Question: QUESTION 2 (a) The Doom Company Ltd. has issued 10,000,000, K10 par equity shares Which are at present selling for K30 per share? The

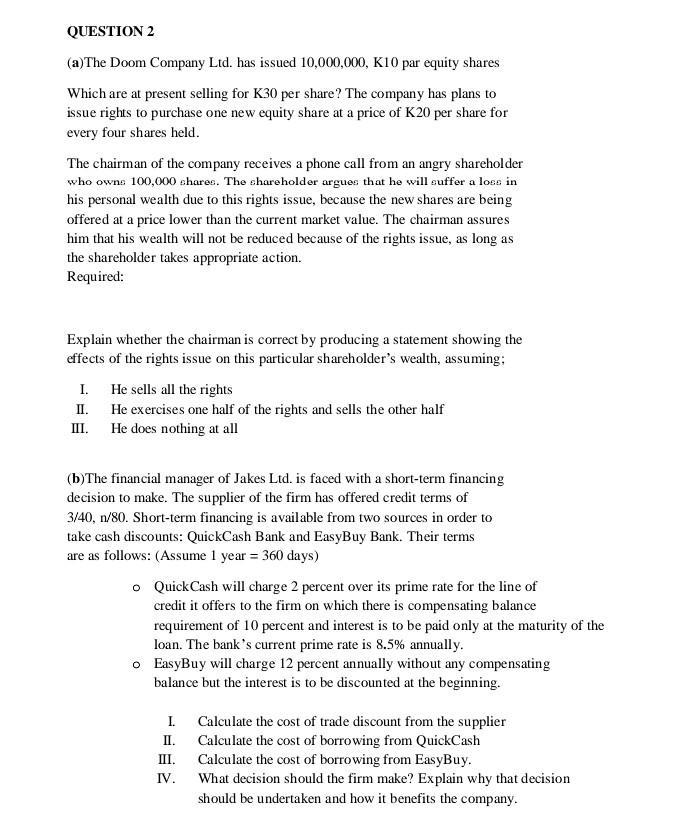

QUESTION 2 (a) The Doom Company Ltd. has issued 10,000,000, K10 par equity shares Which are at present selling for K30 per share? The company has plans to issue rights to purchase one new equity share at a price of K20 per share for every four shares held. The chairman of the company receives a phone call from an angry shareholder who owns 100,000 shares. The shareholder argues that he will suffer a loss in his personal wealth due to this rights issue, because the new shares are being offered at a price lower than the current market value. The chairman assures him that his wealth will not be reduced because of the rights issue, as long as the shareholder takes appropriate action. Required: Explain whether the chairman is correct by producing a statement showing the effects of the rights issue on this particular shareholder's wealth, assuming; I. II. III. He sells all the rights He exercises one half of the rights and sells the other half He does nothing at all (b) The financial manager of Jakes Ltd. is faced with a short-term financing decision to make. The supplier of the firm has offered credit terms of 3/40, n/80. Short-term financing is available from two sources in order to take cash discounts: QuickCash Bank and EasyBuy Bank. Their terms are as follows: (Assume 1 year = 360 days) o QuickCash will charge 2 percent over its prime rate for the line of credit it offers to the firm on which there is compensating balance requirement of 10 percent and interest is to be paid only at the maturity of the loan. The bank's current prime rate is 8.5% annually. o EasyBuy will charge 12 percent annually without any compensating balance but the interest is to be discounted at the beginning. I. Calculate the cost of trade discount from the supplier II. Calculate the cost of borrowing from QuickCash Calculate the cost of borrowing from EasyBuy. III. IV. What decision should the firm make? Explain why that decision should be undertaken and how it benefits the company.

Step by Step Solution

3.55 Rating (148 Votes )

There are 3 Steps involved in it

Question 2 a Chairman is correct because as long as the shareholder sells the rights or exercises the rights there is no effect on wealth of the shareholder Explanation I He sells all the rights In th... View full answer

Get step-by-step solutions from verified subject matter experts