Question: Project Data Alternative 4 After-Tax Salvage Cash Flow Project Type Mut. Excl. w/Alt 3 Ending Book Value MV - BV if positive would be a

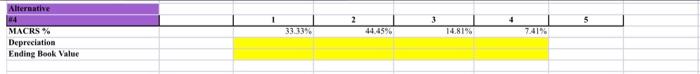

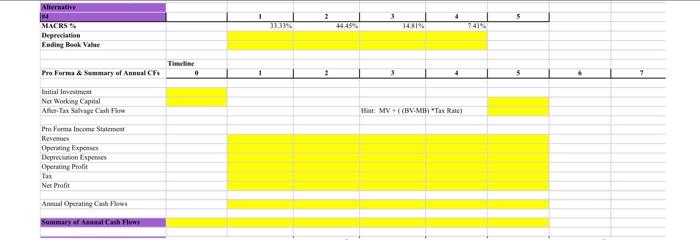

| Project Data | Alternative 4 | After-Tax Salvage Cash Flow | |||||||||||||

| Project Type | Mut. Excl. w/Alt 3 | Ending Book Value | MV - BV if positive would be a capital gain. | ||||||||||||

| Equipment for project at t=0 | Ending Market Val. | Capital Gain would mean tax is owed. | |||||||||||||

| Installation costs at t=0 | BV - MB | Company would have cash inflow of the MV and outflow of taxes | |||||||||||||

| Net Working Cap. Initial Investment* | *At the end of the project all NWC borrowed from the firm will be returned to the firm (recouped) | The net would be the A.T. Salvage CF | |||||||||||||

| Initial Sales | A.T. Salvage CF | Hint: MV + ( (BV-MB) *Tax Rate) | |||||||||||||

| Annual Sales Growth Rates | |||||||||||||||

| Annual Variable costs as a % of Sales | |||||||||||||||

| Annual Fixed Costs | |||||||||||||||

| Project life | |||||||||||||||

| Method of Depreciation | MACRS | ||||||||||||||

| Expected Life of Equipment | |||||||||||||||

| Market Value at t=T | |||||||||||||||

| Salvage Value at t=T | |||||||||||||||

Use the ABOVE data inputs to create Pro Forma Project Valuation and Summary of Annual Cash Flows | |||||||||||||||

| ALL cells must be linked to other cells, or contain a formula linking cells. | |||||||||||||||

| Only the number/value 1 can used in any excel formula. | |||||||||||||||

*yellow only

please include Excel formulas for work

Alternative 2 5 333% 44.45% 14,81% 74198 MACRS % Depreciation Ending Book Value Alternate 44454 1431 7419 MACRS Depreciation Ending Book Value Timeline Hint My((BV.MB "Tax Rate Pro Forma & Summary of Annual CF Initial lavestment Net Working Capital Aller-Tax Saage Chow Pro Forma Income Sulema Reves Operating Expo Depreciation Lispenses Operating Profit Tax Net Prote Anal Operating without Summary of Cash Flow

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock