Question: PROJECT FINANCE ASSIGNMENT 2022 This is a group assignment. A group can consist of one, two or three students. The purpose of the assignment is

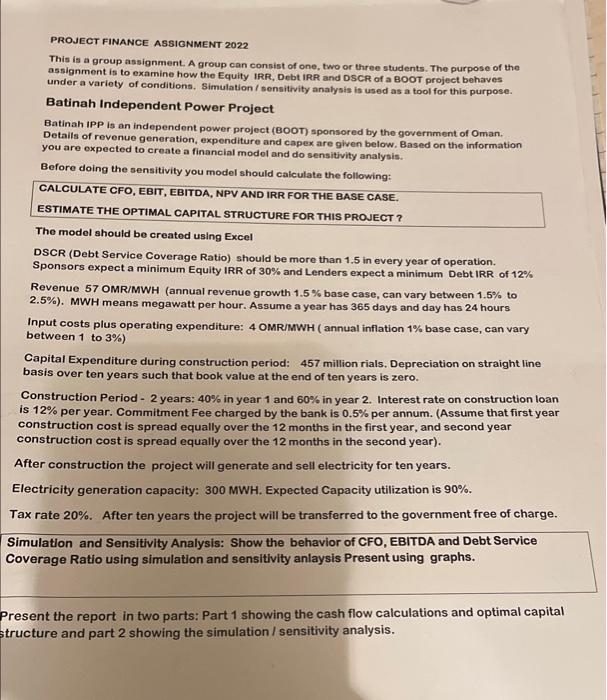

PROJECT FINANCE ASSIGNMENT 2022 This is a group assignment. A group can consist of one, two or three students. The purpose of the assignment is to examine how the Equity IRR, Debt IRR and DSCR of a BOOT project behaves under a variety of conditions. Simulation / sensitivity analysis is used as a tool for this purpose. Batinah Independent Power Project Batinah IPP is an independent power project (BOOT) sponsored by the government of Oman. Details of revenue generation, expenditure and capex are given below. Based on the information you are expected to create a financial model and do sensitivity analysis. Before doing the sensitivity you model should calculate the following: CALCULATE CFO, EBIT, EBITDA, NPV AND IRR FOR THE BASE CASE. ESTIMATE THE OPTIMAL CAPITAL STRUCTURE FOR THIS PROJECT? The model should be created using Excel DSCR (Debt Service Coverage Ratio) should be more than 1.5 in every year of operation. Sponsors expect a minimum Equity IRR of 30% and Lenders expect a minimum Debt IRR of 12% Revenue 57 OMR/MWH (annual revenue growth 1.5 % base case, can vary between 1.5% to 2.5%). MWH means megawatt per hour. Assume a year has 365 days and day has 24 hours Input costs plus operating expenditure: 4 OMR/MWH (annual inflation 1% base case, can vary between 1 to 3%) Capital Expenditure during construction period: 457 million rials. Depreciation on straight line basis over ten years such that book value at the end of ten years is zero. Construction Period - 2 years: 40% in year 1 and 60% in year 2. Interest rate on construction loan is 12% per year. Commitment Fee charged by the bank is 0.5% per annum. (Assume that first year construction cost is spread equally over the 12 months in the first year, and second year construction cost is spread equally over the 12 months in the second year). After construction the project will generate and sell electricity for ten years. Electricity generation capacity: 300 MWH. Expected Capacity utilization is 90%. Tax rate 20%. After ten years the project will be transferred to the government free of charge. Simulation and Sensitivity Analysis: Show the behavior of CFO, EBITDA and Debt Service Coverage Ratio using simulation and sensitivity anlaysis Present using graphs. Present the report in two parts: Part 1 showing the cash flow calculations and optimal capital structure and part 2 showing the simulation / sensitivity analysis. PROJECT FINANCE ASSIGNMENT 2022 This is a group assignment. A group can consist of one, two or three students. The purpose of the assignment is to examine how the Equity IRR, Debt IRR and DSCR of a BOOT project behaves under a variety of conditions. Simulation / sensitivity analysis is used as a tool for this purpose. Batinah Independent Power Project Batinah IPP is an independent power project (BOOT) sponsored by the government of Oman. Details of revenue generation, expenditure and capex are given below. Based on the information you are expected to create a financial model and do sensitivity analysis. Before doing the sensitivity you model should calculate the following: CALCULATE CFO, EBIT, EBITDA, NPV AND IRR FOR THE BASE CASE. ESTIMATE THE OPTIMAL CAPITAL STRUCTURE FOR THIS PROJECT? The model should be created using Excel DSCR (Debt Service Coverage Ratio) should be more than 1.5 in every year of operation. Sponsors expect a minimum Equity IRR of 30% and Lenders expect a minimum Debt IRR of 12% Revenue 57 OMR/MWH (annual revenue growth 1.5 % base case, can vary between 1.5% to 2.5%). MWH means megawatt per hour. Assume a year has 365 days and day has 24 hours Input costs plus operating expenditure: 4 OMR/MWH (annual inflation 1% base case, can vary between 1 to 3%) Capital Expenditure during construction period: 457 million rials. Depreciation on straight line basis over ten years such that book value at the end of ten years is zero. Construction Period - 2 years: 40% in year 1 and 60% in year 2. Interest rate on construction loan is 12% per year. Commitment Fee charged by the bank is 0.5% per annum. (Assume that first year construction cost is spread equally over the 12 months in the first year, and second year construction cost is spread equally over the 12 months in the second year). After construction the project will generate and sell electricity for ten years. Electricity generation capacity: 300 MWH. Expected Capacity utilization is 90%. Tax rate 20%. After ten years the project will be transferred to the government free of charge. Simulation and Sensitivity Analysis: Show the behavior of CFO, EBITDA and Debt Service Coverage Ratio using simulation and sensitivity anlaysis Present using graphs. Present the report in two parts: Part 1 showing the cash flow calculations and optimal capital structure and part 2 showing the simulation / sensitivity analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts