Question: 1. You've found a $10,000 bond with four years left on it until maturity and an annual coupon of 8%? a. If the best

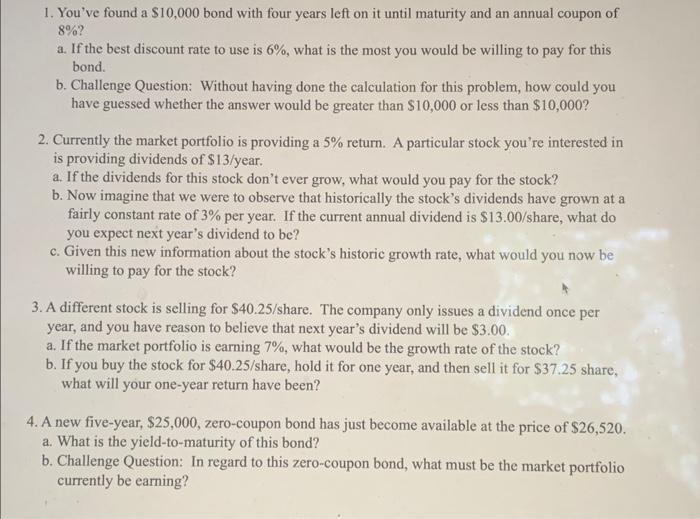

1. You've found a $10,000 bond with four years left on it until maturity and an annual coupon of 8%? a. If the best discount rate to use is 6%, what is the most you would be willing to pay for this bond. b. Challenge Question: Without having done the calculation for this problem, how could you have guessed whether the answer would be greater than $10,000 or less than $10,000? 2. Currently the market portfolio is providing a 5% return. A particular stock you're interested in is providing dividends of $13/year. a. If the dividends for this stock don't ever grow, what would you pay for the stock? b. Now imagine that we were to observe that historically the stock's dividends have grown at a fairly constant rate of 3% per year. If the current annual dividend is $13.00/share, what do you expect next year's dividend to be? c. Given this new information about the stock's historic growth rate, what would you now be willing to pay for the stock? 3. A different stock is selling for $40.25/share. The company only issues a dividend once per year, and you have reason to believe that next year's dividend will be $3.00. a. If the market portfolio is earning 7%, what would be the growth rate of the stock? b. If you buy the stock for $40.25/share, hold it for one year, and then sell it for $37.25 share, what will your one-year return have been? 4. A new five-year, $25,000, zero-coupon bond has just become available at the price of $26,520. a. What is the yield-to-maturity of this bond? b. Challenge Question: In regard to this zero-coupon bond, what must be the market portfolio currently be earning?

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

1 a 10000 b Less than 10000 2 a 40 b 4120 3 a 5 b 7 4 a 325 b 325 ... View full answer

Get step-by-step solutions from verified subject matter experts