Question: Project: Part 1 Scenario: You are a 2 1 - year - old individual who just graduated college. You currently have $ 6 , 0

Project: Part

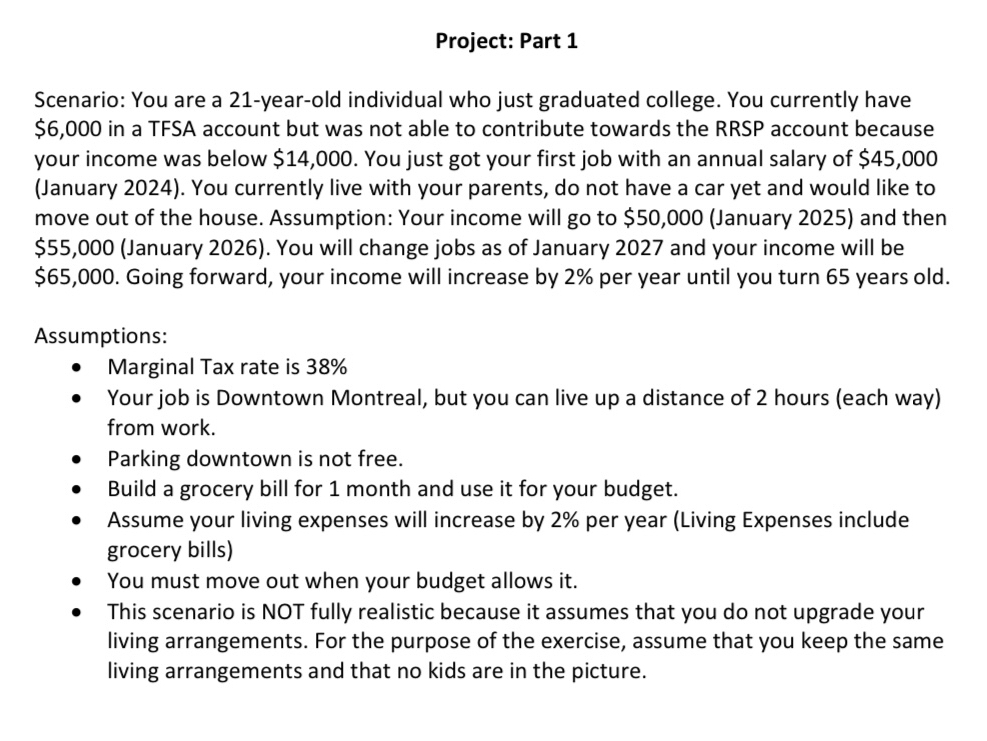

Scenario: You are a yearold individual who just graduated college. You currently have $ in a TFSA account but was not able to contribute towards the RRSP account because your income was below $ You just got your first job with an annual salary of $January You currently live with your parents, do not have a car yet and would like to move out of the house. Assumption: Your income will go to $January and then $January You will change jobs as of January and your income will be $ Going forward, your income will increase by per year until you turn years old.

Assumptions:

Marginal Tax rate is

Your job is Downtown Montreal, but you can live up a distance of hours each way from work.

Parking downtown is not free.

Build a grocery bill for month and use it for your budget.

Assume your living expenses will increase by per year Living Expenses include grocery bills

You must move out when your budget allows it

This scenario is NOT fully realistic because it assumes that you do not upgrade your living arrangements. For the purpose of the exercise, assume that you keep the same living arrangements and that no kids are in the picture.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock