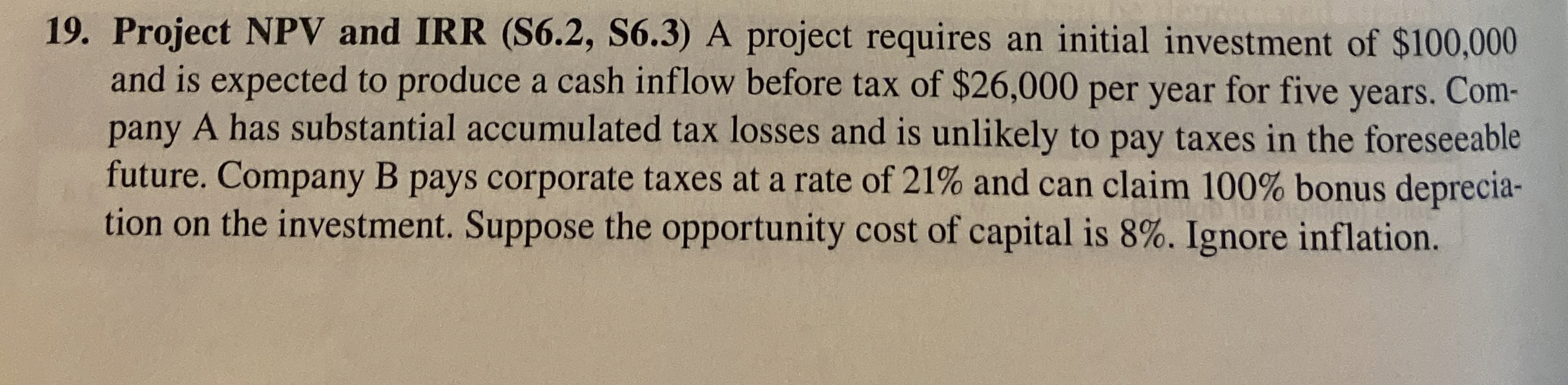

Question: Project NPV and IRR ( S 6 . 2 , S 6 . 3 ) A project requires an initial investment of $ 1 0

Project NPV and IRR S S A project requires an initial investment of $

and is expected to produce a cash inflow before tax of $ per year for five years. Com

pany A has substantial accumulated tax losses and is unlikely to pay taxes in the foreseeable

future. Company B pays corporate taxes at a rate of and can claim bonus deprecia

tion on the investment. Suppose the opportunity cost of capital is Ignore inflation.

Calculate project NPV for each company

What is the IRR of the aftertax cash flows for each company? Why are the IRRs for A and B the same?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock