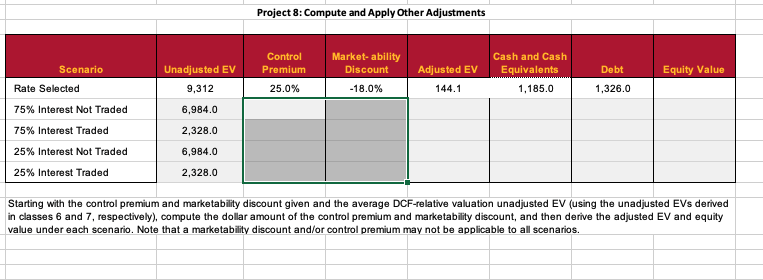

Question: Project &: Compute and Apply Other Adjustments Control Market- ability Cash and Cash Scenario Unadjusted EV Premium Discount Adjusted EV Equivalents Debt Equity Value Rate

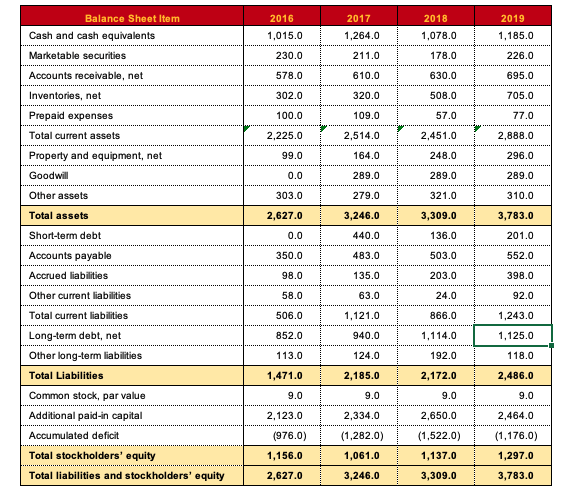

Project &: Compute and Apply Other Adjustments Control Market- ability Cash and Cash Scenario Unadjusted EV Premium Discount Adjusted EV Equivalents Debt Equity Value Rate Selected 9,312 25.0% -18.0% 144.1 1,185.0 1,326.0 75% Interest Not Traded 6,984.0 75% Interest Traded 2,328.0 25% Interest Not Traded 6,984.0 25% Interest Traded 2,328.0 Starting with the control premium and marketability discount given and the average DCF-relative valuation unadjusted EV (using the unadjusted EVs derived in classes 6 and 7, respectively), compute the dollar amount of the control premium and marketability discount, and then derive the adjusted EV and equity value under each scenario. Note that a marketability discount and/or control premium may not be applicable to all scenarios.Balance Sheet Item 2016 2017 2018 2019 Cash and cash equivalents 1,015.0 1,264.0 1,078.0 1,185.0 Marketable securities 230.0 211.0 178.0 226.0 Accounts receivable, net 578.0 610.0 630.0 695.0 Inventories, net 302.0 320.0 508.0 705.0 Prepaid expenses 100.0 109.0 57.0 77.0 Total current assets 2,225.0 2,514.0 2,451.0 2,888.0 Properly and equipment, net 99.0 164.0 248.0 296.0 Goodwill 0.0 289.0 289.0 289.0 Other assets 303.0 279.0 321.0 310.0 Total assets 2,627.0 3,246.0 3,309.0 3,783.0 Short-term debt 0.0 440.0 136.0 201.0 Accounts payable 350.0 483.0 503.0 52.0 Accrued liabilities 98.0 135.0 203.0 398.0 Other current liabilities 58.0 63.0 24.0 92.0 Total current liabilities 506.0 1,121.0 366.0 1,243.0 Long-term debt, net B52.0 940.0 1,114.0 1,125.0 Other long-term liabilities 113.0 124.0 192.0 118.0 Total Liabilities 1,471.0 2,185.0 2,172.0 2,486.0 Common stock, par value 9.0 9.0 9.0 9.0 Additional paid-in capital 2,123.0 2,334.0 2,650.0 2,464.0 Accumulated deficit (976.0) (1,282.0) (1,522.0) (1,176.0) Total stockholders' equity 1,156.0 1,061.0 1,137.0 1,297.0 Total liabilities and stockholders' equity 2,627.0 3,246.0 3,309.0 3,783.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts