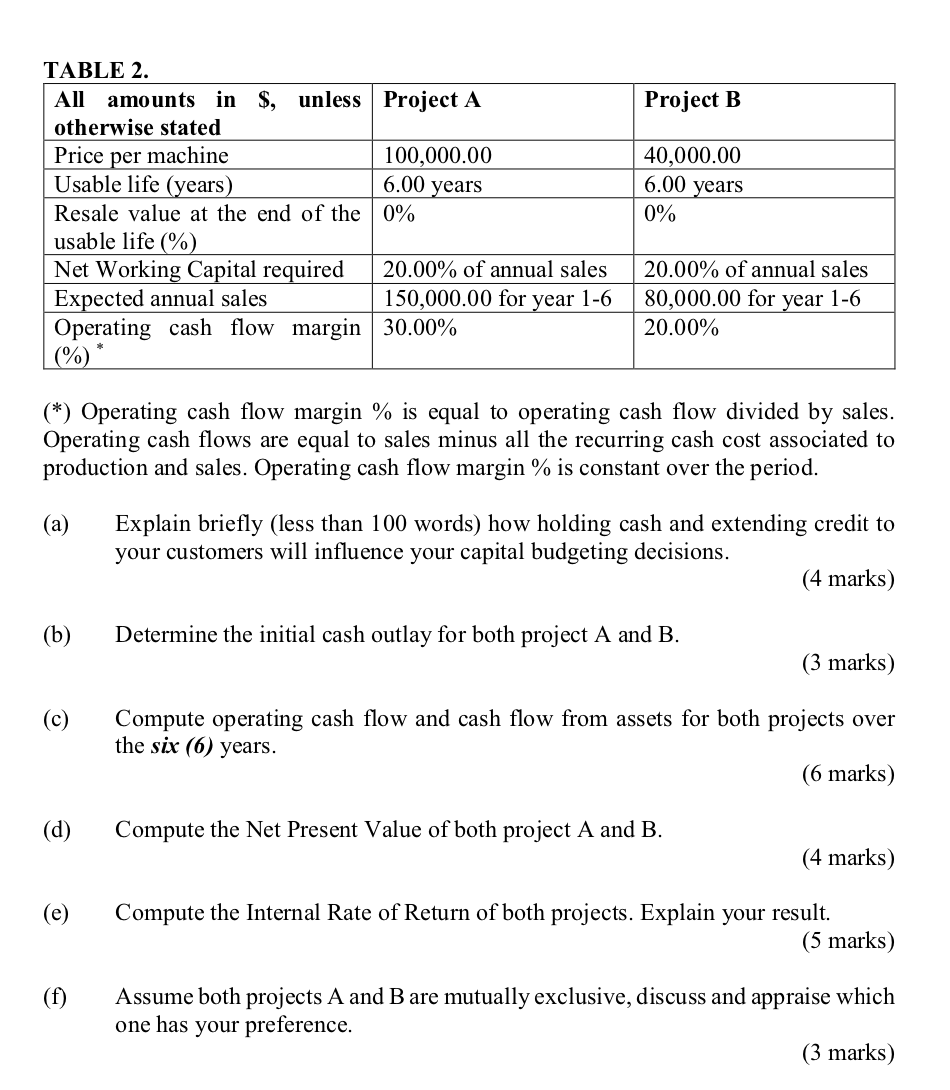

Question: Project B 40,000.00 6.00 years 6.00 years TABLE 2. All amounts in $, unless Project A otherwise stated Price per machine 100,000.00 Usable life (years)

Project B 40,000.00 6.00 years 6.00 years TABLE 2. All amounts in $, unless Project A otherwise stated Price per machine 100,000.00 Usable life (years) Resale value at the end of the 0% usable life (%) Net Working Capital required 20.00% of annual sales Expected annual sales 150,000.00 for year 1-6 Operating cash flow margin 30.00% (%) * 0% 20.00% of annual sales 80,000.00 for year 1-6 20.00% (*) Operating cash flow margin % is equal to operating cash flow divided by sales. Operating cash flows are equal to sales minus all the recurring cash cost associated to production and sales. Operating cash flow margin % is constant over the period. (a) Explain briefly (less than 100 words) how holding cash and extending credit to your customers will influence your capital budgeting decisions. (4 marks) (b) Determine the initial cash outlay for both project A and B. (3 marks) (c) Compute operating cash flow and cash flow from assets for both projects over the six (6) years. (6 marks) (d) ( Compute the Net Present Value of both project A and B. (4 marks) (e) Compute the Internal Rate of Return of both projects. Explain your result. (5 marks) (f) Assume both projects A and B are mutually exclusive, discuss and appraise which one has your preference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts