Question: Project C and Project D are mutually exclusive projects with conventional cashflows. The net present values (NPV) of the projects are calculated at the cost

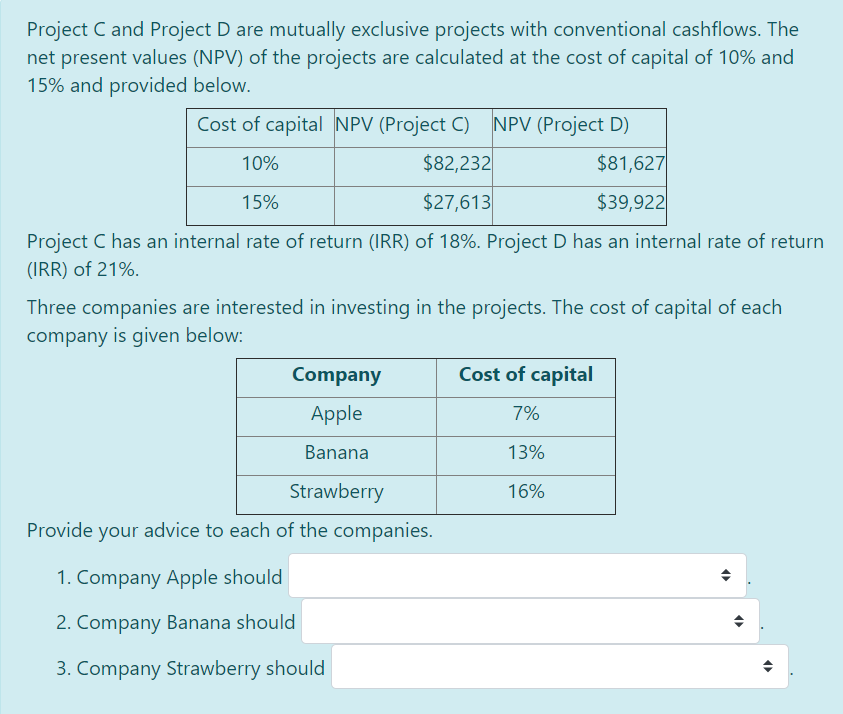

Project C and Project D are mutually exclusive projects with conventional cashflows. The net present values (NPV) of the projects are calculated at the cost of capital of 10% and 15% and provided below. Cost of capital NPV (Project C) NPV (Project D ) 10% $82,232 $81,627 15% $27,613 $39,922 Project C has an internal rate of return (IRR) of 18%. Project D has an internal rate of return (IRR) of 21%. Three companies are interested in investing in the projects. The cost of capital of each company is given below: Company Cost of capital Apple 7% Banana 13% 16% Strawberry Provide your advice to each of the companies. 1. Company Apple should 2. Company Banana should > 3. Company Strawberry should

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts