Question: Project Part 1 : Brute Force Approach Implement a brute force algorithm to exhaustively search all possible asset allocations within the given investment amount. Evaluate

Project Part : Brute Force Approach

Implement a brute force algorithm to exhaustively search all possible asset allocations within the given investment amount. Evaluate the return and risk of each allocation and find the one that maximizes the expected return while keeping the risk within the specified tolerance level.

Deliverables

The source code for the implementation of the two algorithms BF Dynamic program ming in JAVA.

A report that includes the following sections: Cover page

For each design paradigm, write the pseudocode of the algorithm that finds the composition of an optimal allocation of assets.

For the dynamic programming approach, the composition should be obtained from the table generated during the algorithms execution.

For the dynamic programming approach, write the recurrence function.

For each of the two algorithms, provide the best and worst time complexity of your solutions. Present the complexities on a table and argue with examples to demon strate the cases.

Experimental results demonstrating the performance of the algorithms for various portfolio sizes and investment amounts.

Screenshots of the complete code and sample run.

Source code in Courier New with font size: with comments.

Describe challenges faced and how you tackled them

Student peer evaluation form see Team Work Evaluation table below Use meaningful variable names in your code.

Sample run:

Input will be in the form of a text file your program should read. The input has the following format:

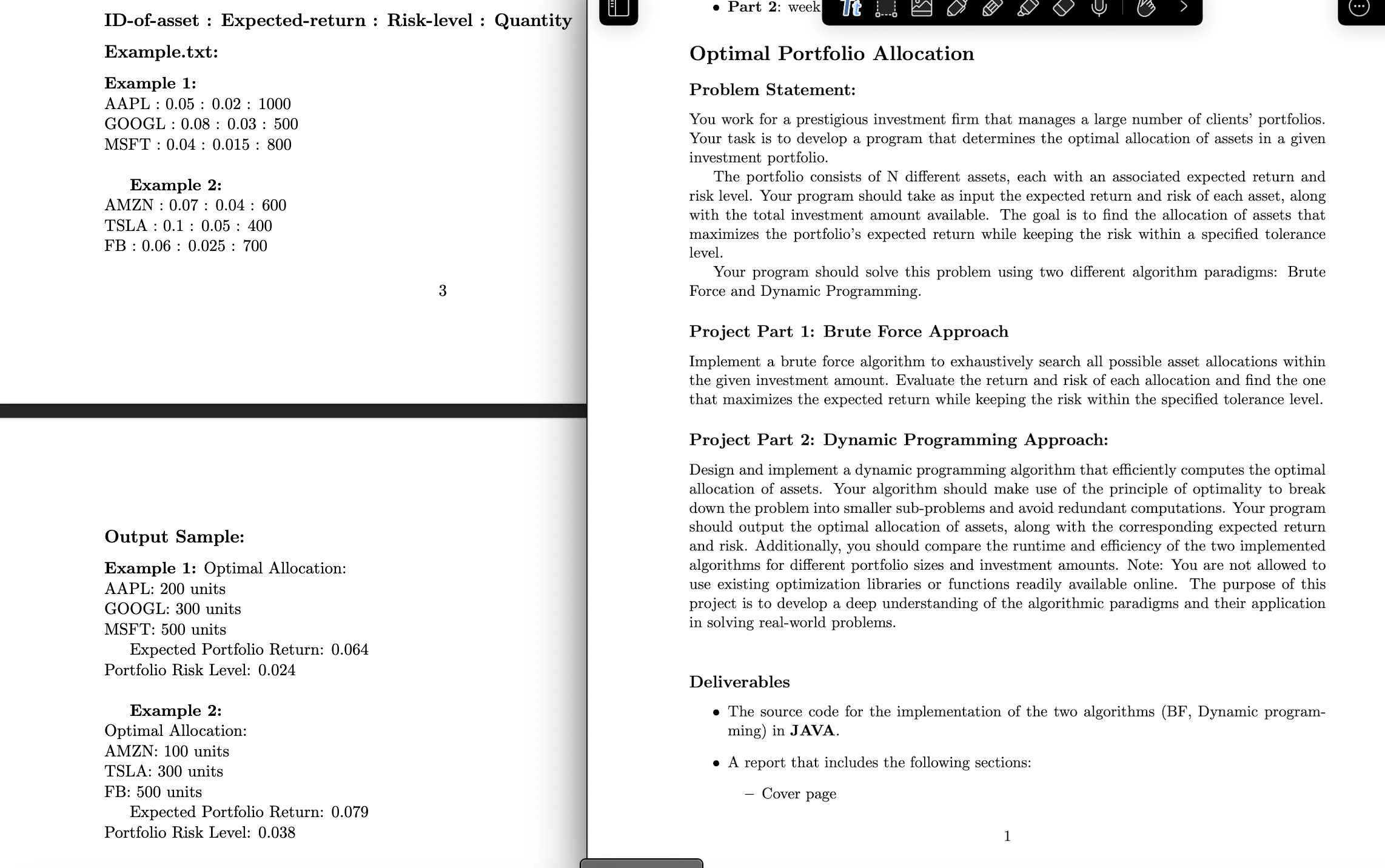

IDofasset : Expectedreturn : Risklevel : Quantity

Example.txt:

Example :

AAPL : : : GOOGL : : : MSFT : : :

Example :

AMZN : : : TSLA : : : FB : : :

Output Sample:

Example : Optimal Allocation: AAPL: units

GOOGL: units

MSFT: units

Expected Portfolio Return: Portfolio Risk Level:

Example :

Optimal Allocation: AMZN: units TSLA: units FB: units

Expected Portfolio Return: Portfolio Risk Level: IDofasset : Expectedreturn : Risklevel : Quantity

Example.txt:

Example :

AAPL : ::

GOOGL : ::

MSFT : ::

Example :

AMZN : ::

TSLA : ::

FB :::

Output Sample:

Example : Optimal Allocation:

AAPL: units

GOOGL: units

MSFT: units

Expected Portfolio Return:

Portfolio Risk Level:

Example :

Optimal Allocation:

AMZN: units

TSLA: units

FB: units

Expected Portfolio Return:

Portfolio Risk Level:

Optimal Portfolio Allocation

Problem Statement:

You work for a prestigious investment firm that manages a large number of clients' portfolios.

Your task is to develop a program that determines the optimal allocation of assets in a given

investment portfolio.

The portfolio consists of different assets, each with an associated expected return and

risk level. Your program should take as input the expected return and risk of each asset, along

with the total investment amount available. The goal is to find the allocation of assets that

maximizes the portfolio's expected return while keeping the risk within a specified tolerance

level.

Your program should solve this problem using two different algorithm paradigms: Brute

Force and Dynamic Programming.

Project Part : Brute Force Approach

Implement a brute force algorithm to exhaustively search all possible asset allocations within

the given investment amount. Evaluate the return and risk of each allocation and find the one

that maximizes the expected return while keeping the risk within the specified tolerance level.

Project Part : Dynamic Programming Approach:

Design and implement a dynamic programming algorithm that efficiently computes the optimal

allocation of assets. Your algorithm should make use of the principle of optimality to break

down the problem into smaller subproblems and avoid redundant computations. Your program

should output the optimal allocation of assets, along with the corresponding expected return

and risk. Additionally, you should compare the runtime and efficiency of the two implemented

algorithms for different portfolio sizes and investment amounts. Note: You are not allowed to

use existing optimization libraries or functions readily available online. The purpose of this

project is to develop a deep understanding of the algorithmic paradigms and their application

in solving realworld problems.

Deliverables

The source code for the implementation of the two algorithms BF Dynamic program

ming in JAVA.

A report that includes the following sections:

Cover page

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock