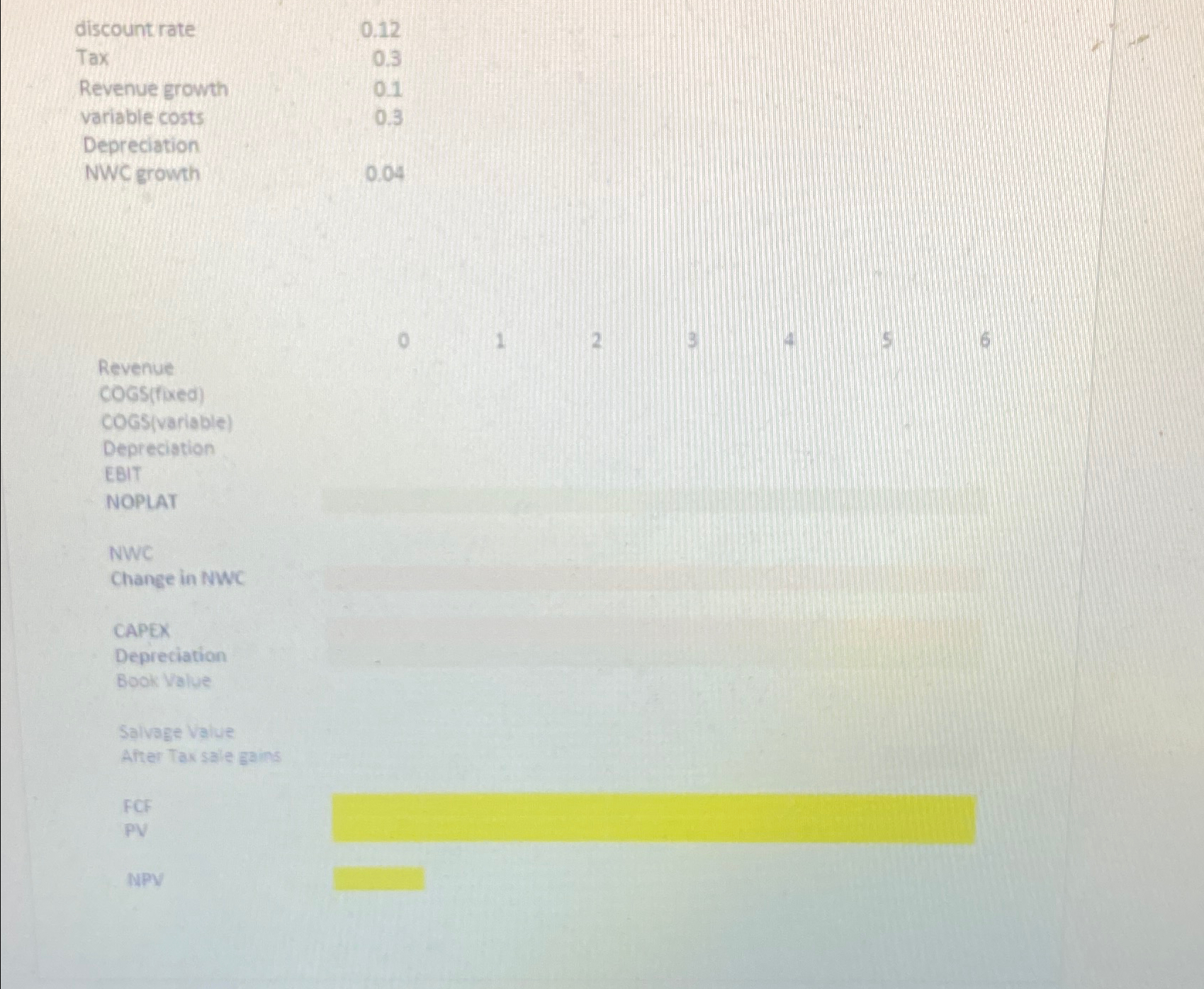

Question: Project analysis ( Pset 4 ) Your job: Determine whether HP should produce a high - end smartphone. The project lasts 6 years. Investments $

Project analysis Pset

Your job: Determine whether HP should produce a highend smartphone. The project lasts years.

Investments

$ million in year for machinery. Assume straightline depreciation over years

Machinery will be sold for $ million at the project's end

NWC of $ million to begin the project, which will increase at a rate each year

Revenue and cost estimates.

$ million in year growing at yearly after

Annual operating costs of a $ million fixed, and b variable costs of of annual revenues

Tax rate Discount rate

tablediscount rate,TaxRevenue growth,variable costs,DepreciationNWC growth,

Revenue

cossfixed

COGSvariable

Deprecistion

EBIT

NOPLAT

NWC

Change in NWC

CAPEX

Depreciation

Book Value

Salvage value

After Tax sale gains

FCF

PV

NPV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock