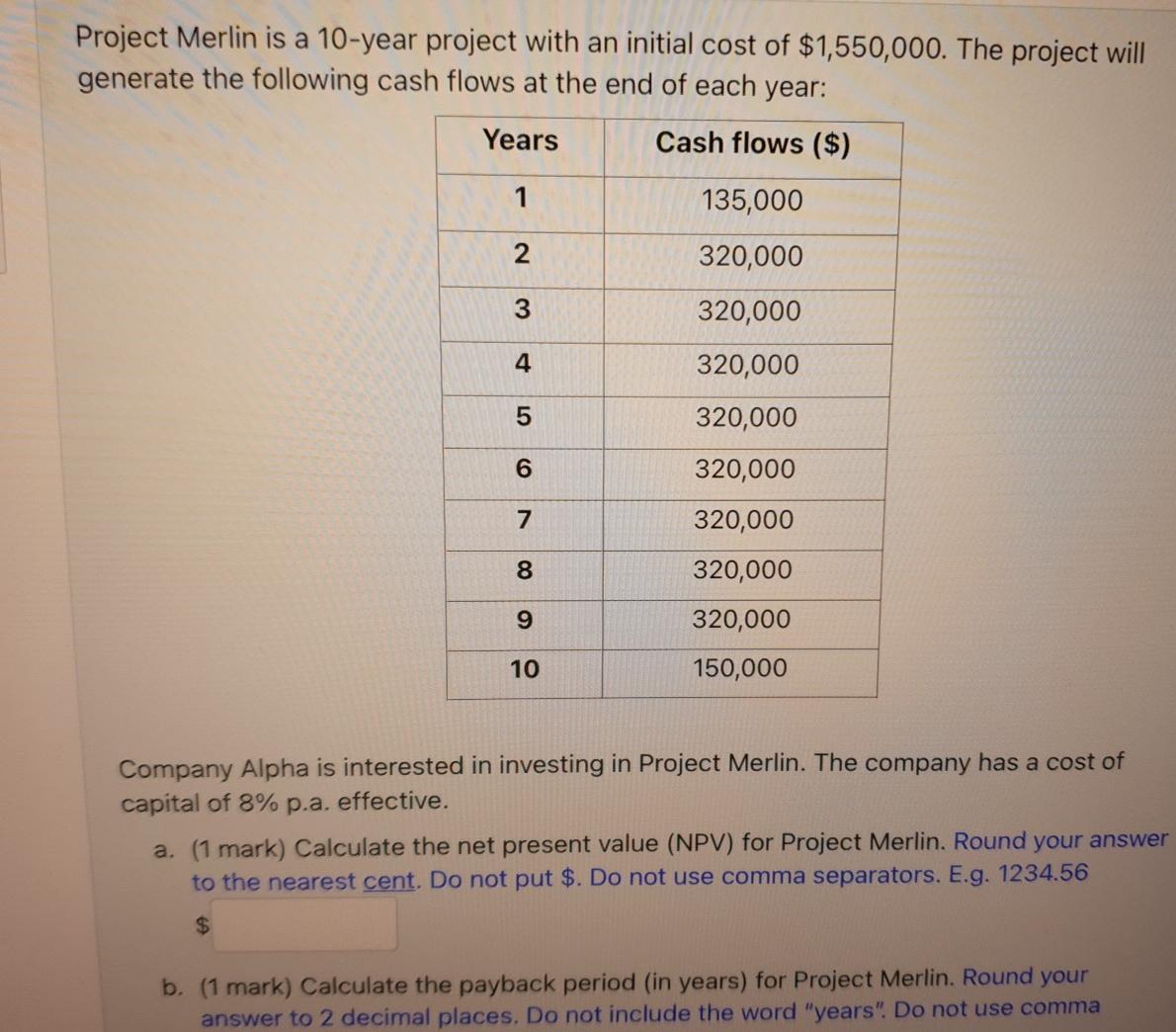

Question: Project Merlin is a 10-year project with an initial cost of $1,550,000. The project will generate the following cash flows at the end of each

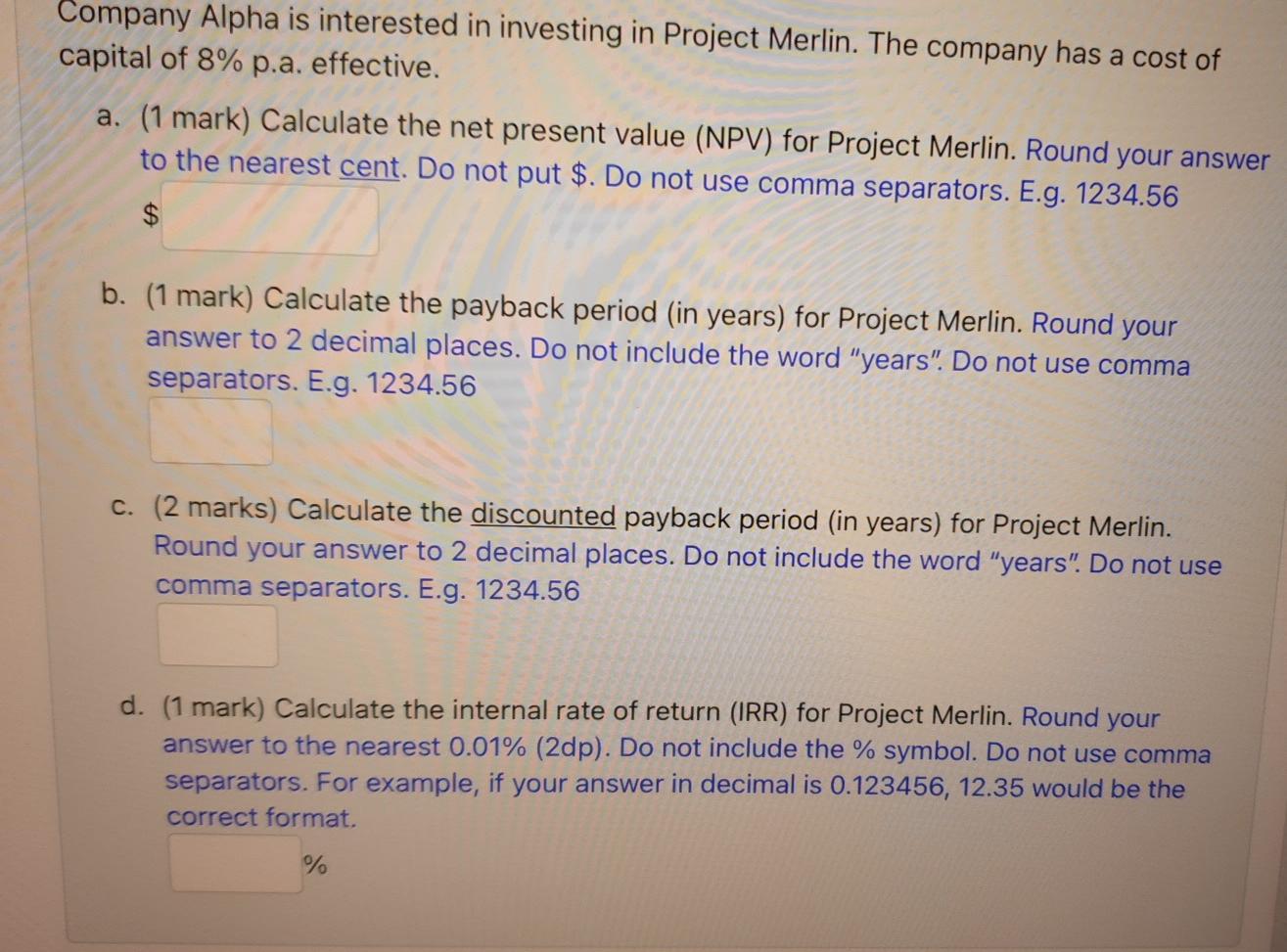

Project Merlin is a 10-year project with an initial cost of $1,550,000. The project will generate the following cash flows at the end of each year: Years Cash flows ($) 1 135,000 2 320,000 3 320,000 4 320,000 01 320,000 6 320,000 7 320,000 8 320,000 9 320,000 150,000 10 Company Alpha is interested in investing in Project Merlin. The company has a cost of capital of 8% p.a. effective. a. (1 mark) Calculate the net present value (NPV) for Project Merlin. Round your answer to the nearest cent. Do not put $. Do not use comma separators. E.g. 1234.56 $ b. (1 mark) Calculate the payback period (in years) for Project Merlin. Round your answer to 2 decimal places. Do not include the word "years". Do not use comma Company Alpha is interested in investing in Project Merlin. The company has a cost of capital of 8% p.a. effective. a. (1 mark) Calculate the net present value (NPV) for Project Merlin. Round your answer to the nearest cent. Do not put $. Do not use comma separators. E.g. 1234.56 $ b. (1 mark) Calculate the payback period (in years) for Project Merlin. Round your answer to 2 decimal places. Do not include the word "years". Do not use comma separators. E.g. 1234.56 c. (2 marks) Calculate the discounted payback period (in years) for Project Merlin. Round your answer to 2 decimal places. Do not include the word "years". Do not use comma separators. E.g. 1234.56 d. (1 mark) Calculate the internal rate of return (IRR) for Project Merlin. Round your answer to the nearest 0.01% (2dp). Do not include the % symbol. Do not use comma separators. For example, if your answer in decimal is 0.123456, 12.35 would be the correct format. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts