Question: PROJECT MANAGEMENT Problem: 1 You are considering a project costing USD 60,000 with estimated useful life of 5 years (using the straight-line depreciation method). Expected

PROJECT MANAGEMENT

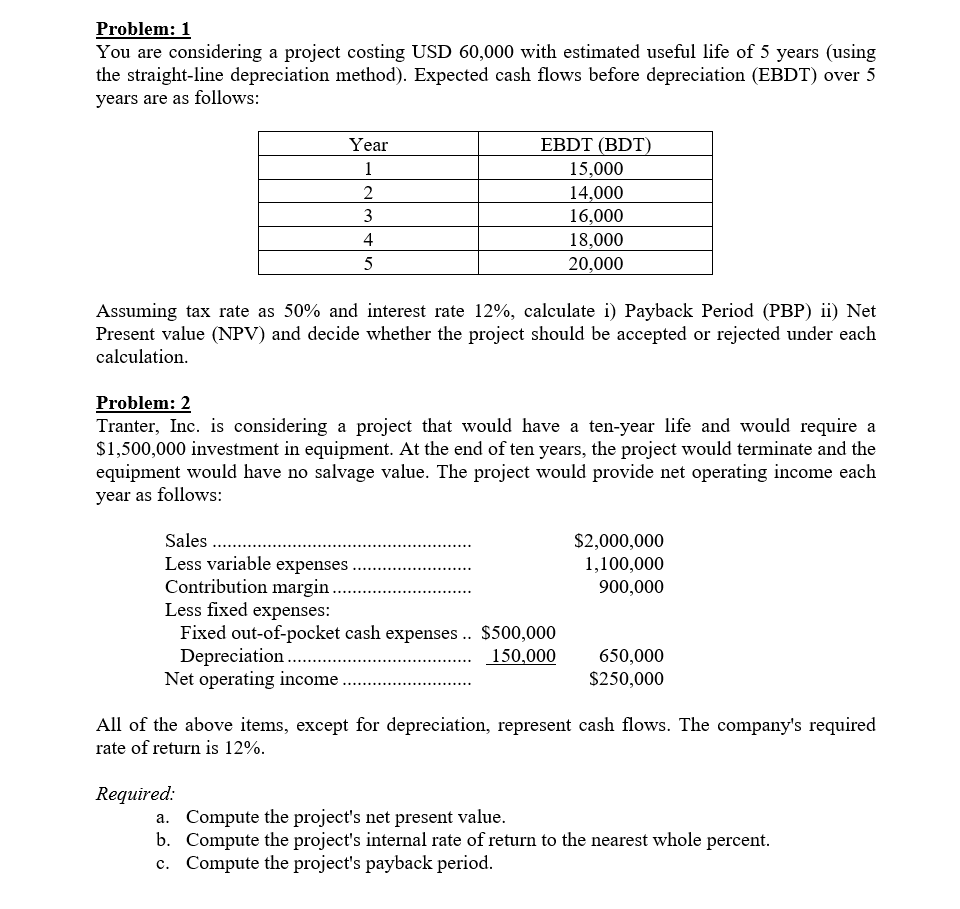

Problem: 1 You are considering a project costing USD 60,000 with estimated useful life of 5 years (using the straight-line depreciation method). Expected cash flows before depreciation (EBDT) over 5 years are as follows: Assuming tax rate as 50% and interest rate 12\%, calculate i) Payback Period (PBP) ii) Net Present value (NPV) and decide whether the project should be accepted or rejected under each calculation. Problem: 2 Tranter, Inc. is considering a project that would have a ten-year life and would require a $1,500,000 investment in equipment. At the end of ten years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows: All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 12%. Required: a. Compute the project's net present value. b. Compute the project's internal rate of return to the nearest whole percent. c. Compute the project's payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts