Question: Project Part ( B ) As an enginner in RedOak company, your department head asked you to perform an analysis of installing MAP / TOP

Project Part B

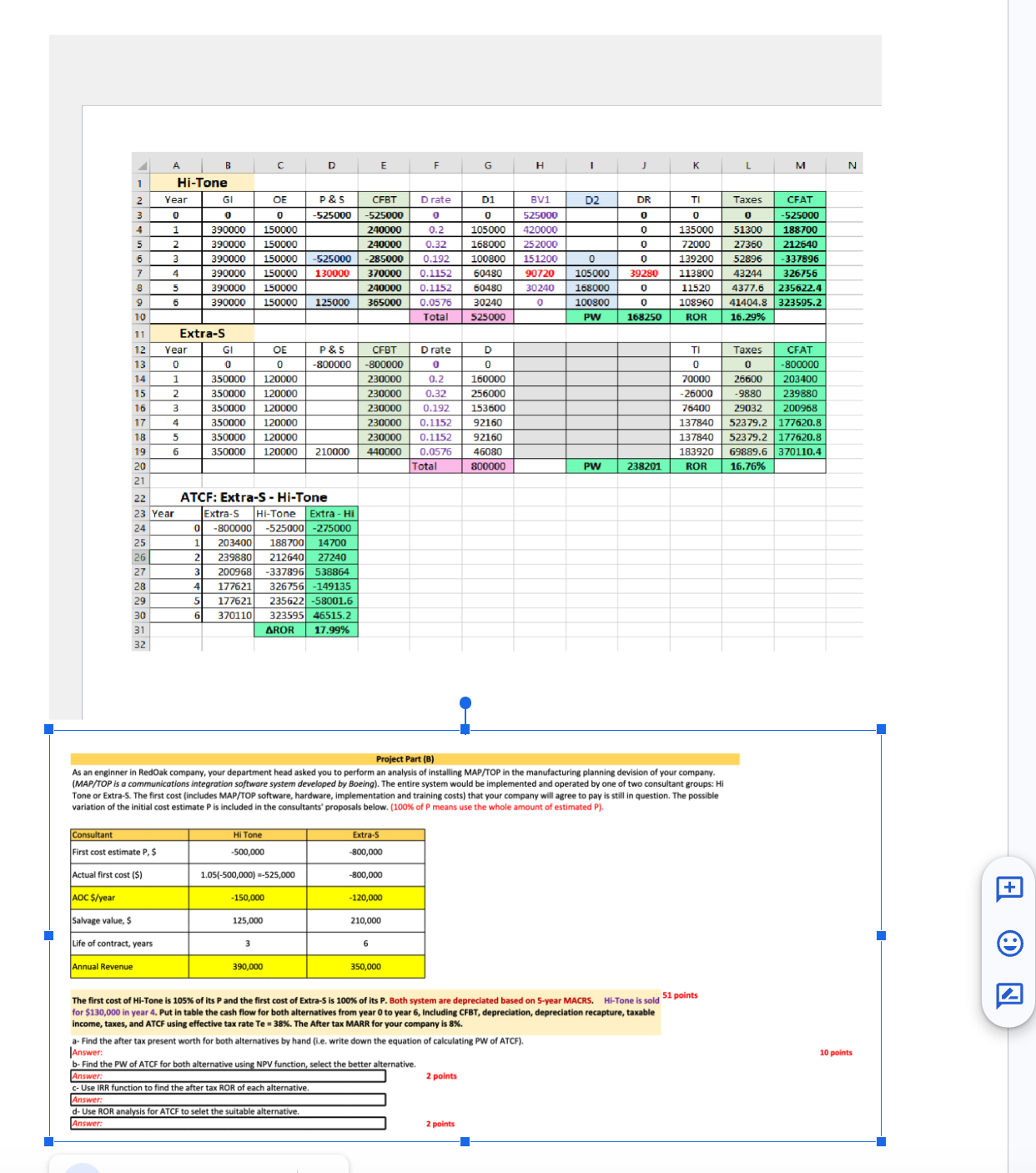

As an enginner in RedOak company, your department head asked you to perform an analysis of installing MAPTOP in the manufacturing planning devision of your company.

MAPTOP is a communications integration software system developed by Boeing The entire system would be implemented and operated by one of two consultant groups:

Tone or ExtraS The first cost includes MAPTOP software, hardware, implementation and training costs that your company will agree to pay is still in question. The possible

variation of the initial cost estimate is included in the consultants' proposals below. of P means use the whole amount of estimated P

The first cost of Tone is of its and the first cost of ExtraS is of its Both system are depreciated based on year MACRS. HiTone is sold

points

for $ in year Put in table the cash flow for both alternatives from year to year Including CFBT depreciation, depreciation recapture, taxable

income, taxes, and ATCF using effective tax rate The After tax MARR for your company is

a Find the after tax present worth for both alternatives by hand ie write down the equation of calculating PW of ATCF

Answer:

b Find the PW of ATCF for both alternative using NPV function, select the better alternative.

Answer:

points

c Use IRR function to find the after tax ROR of each alternative.

Answer:

d Use ROR analysis for ATCF to selet the suitable alternative.

Answer:Project Part B

As an enginner in RedOak company, your department head asked you to perform an analysis of installing MAPTOP in the manufacturing planning devision of your company.

MAPTOP is a communications integration software system developed by Boeing The entire system would be implemented and operated by one of two consultant groups:

Tone or ExtraS The first cost includes MAPTOP software, hardware, implementation and training costs that your company will agree to pay is still in question. The possible

variation of the initial cost estimate is included in the consultants' proposals below. of P means use the whole amount of estimated P

The first cost of Tone is of its and the first cost of ExtraS is of its Both system are depreciated based on year MACRS. HiTone is sold

points

for $ in year Put in table the cash flow for both alternatives from year to year Including CFBT depreciation, depreciation recapture, taxable

income, taxes, and ATCF using effective tax rate The After tax MARR for your company is

a Find the after tax present worth for both alternatives by hand ie write down the equation of calculating PW of ATCF

Answer:

b Find the PW of ATCF for both alternative using NPV function, select the better alternative.

Answer:

points

c Use IRR function to find the after tax ROR of each alternative.

Answer:

d Use ROR analysis for ATCF to selet the suitable alternative.

Answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock