PROJECT ANALYSIS CASE One month after joining the working group of your company's investment department planning for 2021 began and you are in the work

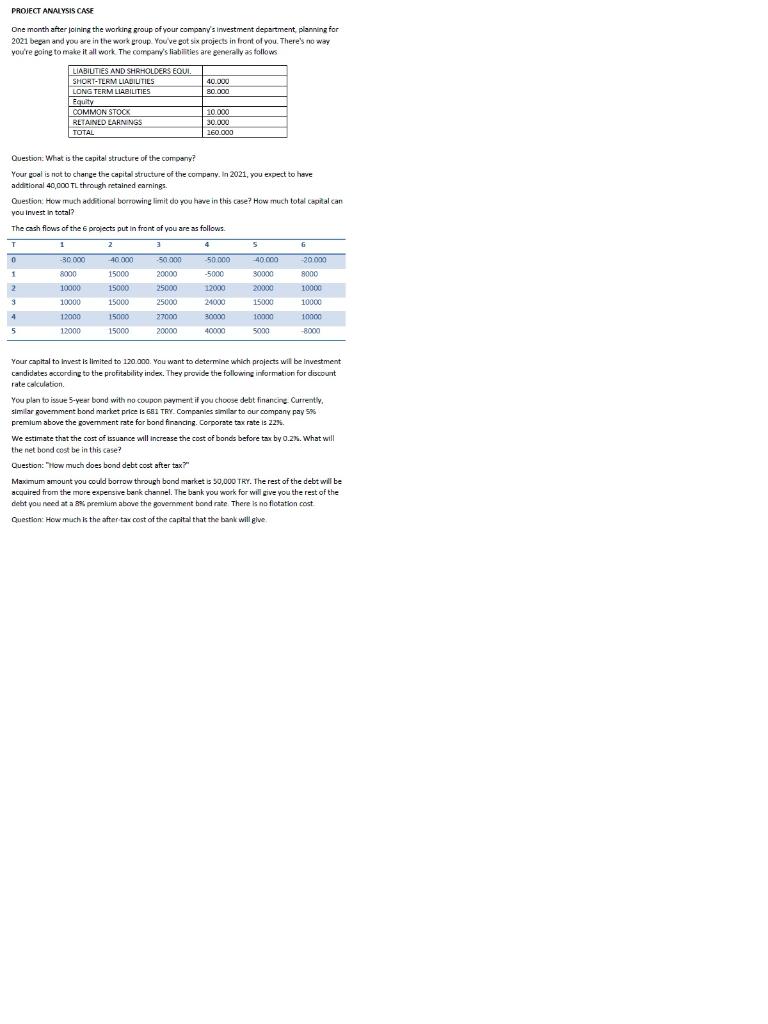

PROJECT ANALYSIS CASE One month after joining the working group of your company's investment department planning for 2021 began and you are in the work group. You've got six projects in front of you. There's no way you're going to make it all work. The company's liabilities are generally as follows 40.000 80.000 LIABIUTIES AND SHRHOLDERS EQUI. SHORT-TERM LIABILTILS LONG TERM LIABILITIES Equity COMMON STOCK RETAINED LARNINGS TOTAL 10.000 30.000 260.000 Question: What is the capital structure of the company? Your goal is not to change the capital structure of the company. In 2021, you expect to have additional 40,000 TL through retained earnings. Question How much additional borrowing limit do you have in this case? How much total capital can you invest in total? The cash flows of the projects put in front of you are as follows. T 1 2 3 4 5 G 0 40.000 20 000 -30.000 8000 -50 000 20000 1 2 2 10000 10000 12000 12000 40.000 15000 15000 15000 15000 25000 25000 27000 20000 50.000 -5000 12000 24000 30000 40000 30000 20000 15000 10000 8000 10000 10000 10000 -8000 4. 5 15000 5000 Your capital to invest is limited to 120.000. You want to determine which projects will be investment Candidates according to the profitability index. They provide the following information for discount rate calculation. You plan to issue 5-year bond with no coupon payment if you choose debt financing Currently similar government bond market price is 681 TRY. Companies similar to our company pay 5% premium above the government rate for bond financing. Corporate tax rate is 22% We estimate that the cost of issuance will increase the cost of bonds before tax by 0.2%. What will the net bond cost be in this case? Question"How much does bond debt cost after tax? Maximum amount you could borrow through bond market is 30,000 TRY. The rest of the debt will be acquired from the more expensive bank channel. The bank you work for will give you the rest of the debt you need at a premium above the government bond rate. There is no flotation cost Question How much is the after tax cost of the capital that the bank will give 5. How can Aynur explain that modified IRR is a more realistic method when it is necessary to make decisions for simultaneous projects? No calculation is necessary. 6. Calculate the profitability index. Can this solve Aynur's problem? 7. Looking at both cash flows, the ARAGON team's estimates show that is a bit more pessimistic than the APOCH team. What effect could this have on the analysis? 8. In the documents prepared by both project teams, ARAGON technology Initially requires a serious R&D, while APOCH technology is almost ready. What effect does this have on your analysis? Would it lead to a change in your calculations? Would It lead to a change in your decision making analysis? PROJECT ANALYSIS CASE One month after joining the working group of your company's investment department planning for 2021 began and you are in the work group. You've got six projects in front of you. There's no way you're going to make it all work. The company's liabilities are generally as follows 40.000 80.000 LIABIUTIES AND SHRHOLDERS EQUI. SHORT-TERM LIABILTILS LONG TERM LIABILITIES Equity COMMON STOCK RETAINED LARNINGS TOTAL 10.000 30.000 260.000 Question: What is the capital structure of the company? Your goal is not to change the capital structure of the company. In 2021, you expect to have additional 40,000 TL through retained earnings. Question How much additional borrowing limit do you have in this case? How much total capital can you invest in total? The cash flows of the projects put in front of you are as follows. T 1 2 3 4 5 G 0 40.000 20 000 -30.000 8000 -50 000 20000 1 2 2 10000 10000 12000 12000 40.000 15000 15000 15000 15000 25000 25000 27000 20000 50.000 -5000 12000 24000 30000 40000 30000 20000 15000 10000 8000 10000 10000 10000 -8000 4. 5 15000 5000 Your capital to invest is limited to 120.000. You want to determine which projects will be investment Candidates according to the profitability index. They provide the following information for discount rate calculation. You plan to issue 5-year bond with no coupon payment if you choose debt financing Currently similar government bond market price is 681 TRY. Companies similar to our company pay 5% premium above the government rate for bond financing. Corporate tax rate is 22% We estimate that the cost of issuance will increase the cost of bonds before tax by 0.2%. What will the net bond cost be in this case? Question"How much does bond debt cost after tax? Maximum amount you could borrow through bond market is 30,000 TRY. The rest of the debt will be acquired from the more expensive bank channel. The bank you work for will give you the rest of the debt you need at a premium above the government bond rate. There is no flotation cost Question How much is the after tax cost of the capital that the bank will give 5. How can Aynur explain that modified IRR is a more realistic method when it is necessary to make decisions for simultaneous projects? No calculation is necessary. 6. Calculate the profitability index. Can this solve Aynur's problem? 7. Looking at both cash flows, the ARAGON team's estimates show that is a bit more pessimistic than the APOCH team. What effect could this have on the analysis? 8. In the documents prepared by both project teams, ARAGON technology Initially requires a serious R&D, while APOCH technology is almost ready. What effect does this have on your analysis? Would it lead to a change in your calculations? Would It lead to a change in your decision making analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts