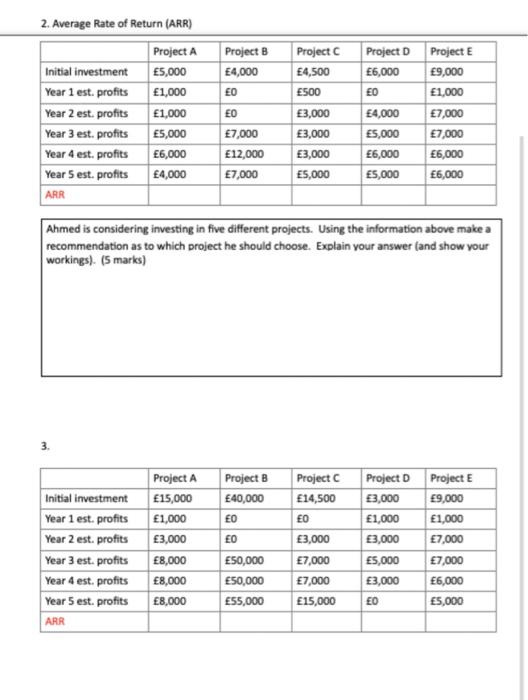

Question: Project B 4,000 ED Project D 6,000 EO 2. Average Rate of Return (ARR) Project A Initial investment 5,000 Year 1 est profits 1,000 Year

Project B 4,000 ED Project D 6,000 EO 2. Average Rate of Return (ARR) Project A Initial investment 5,000 Year 1 est profits 1,000 Year 2 est profits 1,000 Year 3 est. profits 5,000 Year 4 est, profits 6,000 Year 5 est, profits 4,000 ARR EO Project 4,500 500 3,000 3,000 3,000 E5,000 Project E 9,000 1,000 7,000 E7,000 6,000 6,000 4,000 5,000 6,000 5,000 7,000 12,000 7,000 Ahmed is considering investing in five different projects. Using the information above make a recommendation as to which project he should choose. Explain your answer (and show your workings). (5 marks) 3. Initial investment Year 1 est, profits Year 2 est profits Year 3 est, profits Year 4 est, profits Year 5 estprofits ARR Project A 15,000 1,000 3,000 8,000 8,000 8,000 Project B 40,000 EO EO 50,000 50,000 55,000 Project C E14,500 EO 3,000 7,000 7,000 15,000 Project D 3,000 1,000 3,000 5,000 3,000 EO Project E 9,000 1,000 7,000 7,000 6,000 5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts